Browsing this Thread:

1 Anonymous Users

|

Re: Zillow.com finds New York area homes lost $130B in value from 2007 to 2008 - is now the time to

|

||||

|---|---|---|---|---|

|

Just can't stay away

Joined:

2007/8/1 16:17 Last Login : 2011/5/18 20:12 From Harsimus Cove

Group:

Registered Users

Posts:

103

|

Quote:

Great point, chiefdahill. If you buy cheap, you get cheap.

Posted on: 2009/2/12 23:30

|

|||

|

We are what we pretend to be. So we must be careful what we pretend to be - Vonnegut

|

||||

|

||||

|

Re: Zillow.com finds New York area homes lost $130B in value from 2007 to 2008 - is now the time to

|

||||

|---|---|---|---|---|

|

Home away from home

Joined:

2007/10/9 19:48 Last Login : 2013/2/18 15:54 From Van Vorst Park

Group:

Registered Users

Posts:

369

|

Quote:

They are charging you to list your home on a website. You still pay the buyers agent 3% fee. Why not get a RE license and list it yourself if you are still paying the 3% fee or FSBO on the nytimes.com You get what you pay for. Foxtons tried this and they went out of business.

Posted on: 2009/2/12 0:24

|

|||

|

||||

|

Re: Zillow.com finds New York area homes lost $130B in value from 2007 to 2008 - is now the time to

|

||||

|---|---|---|---|---|

|

Home away from home

|

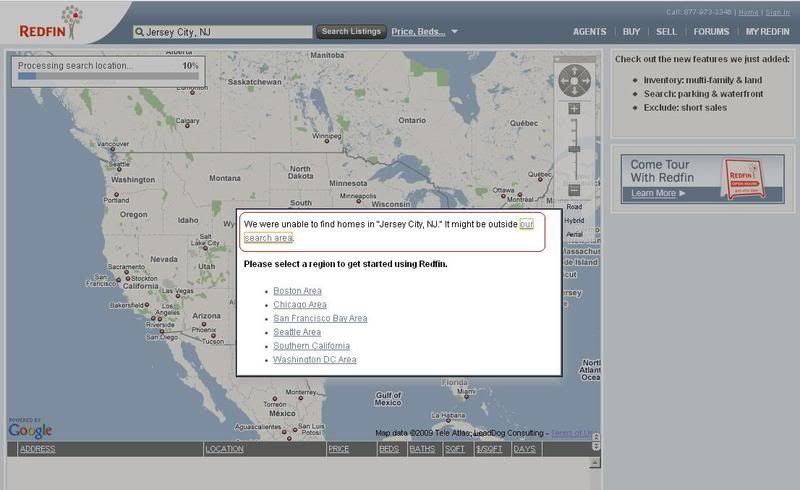

There are some "real estate people" willing to perform a transaction for a fixed fee.

http://www.redfin.com/

Posted on: 2009/2/11 23:50

|

|||

|

||||

|

Re: Zillow.com finds New York area homes lost $130B in value from 2007 to 2008 - is now the time to buy?

|

||||

|---|---|---|---|---|

|

Just can't stay away

Joined:

2007/8/1 16:17 Last Login : 2011/5/18 20:12 From Harsimus Cove

Group:

Registered Users

Posts:

103

|

Quote:

ALWAYS? I agree that there are plenty of people who try their best to paint a pretty picture in difficult markets, be it for inexperience, lack of trustworthiness or complete incompitence. "Always" is too much of an absolute for me to buy into. Its the same thing as saying you can NEVER get an acurate estimation of value from real estate people. BTW, I agree with you about Zillow. After all, its just a website posting (z)estimated home values for properties that no one associated with the site has ever actually seen. That leaves a large margin for error.

Posted on: 2009/2/11 20:38

|

|||

|

We are what we pretend to be. So we must be careful what we pretend to be - Vonnegut

|

||||

|

||||

|

Re: Zillow.com finds New York area homes lost $130B in value from 2007 to 2008 - is now the time to buy?

|

||||

|---|---|---|---|---|

|

Newbie

|

here's some more interesting reading:

http://curbed.com/archives/2009/01/08 ... have_to_kill_yourself.php http://matrix.millersamuel.com/?p=2950

Posted on: 2009/2/11 15:05

|

|||

|

||||

|

Re: Zillow.com finds New York area homes lost $130B in value from 2007 to 2008 - is now the time to buy?

|

||||

|---|---|---|---|---|

|

Home away from home

|

Yes, and the NAR "economist" predictions are just funny. But I strongly suspect there is a disconnect between what they say and what they do. Given that Realtors are paid on commission, a percentage of a smaller price and a quick sale beats nothing from a higher price and they don't adopt the same strategy when selling their own property: http://pricetheory.uchicago.edu/levit ... rs/LevittSyverson2004.pdf

Similarly, getting a landlord to pay 1 month's rent as commission for a rental beats 18 months from a potential tenant (which used to happen in NYC) and both beat the landlord going to CraigsList or the local paper and them getting nothing. Quote:

Posted on: 2009/2/11 4:15

|

|||

|

||||

|

Re: Zillow.com finds New York area homes lost $130B in value from 2007 to 2008 - is now the time to buy?

|

||||

|---|---|---|---|---|

|

Home away from home

|

I've always thought ZILLOW overpriced/overoptimistic (for owners)...perhaps to get listings.

Anyhoo, I'm singularly unimpressed when ZILLOW says we now found that prices have dropped. Yes, from way overpriced to merely overpriced. Also, saying that 50.6% of owners lowered their asking price after listing says only that sellers have unreasonable expectations...probably resulting from Zillow quotes.  Interesting article on falling Rents in the Times Real Estate section Sunday: http://www.nytimes.com/2009/02/01/rea ... 01cov.html?ref=realestate We must always remember the overarching imperative: Real Estate people make more when prices are high...thus they will ALWAYS overstate value, whether consciously or unconsciously. A "rising" market is probably not rising as much as the cheerleaders say, and a falling market is proably falling faster.

Posted on: 2009/2/4 14:41

|

|||

|

||||

|

Re: Zillow.com finds New York area homes lost $130B in value from 2007 to 2008 - is now the time to

|

||||

|---|---|---|---|---|

|

Home away from home

|

renter-gloaters, meet owner Schadenfreude!

All is possible in the NEW, post-capitalist world.

Posted on: 2009/2/4 3:51

|

|||

|

||||

|

Re: Zillow.com finds New York area homes lost $130B in value from 2007 to 2008 - is now the time to

|

||||

|---|---|---|---|---|

|

Quite a regular

|

renter schadenfreude, meet owner-gloaters.

Posted on: 2009/2/4 3:31

|

|||

|

||||

|

Re: Zillow.com finds New York area homes lost $130B in value from 2007 to 2008 - is now the time to buy?

|

||||

|---|---|---|---|---|

|

Home away from home

|

How many renters can imagine their landlord selling for 10x their rent? Unless I am mistaken that's what knowledgeable value oriented landlords are looking for.

Anywho, the cost of renting is far below the cost of owning and has been for many years. Perhaps the "bitter renter" epitaph will soon be replaced by "regretful owner". Even the NY Times foretold this: http://www.nytimes.com/2005/09/25/rea ... 1&scp=1&sq=renting&st=cse One might think that as house prices declined, rentals might increase, in the normal course of markets equilibrating (and mean reverting) but these are not normal times. Rents are going down too: http://www.nytimes.com/2009/02/01/rea ... l?scp=1&sq=renting&st=cse Quote:

Posted on: 2009/2/4 3:30

|

|||

|

||||

|

Re: Zillow.com finds New York area homes lost $130B in value from 2007 to 2008 - is now the time to

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

Listen to brewster, kids.

Posted on: 2009/2/4 3:13

|

|||

|

||||

|

Re: Zillow.com finds New York area homes lost $130B in value from 2007 to 2008 - is now the time to

|

||||

|---|---|---|---|---|

|

Not too shy to talk

|

I also agree with the 10 x rent roll. Thats the way we did it before the boom.

We also need our realtors to start pricing these homes correctly and not be so worried about getting the listing. The investors are the ones that are going to help get this market back on track. There are alot of people who made alot of money in the condo conversion craze, that are on the sidelines. Brewster I also remember those days. One of my 1st buys back in 1996 was a brownstone on 4th just off cole that I converted to a 4 family. The price $67,500. Thats no Typo.

Posted on: 2009/2/4 3:08

|

|||

|

||||

|

Re: Zillow.com finds New York area homes lost $130B in value from 2007 to 2008 - is now the time to

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

I still kick myself when I drive by downtown properties we passed on or lowballed in 99. A 4 family on 4th & Monmouth for $335k. OUCH!! Our 2nd purchase was in 04 in the Heights and was a 10x. I'm going to be looking in the Heights and Lincoln Park when the time is right, assuming the banks aren't off their rockers still. Our loans are with Pamrapo, who like Hudson Savings, holds their own paper and didn't take the kool-aid.

Posted on: 2009/2/4 1:49

|

|||

|

||||

|

Re: Zillow.com finds New York area homes lost $130B in value from 2007 to 2008 - is now the time to

|

||||

|---|---|---|---|---|

|

Home away from home

|

Brewster

I figured that was what you meant. I've been doing the same formula as you before I even knew how to do the cap rate formula. It works almost the same way. If a property was $400k and brought in $40k or so in rent roll with sep utilities I would consider it a great buy, especially in these areas. I dont believe we will se 10x downtown or hoboken areas (I could be wrong) but definitely will in the heights and JSQ and it already exists in Greenville. Yeah that 8 family is worth $350k especially if heat isnt split off.

Posted on: 2009/2/4 0:20

|

|||

|

||||

|

Re: Zillow.com finds New York area homes lost $130B in value from 2007 to 2008 - is now the time to

|

||||

|---|---|---|---|---|

|

Home away from home

Joined:

2004/11/7 17:04 Last Login : 2015/2/24 18:16 From "Pay for Play"

Group:

Registered Users

Posts:

1531

|

Quote:

Yes I'm sure that with "some of the renters" schadenfreude is a big smirk, but we're not all "bitter renters", as I am just glad to rent in an enviable situation, since our building is a "non eviction conversion" we can buy when we choose (so long as seller wants to sell our unit)or continue to pay rent. Right now I'll choose to pay rent as it works for me and I think we will see real estate value drop considerably more than this last year whether you believe the stats of questionable sites like Zillow or other bloggers of past real estate porn hubris. We're all bozos on this bus.

Posted on: 2009/2/3 23:07

|

|||

|

||||

|

Re: Zillow.com finds New York area homes lost $130B in value from 2007 to 2008 - is now the time to buy?

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

Yes that's what I mean. It's not the perfect metric by any means, but just like an equity P/E, it gives you a quick rough value score. Cap rate would be the next calculation, but you need more info than price and rents, and half of what you get from the seller is BS anyway. (have you ever found the common utilities disclosure in the mls to be accurate?) I usually figure about $12k yearly in tax and expenses for a 3 or 4 family with individual heat in a quick cap rate calc. So if you're shopping that market and your finance costs are similar, simple P/E is a quick, easy way to compare similar properties. or tell if you even want to see it. Down the street an 8 family was asking $849k with a $36k rent roll, that's over 24x. I don't need to calc a cap rate to know its not doable as a rental.

Posted on: 2009/2/3 23:05

|

|||

|

||||

|

Re: Zillow.com finds New York area homes lost $130B in value from 2007 to 2008 - is now the time to buy?

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

VV - I recall that we already agreed on a couple of things before. Peace.

Posted on: 2009/2/3 22:53

|

|||

|

||||

|

Re: Zillow.com finds New York area homes lost $130B in value from 2007 to 2008 - is now the time to buy?

|

||||

|---|---|---|---|---|

|

Home away from home

|

These zillow numbers really dont mean much but if property values do drop 70% it means we are watching a real $hit show.

Since when is goldman sacks the real estate trends guru, didnt they suck at what they were supposed to specialize in? brewster when you say 10 x rent can you give me an example? IE 6 family for $600,000 brings in 60k per yr. is that what you mean? also dont you you go by cap rates? Thanks

Posted on: 2009/2/3 22:12

|

|||

|

||||

|

Re: Zillow.com finds New York area homes lost $130B in value from 2007 to 2008 - is now the time to buy?

|

||||

|---|---|---|---|---|

|

Home away from home

Joined:

2006/11/13 18:42 Last Login : 2022/2/28 7:31 From 280 Grove Street

Group:

Registered Users

Posts:

4192

|

The only sentence worth reading in the article.

Quote:

Posted on: 2009/2/3 21:36

|

|||

|

My humor is for the silent blue collar majority - If my posts offend, slander or you deem inappropriate and seek deletion, contact the webmaster for jurisdiction.

|

||||

|

||||

|

Re: Zillow.com finds New York area homes lost $130B in value from 2007 to 2008 - is now the time to buy?

|

||||

|---|---|---|---|---|

|

Home away from home

|

i agree all the numbers on zillow is crap, and to use it as any kind of stats is laughable.

Posted on: 2009/2/3 21:35

|

|||

|

||||

|

Re: Zillow.com finds New York area homes lost $130B in value from 2007 to 2008 - is now the time to buy?

|

||||

|---|---|---|---|---|

|

Home away from home

|

Injc, there there now, my comment wasn't in reference to Brewster's post at all but rather the refrain you sometimes see on the real estate threads ... people conveying a desire for the market to implode to validate the notion that people shouldn't have bought or that JC isn't worth the investment. I was suggesting that this post may incite this type of response. that's all. and as to your last post, here's something we finally agree on. Cheers.

Posted on: 2009/2/3 21:16

|

|||

|

||||

|

Re: Zillow.com finds New York area homes lost $130B in value from 2007 to 2008 - is now the time to buy?

|

||||

|---|---|---|---|---|

|

Home away from home

|

VV, if you're referring to brewster's post, you need to know that he (she) is a landlord renting out multiple apartments.

Brewster knows what he (she) is talking about regarding real estate. Having said that, if the prices go to below 10x multiple monthly rent, it will be a bloodbath (not that it won't happen - I think it actually will). The above correction will mean that the RE prices in JC will have declined by about 70% from the peak of the bubble. At that point I would rather worry about maintaining social order, food supply, heat, and public safety - you know, the essentials.

Posted on: 2009/2/3 20:47

|

|||

|

||||

|

Re: Zillow.com finds New York area homes lost $130B in value from 2007 to 2008 - is now the time to buy?

|

||||

|---|---|---|---|---|

|

Home away from home

|

.... and the Schadenfreude ensues among some of the renters.

Posted on: 2009/2/3 20:06

|

|||

|

||||

|

Re: Zillow.com finds New York area homes lost $130B in value from 2007 to 2008 - is now the time to buy?

|

||||

|---|---|---|---|---|

|

Home away from home

|

Do I read this correctly that they're trying to put meaning into a listing reducing it's price from an unrealistic one to one that'll sell? All it means is it wasn't priced properly to begin with. Sellers got too used to crazy high prices still getting bids.+

The time to buy will be when the price comes down to under 10x yearly rent. I have yet to see that. It's odd that the local MLS giveaway is very thin, have sellers simply given up rather than reduce prices to realistic levels?

Posted on: 2009/2/3 19:20

|

|||

|

||||

|

Zillow.com finds New York area homes lost $130B in value from 2007 to 2008 - is now the time to buy?

|

||||

|---|---|---|---|---|

|

Home away from home

|

Here is what sold in the last 6 months for zipcode 07302

Click here for Zillow for 07302 =================================== Study finds New York area homes lost $130B in value from 2007 to 2008 - is now the time to buy? BY CATEY HILL DAILY NEWS STAFF WRITER Monday, February 2nd 2009 Sky-high real estate statistics usually don't faze us. A $10 million price tag on a SoHo loft doesn't even raise eyebrows. A dilapidated brownstone in Harlem fetching millions doesn't make us flinch. But even normally unflappable New Yorkers may be shocked at the latest sky-high real estate number: $130 billion. Homeowners in the NY metro area lost $130,291,409,688 in home value in 2008, according to Zilliow.com. In the U.S. as a whole, home values dropped about $2 trillion, the study found. More than half of this $130-billion loss - about $75 billion - came in the fourth quarter, as the Wall Street crisis and other economic woes hit the real estate market - hard, the study found. "Over the last couple of years while much of the country had a debilitating downturn, New York was relatively immune," said Spencer Rascoff, COO of Zillow.com. "But the party's over for New York." Dottie Herman, CEO of Prudential Douglas Elliman, mirrored Rascoff's thoughts. "If you think you're going to lose your job, you're not going to buy. [We're] a long way off from the past couple of years," Herman told CNN. The data begs the question: Is now the time to buy? This is a tough question to answer, but several studies suggest that home prices have a good deal more to fall before they bottom out. Goldman Sachs recently issued a report predicting that New York City's real estate prices may fall by as much as 44%, according to CNN. The Case-Shiller Home Price Index report predicted that prices would fall more than 20% in the next four years. It also depends on where you want to buy. Manhattan home prices actually showed an increase from the third to the fourth quarter, according to several of the city's biggest real estate agencies. The median sale price of a Manhattan apartment rose 8% from a year ago, to $895,000, according to Halstead and Brown Harris Stevens, CNN reported. Prudential Douglas Elliman estimated the rise at 5.9% and Corcoran Group estimated it at 3%. However, there were signs that even Manhattan is feeling the burn. The number of closings for Manhattan homes dropped 34% from last quarter, according to a study by Streeteasy.com. This was the sharpest decline since 2005, when Streeteasy.com started keeping records. "What we are seeing is a lack of confidence among buyers due to the state of the economy and so much of what is happening on Wall Street, the credit crunch and even the Madoff scandal," said Sofia Kim, Vice President of Research from Streeteasy.com, a leading real estate website providing data across a variety of brokerages. Some New York City neighborhoods are offering better deals than others. According to Streeteasy.com, here are some of the neighborhoods where you might be able to find better read estate deals: These neighborhoods saw the most price cuts from Q3 to Q4: Beekman (50.6% of listings cut prices), Manhattan Valley (45.7%), East Village (43.1%), Central Park South (41.9%), SoHo (41.7%). These neighborhoods saw the deepest price cuts from Q3 to Q4: Clinton (10.93% was the average discount), Tribeca (10.83%), Flatiron (10.35%), Central Harlem (8.58%), East Harlem (9.98%). From 2007 to 2008, Zillow.com found that these places in the tri-state area had the most drastic losses in home value: Newark down 13.1%, Jersey City down 14.4% and New Brunswick down 11.9%. But will these prices fall even more? Only time will tell for sure. One thing that does seem likely is that New York City home prices haven't hit bottom yet.

Posted on: 2009/2/3 17:52

|

|||

|

||||