Browsing this Thread:

1 Anonymous Users

|

Re: Is Jersey City Real Estate in a bubble?

|

||||

|---|---|---|---|---|

|

Not too shy to talk

|

Quote:

I'm a realtor and you're way off base. Gulls Cove units (and one bedrooms there specifically) are some of the hottest inventory in Jersey City. One listing a couple of weeks back had eight offers and went $50k over asking price. Another one bed just went $30k over ask and just hit $800 per square foot. It should hit $1,000 per square foot there over the next few years. Prices are definitely not flat there, one beds are up at least 15% over the past year and half, with no signs of slowing down. The listing that just had it's priced dropped stares right into the Gulls Cove 2 courtyard and was overpriced by about $50k when it was listed. I do agree that demand will temper with increasing interest rates, but none of the new construction is condo - it's all rental. So when most of the buyers are coming from NYC and Brooklyn, JC still has relative value.

Posted on: 2016/11/16 3:49

|

|||

|

||||

|

Re: Is Jersey City Real Estate in a bubble?

|

||||

|---|---|---|---|---|

|

Home away from home

Joined:

2006/11/13 18:42 Last Login : 2022/2/28 7:31 From 280 Grove Street

Group:

Registered Users

Posts:

4192

|

What are the odds that Trump will lean of Christie for a Casino in JC for his family to run and profit from?

Posted on: 2016/11/16 1:55

|

|||

|

My humor is for the silent blue collar majority - If my posts offend, slander or you deem inappropriate and seek deletion, contact the webmaster for jurisdiction.

|

||||

|

||||

|

Re: Is Jersey City Real Estate in a bubble?

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

Who told you this? lol....I've been following listings at Gull's Cove and a few other buildings in the past year and a half and prices there are flat over this period (in fact, a unit that tried to sell close to $600k a month ago just dropped its asking to $565k today...really not any higher than prices were 18 months ago). I wouldn't expect them to rise by any significant amount if interest rates keep climbing and new construction inventory surges.

Posted on: 2016/11/16 1:53

|

|||

|

||||

|

Re: Is Jersey City Real Estate in a bubble?

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

Seems to me the really higher end like >$5m is the most volatile, since it has the least to do with actual construction costs and everything to do with what the market will bear. Seeing price drops of 30-50% in these as the market fluctuates is not uncommon.

Posted on: 2016/11/15 23:44

|

|||

|

||||

|

Re: Is Jersey City Real Estate in a bubble?

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

I know of some Chinese investors have purchased multiple units in some of the waterfront buildings. They prefer higher end RE knowing they will get a better return on their investment.

Posted on: 2016/11/15 22:17

|

|||

|

||||

|

Re: Is Jersey City Real Estate in a bubble?

|

||||

|---|---|---|---|---|

|

Home away from home

|

Something to keep an eye on....

China's well-to-do have been trying to cash out of China for a while now. The Chinese government has been putting capital controls in place, as it has been forced to dump US Treasuries to cover the capital outflows. The capital controls were one of the main reasons my wife's employer pulled their manufacturing out of China (made paying for components imported to China too difficult). So far, the controls haven't been that effective and China continues to bleed. It appears a lot of the Chinese money is being parked into real estate, driving up prices in certain locals. Vancouver has started taxing Chinese real estate investors with the idea it will slow or stop the property price inflation. It looks like the Chinese money is heading to the USA as well (not just places like NYC). Bloomberg had this: Chinese buyers have responded by branching out to cheaper cities. In the U.S., they?re increasingly searching for properties in Houston, Orlando and Seattle, which displaced San Francisco in the first quarter as the third-most viewed U.S. market on Juwai.com, a Chinese search engine for offshore real estate. http://www.bloomberg.com/news/article ... coming-to-a-city-near-you Curious if the Chinese money is also flowing into Jersey City? If it is, we could see a continue support of high prices, even if the Fed hikes rates in December. On a side note: The Chinese leaving home with their money reminds me of what happened in Thailand in the mid 1990s. The capital outflows eventually led to an economic crash that sucked in much of Southeast Asia.

Posted on: 2016/11/15 21:02

|

|||

|

||||

|

Re: Is Jersey City Real Estate in a bubble?

|

||||

|---|---|---|---|---|

|

Home away from home

Joined:

2014/8/19 16:35 Last Login : 2019/1/12 22:36 From the village

Group:

Registered Users

Posts:

232

|

Quote:

Of the 1br's I've been watching in 07302, they have averaged 5% over asking and landed around $680/ft. Probably a bit of selection bias as I've only really been watching nicer looking places.

Posted on: 2016/5/13 23:17

|

|||

|

||||

|

Re: Is Jersey City Real Estate in a bubble?

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

Listed =/= Sold

Posted on: 2016/5/13 22:20

|

|||

|

||||

|

Re: Is Jersey City Real Estate in a bubble?

|

||||

|---|---|---|---|---|

|

Home away from home

Joined:

2014/8/19 16:35 Last Login : 2019/1/12 22:36 From the village

Group:

Registered Users

Posts:

232

|

Posted on: 2016/5/13 22:14

|

|||

|

||||

|

Re: Is Jersey City Real Estate in a bubble?

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

And there, in a perfect nutshell, is the your perception problem. It was definitely NOT small to property owners at the time, particularly in areas on the gentrification bubble like DTJC where the effect was amplified. We bought our 1st property in 97, which was the dead bottom of that slump in real dollars. We saw properties from owners that were as distressed as the ones we saw in 2011. One group of investors had buildings they had bought in the late 80's and had watched slump for a decade before deciding to pull out. had they stayed in they would have made millions. It makes no difference at all that there were different triggers for all these market crashes, the point is it WILL happen. Sure it may be only 15%, but if you have invested at a price dependent on growth, you have a problem. Recognizing that and being prepared to ride it out is really my only point.

Posted on: 2016/4/18 16:25

|

|||

|

||||

|

Re: Is Jersey City Real Estate in a bubble?

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

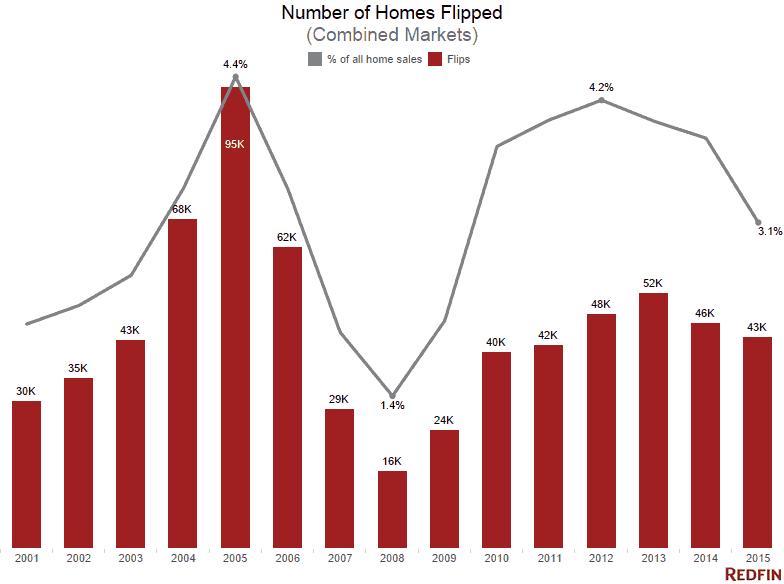

You mean, when the CS Index went from 143 in 1989, to 127 in 1992? The one so small, people barely recall it, as its effects were largely swamped by (if not caused by) the '87 recession and the S&L crisis? Quote: No doubt the crash of 79 was different too, can't be related to this market. I'd say it should be screamingly obvious that both the US economy and housing markets were very different in 1979 and 1989 than today. Unsurprisingly, those differences are not going to be represented in a single chart of a specific type of home sales. Quote: Yup, we're SOOO different this time the hot market will never end, or at least have a nice soft landing. Uh huh. Good grief. I never said, and never will said, that the "hot market will never end." As to soft landing, it's arguable that JC has in fact had a soft landing for the past year or so. Hmmmmm. Quote: Fun Fact of the Day:Number of Active Home Flippers in 2015 Highest Since 2007 http://www.realtytrac.com/news/real-e ... u-s-home-flipping-report/ That's it? That's all you've got? Did you read the article, or just the headline? The number of flippers: 2015 = 110,000 2007 = 130,000 2005 = 259,000  Or look at other stats, which suggest a very different trend?  Or perhaps you can state what a constitutes a healthy number of flippers?

Posted on: 2016/4/18 14:36

|

|||

|

||||

|

Re: Is Jersey City Real Estate in a bubble?

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

You forgot the other time it was different, the crash of 88. No doubt the crash of 79 was different too, can't be related to this market. Those were nowhere near the scale of 2008, but were contractions nationally of ~15%. And as you point out, that national number doesn't account for regions, but NY metro tends to be one of the more volatile regions. Yup, we're SOOO different this time the hot market will never end, or at least have a nice soft landing. Uh huh. Fun Fact of the Day:Number of Active Home Flippers in 2015 Highest Since 2007 http://www.realtytrac.com/news/real-e ... u-s-home-flipping-report/

Posted on: 2016/4/18 3:23

|

|||

|

||||

|

Re: Is Jersey City Real Estate in a bubble?

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

Seems like you see what you want to see. Real estate markets are highly regional, and until the big run-up in the early 2000s, the world had never seen a national (let alone global) bubble like that in real estate. That was one of the key psychological drivers of the bubble mentality. I.e. the time when it was different? 2000 to 2007. The 2000 bubble was made possible and exacerbated by a broad variety of factors, which are now subdued or gone. Mortgage originators desperately searching for potential buyers; banks willing to buy crappy mortgages, and slice and dice them until they look like wonderful investments; willing buyers for complex MBSs and CDOs that they don't understand; ratings agencies willing to look the other way; bad datasets that don't account for new uses of jumbo and other non-standard loans; developers happy to overbuild; buyers desperate to buy a home, lest they be left behind. Today, we have lenders putting borrowers under a microscope; banks more cautious; a subdued market for MBSs and CDOs; ratings agencies concerned about federal oversight; updated datasets; a shortage of inventory, due to the (entirely predictable) overreaction to the bubble bursting; buyers far more cautious. It's far from perfect, but it's also very far from 2004. At the peak of the bubble, the trend line at that point would suggest that a more rational index point is 155, and the actual was 215. Today, the trend line indicates around 160, and we are at... 176. Woah. Perhaps most importantly: Case-Shiller is a useful measure, but way too simple to develop any sort of half-way decent forecast, and was never designed to forecast prices. The national index only tracks repeat single-family homes, so it ignores apartments and new construction. It is prices only, so it ignores volume and rental markets. It doesn't measure interest rates (which are still at record lows, and will clearly impact the affordability of a sale) or inventory. It's a useful index. But using the national indext to make predictions about a local market that is heavy in condos and with unusually high rates of renters? Big mistake. Quote: Of course JC is different than a national dataset since we're rapidly gentrifying, but that seems to amplify some of this stuff, not make it moot. No, I am in the "a broken clock that tells the right time twice a day is still broken" camp. If you're going to claim for another year that "we are in a bubble," even though there really isn't much evidence to support it, or acknowledging that prices can easily flatten off or decline so slightly that people barely noticed, then you're still a broken clock.

Posted on: 2016/4/18 1:55

|

|||

|

||||

|

Re: Is Jersey City Real Estate in a bubble?

|

||||

|---|---|---|---|---|

|

Not too shy to talk

|

SRia- thats defintely a tear down, but it,s a very wide and deep lot, which is hard to find in downtown.

Posted on: 2016/4/18 1:07

|

|||

|

||||

|

Re: Is Jersey City Real Estate in a bubble?

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

I don't disagree with what you are saying, but consider that this property is already paying a fairly high common areas fee (50 cents per square foot, for what is essentially zero amenities, well an exercise room) and their taxes is decidedly due for an adjustment. So, if someone had enough money to buy this property outright in an all cash transaction, they would still have to pay $4,700 (or, more) MONTHLY to cover the $1,156 maintenance fee, plus property taxes of at least $3.5K. That's CRAZY.

Posted on: 2016/4/17 14:47

|

|||

|

||||

|

Re: Is Jersey City Real Estate in a bubble?

|

||||

|---|---|---|---|---|

|

Not too shy to talk

|

C'mon. Looking at the location, can't you see this is aimed at builder/developer??? noboby wants to live in this shithole...

Posted on: 2016/4/17 13:41

|

|||

|

||||

|

Re: Is Jersey City Real Estate in a bubble?

|

||||

|---|---|---|---|---|

|

Home away from home

|

And this for $1.9mil???!?!?!? Is it even safe to live in there???

Posted on: 2016/4/17 13:16

|

|||

|

||||

|

Re: Is Jersey City Real Estate in a bubble?

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

Why are you looking at data for the US market? Jersey City (and I know the old-timers hate to hear this) has more in common with the NYC market, in particular the desirable outer borough neighborhoods of NYC. The problem with Case-Shiller is that it lumps in the entire US market (including perpetually depressed areas people are desperate to get away from) with the NYC metro area, where the entire world wants to be. I would not base any assessment on the overall US market.

Posted on: 2016/4/16 0:41

|

|||

|

||||

|

Re: Is Jersey City Real Estate in a bubble?

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

All I see is a rising market and the usual seasonal fluctuations from spring market bringing September closings. The index I posted is seasonally adjusted to reduce this artifact.

Posted on: 2016/4/15 20:47

|

|||

|

||||

|

Re: Is Jersey City Real Estate in a bubble?

|

||||

|---|---|---|---|---|

|

Home away from home

Joined:

2005/12/18 2:57 Last Login : 2017/9/14 20:15 From Crystal Point

Group:

Registered Users

Posts:

747

|

this chart may be more appropriate for downtown JC

Posted on: 2016/4/15 20:45

|

|||

|

||||

|

Re: Is Jersey City Real Estate in a bubble?

|

||||

|---|---|---|---|---|

|

Home away from home

Joined:

2005/12/18 2:57 Last Login : 2017/9/14 20:15 From Crystal Point

Group:

Registered Users

Posts:

747

|

open pic in new tab for larger size

Posted on: 2016/4/15 20:37

|

|||

|

||||

|

Re: Is Jersey City Real Estate in a bubble?

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

The average curve if you plotted it through the entire postwar period, the center of the waveform created by repeated booms and busts. My guess is that center should be about 160 on the vertical axis, but we're above that. Of course JC is different than a national dataset since we're rapidly gentrifying, but that seems to amplify some of this stuff, not make it moot. So you're in the "this time it's different" camp. Go for it! In 2011 we looked at several properties being sold short by people who thought that and went all in buying up properties.

Posted on: 2016/4/15 20:17

|

|||

|

||||

|

Re: Is Jersey City Real Estate in a bubble?

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

Pattern? No. What I see is a huge anomaly in the 2000s, followed by an overcorrection. I also see there is very little information in that chart. Looking at prices alone does not tell us other factors like the effects of interest rates, inflation, inventory, number of sales, variations in market segments, demographics and so on. Quote: Guess where we are right now on that roller coaster? Certainly above the baseline of the curve. What baseline? Which curve? Does the Case-Shiller index look as awful when looking at prices since 1985?  Quote: But this time it's different, right? In economics, every day is different. Real estate prices have steadily gone up in the past few years due to conditions like record low inventories, low interest rates, an economy that's picking up, millennials just starting to get old enough to buy. We certainly do not have mortgage originators pushing everything with a pulse to sign on the dotted line, or banks champing at the bit to buy tons of poorly constructed mortgage-backed securities, or breathless stories about anyone imagining real estate prices will appreciate at 10% per year into perpetuity. There is no indication of any irrational exuberance, no signs we're in a bubble. Current conditions are not the same as they were in 1920, or 1960, or 2000. That also does not mean we are in a bubble. It is possible that tons of inventory will come on line soon, in high-demand areas. But I don't see much evidence of that, especially in the NYC metro area, where a lot of new midrange inventory is coming online as rentals, and purchases are on the high end. That also doesn't mean we are in a bubble. I.e. you cannot simply look at one indicator on one chart, and on that basis declare "it's a bubble, and anyone who denies it is a fool."

Posted on: 2016/4/15 19:15

|

|||

|

||||

|

Re: Is Jersey City Real Estate in a bubble?

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

Well then nevermind... I assumed it was JC because that is the market we are talking about. In general I think RE prices are a reflection of very, very low interest rates. If/when those snap back to historical norms so will RE prices. But I don't know when that happens in a world that simply isn't growing as quickly.

Posted on: 2016/4/15 16:49

|

|||

|

||||

|

Re: Is Jersey City Real Estate in a bubble?

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

Umm, that's the graph for the entire US market, not JC.

Posted on: 2016/4/15 14:47

|

|||

|

||||

|

Re: Is Jersey City Real Estate in a bubble?

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

Well, picking one RE market and saying that the rise is unsustainable is a lot like picking one stock and saying it can't sustain it's price rise. I mean you could be correct or there could be something different about that one stock/RE market. Individual markets/stocks outperform and sustain that out performance on a regular basis. Looking a inflation adjusted rise of just JC is not terribly instructive. Individual markets have a lot of noise. You might as well look at Detroit and say it is vastly undervalued because it hasn't tracked the overall market exactly.

Posted on: 2016/4/15 12:12

|

|||

|

||||

|

Re: Is Jersey City Real Estate in a bubble?

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

I don't think healthy markets rise at this rate. Here's the inflation adjusted Case Schiller for the last century. Notice a pattern from about 1967 on? Guess where we are right now on that roller coaster? Certainly above the baseline of the curve. But this time it's different, right?  http://www.multpl.com/case-shiller-ho ... index-inflation-adjusted/

Posted on: 2016/4/15 3:05

|

|||

|

||||

|

Re: Is Jersey City Real Estate in a bubble?

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

lol In case it wasn't obvious, I'm making fun of the "Doctor Dooms." I must disagree with your analysis, though. Among other things, it leaves no room for healthy real estate markets, or people who correctly identify a bubble, or who correctly identify declining markets. It's also pretty obvious that JC has not been in a bubble for the past year. It's just a hot market without much inventory, and a lot of what's coming on line is rentals.

Posted on: 2016/4/15 0:33

|

|||

|

||||

|

Re: Is Jersey City Real Estate in a bubble?

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

Agreed that the hallways are due for a refresh (I think the lobby is quite nice), but the unit in question has been upgraded like crazy. Other than a couple of outdated features, that is a very high-end renovation (just look at the doors, the bathrooms, that closet, the fireplace, all really high quality stuff) which is nearly assuredly well above the Oakman's standard finishes. And the 22-ish foot high living room definitely adds to the value pretty seriously. There are obviously more amenities at the Oakman, but a lot of people don't really *want* a doorman. I find it awkward. Sure, a common roof deck/pool would be nice, though, but tends to add significantly to the common charges. I wonder if the Oakman has a direct-access garage. Having lived in a lobby-access garage before, the difference in convenience between the two is massive. And, despite a lot of positives, the Oakman is falling into the whole tiny-living-room trap that a lot of newer buildings fall into. I want my bedrooms tiny, and a huge living room for, well, living.

Posted on: 2016/4/14 18:11

|

|||

|

||||