|

Re: Selling a Haunted House? Here’s What You Need to Know

|

||||

|---|---|---|---|---|

|

Home away from home

|

Y'all do know that ghosts don't actually exist, right...?

Posted on: 2019/11/6 15:03

|

|||

|

||||

|

Re: Fulop wants to charge NY’ers their own congestation pricing

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

Uh... No, they really aren't. NJ's population has increased at pretty much the same rate since the 70s. The research is pretty clear that people don't drop their jobs, families, kids' schools, professional networks and friends because taxes went up a few basis points. Similarly, Kansas' population did not soar when the state slashed its taxes -- in fact, population growth slowed, possibly because Kansas' government already does almost nothing, and the tax cuts resulted in year after year of fiscal crisis followed by slashing what little spending remained. Anyway.... People leave mostly because they are getting older and retire to warmer climates, typically Florida.

Posted on: 2019/4/4 3:29

|

|||

|

||||

|

Re: Judge OKs site plan for controversial 'micro-unit' project in Jersey City

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

It's high-density, it's efficient, it's cheap, it's like getting a big apartment without the hassle of finding roommates and hoping they pay their share of the rent. The JC units are prefurnished, the building includes laundry and a gym. I'd add that several cities now have a major problem with affordable housing, and increasing density is one of the few options.

Posted on: 2019/3/1 18:03

|

|||

|

||||

|

Re: New Jersey-New York area lost 5,700 millionaires in 2018

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

Again, that rarely happens. For example, let's say you're an investment banker at JPM. Are you going to quit and move to Florida solely to whack a few grand off your taxes? As you get older (and are paid more, and accumulate more assets) you develop more ties to the community. Moving means taking kids out of school, leaving friends and family and business networks behind. It also means reducing or losing access to NYC, including all those job and business opportunities, cultural institutions, and so on. If NJ announced tomorrow that it will tax incomes higher than $1 million at a 70% tax rate, that would motivate the 1%ers to leave. Are they going to move to Florida, because they want to pay a 1% property tax instead of 2.3%? I don't think so. They'll just hire a good accountant to reduce their tax liabilities. The idea that people flee a state because of higher state taxes is not reality. It's a myth.

Posted on: 2019/1/31 0:09

|

|||

|

||||

|

Re: New Jersey-New York area lost 5,700 millionaires in 2018

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

New Jersey pulls in around $31 billion per year in taxes. I'm gonna go out on a limb and say that NJ's budget can handle an alleged 0.16% drop in annual tax revenues. I'm gonna go out on another limb, and say that your typical billionaire will have all sorts of ways to reduce their state tax burden. Sure, Tepper paid a lot more in taxes than I did, but he didn't move his family and his multi-billion dollar hedge fund to Florida just to save a few million in taxes (that's a rounding error for him). I'd also add that this kind of "volatility" in tax receipts is entirely normal. Tax receipts always rise and fall, usually based on how the (state) economy is performing; any legislator who expects tax revenues to be fully predictable is not paying attention. (In fact, as a percentage of total revenues, NJ relies less on income taxes than New York or California.) I've gotta say, it sounds more to me like certain legislators want to suck up to a few billionaires. By the way, for those who didn't read the article closely: The "5700 less millionaires" is not New Jersey. It's the NYC metro area -- i.e. it includes New York City. The same research entity ("Wealth-X" -- who?) also indicated that NYC alone had nearly 1 million millionaires. Oh, and other sources point out that NJ has spent years adding millionaires (e.g. https://www.nj.com/politics/index.ssf/ ... millionaires_growing.html) And of course, there is very little actual evidence that tax rates actually drive rich people to move. If that was the case, billionaires would be moving to Delaware and Nevada in droves. (https://www.theguardian.com/inequality ... icts-millionaires-threats) So, color me unimpressed about the claims that "zomg high taxes are driving rich people away!" It's a conservative myth.

Posted on: 2019/1/24 3:02

|

|||

|

||||

|

Re: A new N.J. bar’s dress code was called racist. The owner says it was ‘an oversight.’

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

People are reacting to claims that the dress code was selectively applied, as an excuse for racial discrimination. The title of the articles about the Ashford are poorly written, as the dress code itself is not racist. It's the way it was allegedly used. Quote: Restaurant and bars can't win in this environment: if they try to keep out troublemakers and riff raff, they are automatically labeled as racists.... Yeah, that's not what is happening here. There is no problem whatsoever with ejecting a customer who is causing trouble. What a bar or restaurant can't do is eject every customer with brown skin because the owners or managers or bouncers suspect they will cause trouble. (It should be fairly obvious that wearing baseball caps, sunglasses, cargo pants and work boots doesn't mean you are "riff raff." It means you're wearing a cap, sunglasses, cargo pants and work boots.) I also don't hear of a lot of bars in the greater NYC area getting dinged with allegations of racism because they are throwing out troublemakers.

Posted on: 2019/1/17 15:32

|

|||

|

||||

|

Re: A new N.J. bar’s dress code was called racist. The owner says it was ‘an oversight.’

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

Requiring professional attire does not violate any anti-discrimination laws. "Those who wear sweatpants" is not a protected class. If they kicked out everyone who wears sneakers, regardless of race or gender or sexual orientation, then the policy is fine -- even if it rubs some people the wrong way. However, If you have a dress code, you have to apply it neutrally and uniformly; you can't use it as an excuse or cover for racial discrimination. For example, "Sam K" wrote on Yelp: Confused with the dress code. My blonde female friend was allowed in with loose sweat pants but for some reason the other guys in our group (who happened to be black and wearing normal looking pants or at least we thought they were), were not allowed in and told by the bouncer they do not let people in pajamas in. According to their dress code sign now (that they put in place after our night out), Adidas trainers are bad maybe worse than pajamas. But then at the same time my white male friend was let in with gym sneakers no issue. Let's face it. This is going to be one of those places. So if you're into that, you'll have a blast. If you're not, there's plenty of fun places in JC to choose from beyond the first couple blocks of Newark ave without racist and sexist policies. If this is true (and obviously, just posting it on Yelp doesn't prove that it's true), then posting the dress code isn't the problem. It is that someone using the dress code as an excuse to engage in racial discrimination, which is unethical and violates public accommodation laws.

Posted on: 2019/1/17 15:17

|

|||

|

||||

|

Re: Would MTA be a better operator for PATH? And other ideas...

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

If you are talking to me, then I agree, and never said otherwise. However, rail is obviously quite different than ferries, bridges and ARTs. Quote: That giant one in Vietnam was completed in 19 months, including the approval process. Vietnam has an authoritarian government, so... Approvals are not as big an issue as in the NYC area. The towers were all built on undeveloped/park land, connects one large island to a smaller island slated for tourist development, and duplicated an existing ferry service. I.e. it's a tourist attraction, not a commuter system. For a Hudson tram to work, you'd need massive towers (200+ feet high) on both sides, so it will have at least the same local objections as a pedestrian bridge. If the towers are on land, then it will need room for the gondolas to rise. Thus, it offers no advantages in this respect over a bridge. (Ferries obviously already have their docks.) I'm not seeing many signs that they're cheap, either. Portland's ART is 1km long and transports 10k riders per weekday. It was basically built to connect OHSU's two campuses. OHSU patients, students and staff travel free, and everyone else pays $4.70. It cost $56m to build in 2007 (initial projections were $15m btw), mostly on land owned by OHSU. It only travels over land; tallest tower is 140 feet; it needs 3 engines (one is on standby) and a 40 long-ton counterweight; does not operate 24 hours per day, and costs $1.7 million to operate per year. So, like I said... Compared to a bridge, trams need engines, have lots of moving parts, require more ongoing maintenance, require more power, will cost riders more, will require tickets, and still has a first/last mile problem. Nothing you've said proves otherwise. Quote: There's exponentially more tramways & gondolas in the world than subways. ...yes, that's because they are commonly used for ski resorts and tourist attractions. Quote: You clearly have simply no understanding of the engineering challenges that make your bridge a terrible idea. Bridge building is not easy, the history of collapses range from the recent ones in Italy and FL back to classical times. Have you ever seen the film of the collapse of the Tacoma Narrows Bridge due to wind resonance? You saw a movie about the Tacoma Narrows in high school, therefore all bridges are insanely difficult to build and maintain? Are you even remotely serious right now? You should be glad to hear that bridge engineering and construction has come a long way since 1940. Anyway... I never said that building a bridge would be easy. I'm saying it would be easier and greener than a tram (and that expanding existing ferries is easier than both), that it has less of a first/last mile problem, is easier to maintain etc etc. Quote: So, simply put: the design by the stupid architects is not viable due to the number of pylons in the river obstructing traffic and driving up costs.... The plans already meet clearance requirements. They didn't just slap together some renderings in 3ds Max, they did a bit of homework. There is really no question that the project is feasible.

Posted on: 2019/1/16 17:09

|

|||

|

||||

|

Re: Would MTA be a better operator for PATH? And other ideas...

|

||||

|---|---|---|---|---|

|

Home away from home

|

brewster wrote:

Quote:

Please. - A trolley needs some pretty serious engines, has a lot more moving parts, has to carry much heavier loads, and needs a lot of maintenance to ensure reliability and safety - Trolley will require more power, more maintenance = less environmentally friendly Mind you, I'm not saying that a bridge is simple or zero maintenance. It's that it is simpler and requires less maintenance than a tram. Quote: Quote: When compared to a pedestrian bridge, it's a bug. Almost no public transportation systems pay for themselves via fares. Public transportation is incredibly expensive to build and operate; users don't want to pay the full cost; and people flip out when fares rise by any amount (which is why fares can go for years without so much as a simple adjustment for inflation). The NYC subway is one of the most efficient systems in the US, but still loses $1 per trip, and thus incurs a $1.2 billion deficit. The ferries are for-profit, not subsidized, and costs $8 per trip. This is one reason why the ferries carry fewer passengers than the PATH: Higher price = lower demand. If a Hudson tram charges full price, whatever that price is, that will result in lower demand. If they subsidize the price, that increases demand, but then the system essentially loses money on each passenger. Again, once you start charging, you need ticketing systems. That means riders have to spend time buying tickets, it means you need ticket booths, you need customer service.... Best of all, some government agency will have to manage the tram, and absorb the losses. The most likely candidate is, drum roll please... Port Authority! In theory NJ Transit could do it, but they are already in a mess. MTA, by the way, has something like a $6 billion deficit, so they won't want it either. And of course, from the perspective of a commuter, $0 can be quite enticing compared to $8 or $5 or $2.75 per trip. Quote: tourists would pay to use the gondola, subsidizing it's cost. They only subsidize the cost if the tram charges more per trip than it costs to operate -- and that almost never happens with public transportation. (See above.) Quote: I don't disagree with the notion of expanding and subsidizing ferry service, as I said, we need all the transport we can get given the population expansion. I'm just saying the bridge is an extremely stupid idea, a tramway a better idea, more effective and actually doable, but still unlikely. It isn't a "stupid idea," it's just one that does not appeal to you personally. In a region that wants to reduce congestion on the streets, and where an aging subway system is already under strain, enhancing human-powered options is an excellent option, and something we should encourage.

Posted on: 2019/1/15 18:10

|

|||

|

||||

|

Re: Would MTA be a better operator for PATH? And other ideas...

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

I have no doubt it can be done. It's just that subsidizing/adding ferries would be easier, faster, more affordable and more flexible.

Posted on: 2019/1/14 21:54

|

|||

|

||||

|

Re: Would MTA be a better operator for PATH? And other ideas...

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

sigh Again: A trolley system is, ultimately, just a more expensive and less flexible version of a ferry. ? It only goes point-to-point, which leaves a big problem for first- and last-mile ? It's less environmentally friendly than a pedestrian bridge ? It's a much bigger engineering challenge than a pedestrian bridge (or adding ferries) ? It will cost more to build and maintain than a pedestrian bridge (or adding ferries) ? Even if subsidized, it will cost riders more than a pedestrian bridge ? Like the ferries, you have to wait for the tram and to buy tickets; the only way you'd wait for the pedestrian bridge is if it is incredibly crowded ? A tram won't be much faster than a bicycle, possibly slower given boarding times Those are a few reasons why I favor a pedestrian bridge -- or, at least, subsidizing and adding ferries -- over a tram. Quote: For the amount of people you can move via cable car, we could easily solve the issue of moving people in/out of Manhattan. Not so much -- because, again, you've got a first- and last-mile problem. That's not inconsequential, given the paucity of subway stations on most of the West Side. And as we see with the Manhattan and Brooklyn bridges, a bridge that you can bike over doesn't have that issue. Quote: As you correctly point out, a cable car solution would also enjoy tourist interest.... So would a pedestrian bridge.

Posted on: 2019/1/14 21:52

|

|||

|

||||

|

Re: Would MTA be a better operator for PATH? And other ideas...

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

You do know we have ferries, right?

Posted on: 2019/1/11 18:06

|

|||

|

||||

|

Re: Would MTA be a better operator for PATH? And other ideas...

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

Funiculars use pulley systems, which leverage gravity, to transport riders up short slopes. Not long rivers. ;) The closest I'm seeing to those numbers for gondolas in real-world use is Mexicable at 30,000 per day; that's with a low fare (~40 cents). Having higher capacity would change the cost-per-trip calculations of building and operating the system, but not everything else -- cost, point-to-point, last mile problems, ongoing maintenance etc. I.e. all the problems of a ferry, and less flexible. Kinda seems like we'd be better off subsidizing the ferries and increasing frequency -- a policy that, again, does not preclude us from building a pedestrian bridge. And again, claims that "no one will use a pedestrian bridge!" don't add up, given the use of the East River bridge crossings. Just on bike counts alone, Manhattan and Brooklyn are over 6000 per day -- and that's with the Brooklyn Bridge maxed out. Plus, last I checked, "free" is usually a more enticing cost to commuters than $3 or $8 per trip. Even the GWB gets a pretty good amount of bike traffic, even though the walkway isn't open 24/7, sucks for bikes, and it connects Fort Lee to Washington Heights. (Weekend use is 3700+ and growing, btw) By the way, bike commuting is growing significantly in NYC over the years, in no small part because the city is building out cycling infrastructure. Meaning that demand for a ped/bike bridge would be higher in 5, 10, 15 years than it is today. I doubt it would hit 30k bike trips, but 10k seems quite likely.

Posted on: 2019/1/11 18:05

|

|||

|

||||

|

Re: Would MTA be a better operator for PATH? And other ideas...

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

And again: For reference, the new Mario Cuomo bridge cost $4 billion. It's actually two bridges, each 3 miles long, for a total of 8 lanes, plus a pedestrian path, plus removal of the previous structure, all while keeping cars flowing. A pedestrian bridge is not going to cost billions. Like I said -- more like 8 figures rather than 10. And again, consider ongoing maintenance. A bridge obviously doesn't cost $0 to maintain and operate -- but it definitely costs far, far less than a train, or tunnel, or tram. Quote: Yet, I'm willing to put all that aside, and point out that the stakeholders of the neighborhoods and Hudson views on both sides of the river would never let this happen. You have given no though at all to those impacts. Right. So now we've gone from "no one will use it!" (which is wrong) to "it'll cost billions!" (which it won't) to "it'll spark lawsuits!" Pretty much any and every public project in NYC and NJ runs the risk of lawsuits and/or political opposition. That didn't stop the West Side Greenway, or Hudson Yards, or the Hudson River Waterfront Walkway, or refurbishing Washington Square Park, or.... I.e. not every project ends up like Westway. Quote: This is simply a stupid idea at every level for the astonishingly small return to a the few people who live and work close enough to either end and would be willing to make the several mile walk even in fine weather, let alone a brisk day like today. Or: Not everyone is terrified of traveling more than 10 minutes without a motor. A pedestrian bridge is a low-maintenance and green option, available 24/7, that can be equally (if not more) successful than the pedestrian paths on the Manhattan and Brooklyn bridges.

Posted on: 2019/1/11 17:18

|

|||

|

||||

|

Re: Would MTA be a better operator for PATH? And other ideas...

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

I have no idea. But I expect it will be later rather than sooner (i.e. decades not years), as they will soon expand capacity with switch upgrades, then eventually 10-car trains, and (one hopes) open gangway trains. Quote: Quote: It won't happen tomorrow, but the new fleet is already close to 10 years old, and they could replace it in 20-25 years. At any rate, at least it's an option. Quote: While I appreciate your input to brainstorm better ideas for transhudson crossings, it's rich to call out my demand pricing suggestion for peak hours while proposing something that will cost billions and has an extremely minimal chance of being built. If it ever is built by some miracle of God, I would love to walk/bike across it though!! It won't cost billions. The new Tappan Zee -- sorry, new Mario Cuomo -- is 3 miles long, built for car traffic, and cost around $4 billion. That's for two separate structures, 8 auto lanes, a pedestrian crossing, and demolition of the existing bridge, all while keeping traffic flowing. One of the longest pedestrian/bike bridges in the world is Big Dam, which is 1.28km, and cost $12 million. A Liberty Bridge won't be cheap, but I think we're talking 8 figures rather than 10.

Posted on: 2019/1/9 16:44

|

|||

|

||||

|

Re: Would MTA be a better operator for PATH? And other ideas...

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

2nd Street to the park next to Stuyvesant is 1.5km. Even giving more room for entrance and exit, the Big Dam and Bob Kerrey bridges are in the general neighborhood. Obviously, Brooklyn and Manhattan residents are traveling more than 200 feet to get to the bridges. And again, there is no question that in terms of engineering, it's definitely feasible. By the way, Big Dam cost around $12 million in 2007. Obviously a "Liberty Bridge" would be more expensive, but it's not going to cost billions. Quote: Even under the best/rosiest of estimates, you have 5,000 commuters crossing the Brooklyn bridge every day. That's about 5 - 7 PATH trains, or 30 minutes of added rush hour service. That's why I also mentioned the Manhattan Bridge, which has 4000 bicycle crossings alone. Distance isn't a deterrent. The pedestrian/bike path on the Manhattan Bridge is about 1.2 miles long, and still gets lots of weekday crossings. In fact, there would be more commuter crossings on the Brooklyn Bridge if the facility wasn't so crowded. The demand is there, but the capacity isn't. If the path was widened, we'd see more crossings and more commuters using it. Quote: If you want to see a more efficient method to add capacity, at least suggest cable cars/gondolas. That could be a much more effective solution than the idiocy that is a pedestrian bridge over the Hudson. This is not a zero-sum game. It's not "tram or pedestrian bridge." But if you must compare... ? A tram across the Hudson would be much more expensive than a ped/bike bridge. The Roosevelt Island tram, which is around 900m in length, cost $25 million just to renovate in 2010. ? A Liberty Bridge would almost certainly be free to cross, and a Hudson tram would almost certainly charge for rides. I.e. a tram not just more expensive to build and maintain, it's more expensive for people to use. ? Roosevelt Island tram has a max capacity of 14,000 trips per day. (That could go higher if it ran 24 hours, but... it doesn't.) Again, we are at unknown cost-per-trip comparisons, but it seems like a pedestrian bridge would be less expensive, more amenable to tourists, and could have a similar capacity. ? Like RI, a tram probably won't operate 24/7. A Liberty Bridge would almost certainly be open 24/7. ? A tram would basically go from waterfront to waterfront, meaning that like the ferries, those crossers have to use some other system to continue their commute. (That's also true if you walk, but not if you bike.) ? Like the ferries, trams require waiting (7-15 minutes); a pedestrian bridge does not. So while a tram will move faster than walking, you might only save 10-15 minutes. ? Needless to say, a ped/bike bridge is much greener than a tram. To put it another way: A tram has all the same problems as the ferries, except that it's more expensive to build and operate. Yay...? Yeah, I'll go for a Liberty Bridge -- or even ferry expansions and subsidies -- over a tram. No question.

Posted on: 2019/1/9 15:44

|

|||

|

||||

|

Re: Would MTA be a better operator for PATH? And other ideas...

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

And yet, thousands of people do exactly that, every day, with the Manhattan and Brooklyn Bridges. Quote: There are no pedestrian bridges in the world with that kind of length for very good reason. Try again. Big Dam Bridge is 1.28km; Bob Kerrey Bridge is 940m; Nescio is 740m. Those are all relatively new bridges. It's not common, but that alone does not prove it's a bad idea. E.g. almost no transit systems in the US use open gangway cars; does that, in and of itself, prove that it's a bad idea?

Posted on: 2019/1/8 18:55

|

|||

|

||||

|

Re: Would MTA be a better operator for PATH? And other ideas...

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

Haha... No, I had no idea/recollection of your opinion. From a mechanical perspective, there is no question it can be done. ROI on the bridge could be quite good. On weekdays, the Manhattan Bridge has roughly 4000 bike crossings; Brooklyn has another 2200; pedestrian crossings are almost certainly higher. How much would it cost to expand PATH capacity by, say, 10000 riders per day? The construction costs won't be cheap, but will definitely cost less than building a new bridge capable of handling motorized traffic and/or a new rail line. Maintenance will obviously be a fraction of the cost of the Holland Tunnel or GWB. In terms of getting around, bicycles are just as fast as the subway, and greener to boot. Thousands of people commute from Brooklyn to Manhattan via bike, and obviously thousands travel from DTJC to WTC, so there is really almost no question the demand will be there. It only seems crazy because we live in a nation that doesn't value pedestrians and bikes.

Posted on: 2019/1/8 18:41

|

|||

|

||||

|

Re: Would MTA be a better operator for PATH? And other ideas...

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

Alrighty then First, we should also note that the PATH train is nowhere near a "breaking point." (Again, let us know when PA hires subway pushers.) One of the reasons the PATH has a big deficit is because PA is already spending money to expand capacity, with new switches and (eventually) 10-car trains. Another option occasionally mentioned here is using open gangway cars. I don't know if regulations allow that, but it would provide numerous benefits, including expanded capacity and better distribution of passengers on partially crowded trains. However, even the most brilliant ideas to expand capacity on the existing lines probably can't outrun population growth. (I would discuss induced demand, but I think developers will keep building in JC, Harrison and Newark no matter what.) Eventually, the region will require a major expansion of infrastructure. I for one am a fan of building a pedestrian/bicycle bridge across the Hudson....

Posted on: 2019/1/8 15:59

|

|||

|

||||

|

Re: Would MTA be a better operator for PATH? And other ideas...

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

Too late Quote: Integration with NYC Transit would be a godsend. It really wouldn't. First, the PATH will lose money no matter who is running it. Fares only cover half its cost; the idea that you can cut its costs by 50% by changing management is borderline delusional. Meaning that even if it was significantly better run, it would still lose hundreds of millions of dollars a year. On that basis alone, I cannot imagine any government agency in any way wanting to be on the hook for the PATH. Second, the MTA is a freaking mess. Rampant weekend closures, a switching system that dates from the 1930s that will cost $37 billion and ten years to replace, and doesn't include station upgrades. Third, who actually runs the MTA? The Governor of New York. If you think PA is unresponsive, what will happen when the PATH is answerable to Albany? Go ask Di Blasio, who feuds constantly with Cuomo over the MTA. Will Albany want to spend money on stations in New Jersey? Extend the PATH to Newark Airport? Will the agency that was going to shut down the L Train for 15 months do better with WTC tunnel improvements? Is it really better when Cuomo blows away 3 years of planning for the L Train shutdown on a chance encounter (and/or to screw with Di Blasio)? What would happen if the MTA decided to chronically underfund the PATH, as it's done with the NYC subway? To paraphrase the old saying: The PA is the worst agency to manage the PATH, except for every other agency. Quote: Although MTA has it's problems, they look like a well-run Swiss organization compared to the Port Authority or NJ Transit. When was the last time you rode the 6 during rush hour? Quote: My other ideal is much more radical... PATH should add a dollar or more surcharge for swipes during peak periods to reduce overcrowding. That would definitely help, but... that is basically a 36% fare increase during those periods. Some of us can handle it, but that's pretty brutal for some riders. More to your point, it's not going to reduce ridership much (if at all). The people riding during peak times are commuters, who need to get to work. What are they going to do, take the $7 ferry? Drive? Quote: with the extra revenue being used for service improvements... The PATH runs a $400 million deficit. Increasing fares by $1 would reduce the deficit by quite a bit ($260m?) but certainly won't be able to fund service improvements. Quote: Let's face it, the overcrowding situation is at crisis levels. It really isn't. Let us know when the PA needs to hire train pushers.  Quote: The problem is I have no confidence in the Port Authority as they will waste any extra revenue derived from PATH. The finances are already a blackhole. Yeah, thing is? PA is actually putting money into the PATH. That's a key reason why it's got such a huge deficit. I might add, I don't hear a lot of NYC residents expounding on the greatness of the MTA these days. That definitely sounds like a "grass is greener on the other side" thing. The reality is that public transportation and public infrastructure is very expensive... and we don't want to pay for it.

Posted on: 2019/1/7 1:35

|

|||

|

||||

|

Re: DTJC ? Where

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

This isn't an age thing, and public meltdowns are not a new thing. What's changed is that everyone now has an Internet-connected video camera in their pocket at all times, so when someone blows up, it can be recorded and internationally distributed at the push of a button. Something that isn't new? Every generation dumps on younger generations. Once upon a time it was the Boomers who were spoiled rotten and selfish (anyone else remember the "Me Generation"?). Then GenX were a bunch of slackers, mostly because they were joining the workforce during a nasty recession. When the Millennials get a little older, they will find a reason to insult Gen Z (or whatever they end up getting called). Millennials won't have long to wait before they can punch down on the next generation. After all, Millennials are not exactly young anymore -- they are roughly 22 to 38 years old. Of course, they won't be any more right than their predecessors. Being born in a certain year does not impart inherent personality traits, and the empirical evidence does not suggest any major personality differences between generations. (E.g. https://www.psychologytoday.com/us/blo ... aby-boomers-really-differ)

Posted on: 2018/12/31 15:09

|

|||

|

||||

|

Re: Tax Lien

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

That's because if your home is worth $2.2 million, then yes, $16k is a MASSIVE underpayment. Quote: There were properties in the Van Vorst community that was paying over $20,000 a year before reval. So what? Only 243 properties were billed at $20k or more per year. That is 0.5% of all properties. Guess what? Only 80 of those properties had their taxes increased. 163 had their taxes reduced. Why should they have to pay higher taxes? So that YOU can get a tax break, for no reason whatsoever, while the value of your property increases? Quote: My late friend, Joe Duffy, had a house on Grand St. After his death, the row house, around 20 feet wide was turned into a 3 unit condo.... And yet again! You don't give a crap about the people who were overtaxed. Shame on you. Shame.

Posted on: 2018/12/3 22:30

|

|||

|

||||

|

Re: Tax Lien

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

You have no excuse for such incredibly inaccurate and biased claims. You've known about this more than long enough to understand that the reval is revenue-neutral. I just reviewed Appraisal System's assessment list. Out of 43,000 properties, only two homes seem to have gone from $16k to $35k. Guess what? Their taxes went up, because their assessed values went from $200,000 to $2,200,000. Guess what else? If the city budget was still around $485m, their taxes would have still increased dramatically. Guess what else? As already noted, those units underpaid their fair share of taxes for decades. If they owned the unit since the last reval, a ballpark guess is that they didn't have to pay $300,000 in taxes -- none of which they have to pay back. Guess what else? Someone else in Jersey City paid more taxes so that your buddy could get an unfair tax break. Guess what else? Half of Jersey City residents were overtaxed. Half. Why don't you ever express the tiniest iota of sympathy for them? Resisting the reval, or trying to roll it back, or trying to give people a tax break solely because they used to have a deeply unfair tax break, is the epitome of selfishness. You should be ashamed of yourself.

Posted on: 2018/12/3 21:25

|

|||

|

||||

|

Re: Tax Lien

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

You do realize that has nothing whatsoever to do with this discussion?

Posted on: 2018/12/3 17:28

|

|||

|

||||

|

Re: Tax Lien

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

Wrong, wrong, wrong, wrong. Ridiculously wrong. The reval is revenue-neutral. The total property tax bill for Jersey City did not change because of the reval. What the reval does is rebalance the payments to make them more fair. Thus, some people's property taxes went up -- and other people's property taxes went down. I find it hard to believe you don't know this by now.

Posted on: 2018/12/3 17:21

|

|||

|

||||

|

Re: Tax Lien

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

If you have lived in the same home for decades, and your property taxes shot up during the reval, this means.... ? The value of your property has increased significantly over that time. ? The city failed to adjust your assessment, meaning you essentially underpaid your taxes for decades. That means someone else in JC was taxed more to make up the difference. ? If your taxes went from $6000 to $12000, that probably means you were not obligated to pay $60,000 or more over the years -- and someone else paid it instead. From what I can tell, none of the complainers give a second thought to the people who received tax relief after the reval. (This may be due to the complexities of the system, but I'm sure some of it is due to good ol' self-centeredness too.) ? This did not happen overnight. It was in the works for years. Those residents had plenty of time to prepare. If you were shocked, you weren't paying attention. We should also note that a lot of the people whose taxes went up are not fragile retirees on a fixed income. It includes the people who bought in the past 5-10 years, i.e. lots of young professionals who could afford to buy in DTJC. This is why my sympathy for the complainers is limited. It is also why the city should do revals every 3-5 years, instead of every 30 years.

Posted on: 2018/12/2 23:43

|

|||

|

||||

|

Re: Anyone planning to appeal 2018 property tax increases?

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

"Comps" means "comparable sales to your property."

Posted on: 2018/11/29 3:22

|

|||

|

||||

|

Re: Anyone planning to appeal 2018 property tax increases?

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

Your taxes are based on the market value of your property. An appeal will be based not on how much your taxes increased, but your ability to prove that the assessor got it wrong. You do this basically by filling out a form, and listing comparable sales to your property. So no, it's not particularly annoying or painful. A good description is here: https://civicparent.org/2018/06/07/jer ... ic-step-by-step-overview/

Posted on: 2018/11/27 1:26

|

|||

|

||||

|

Re: Jersey City bursting at seams with population surge

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

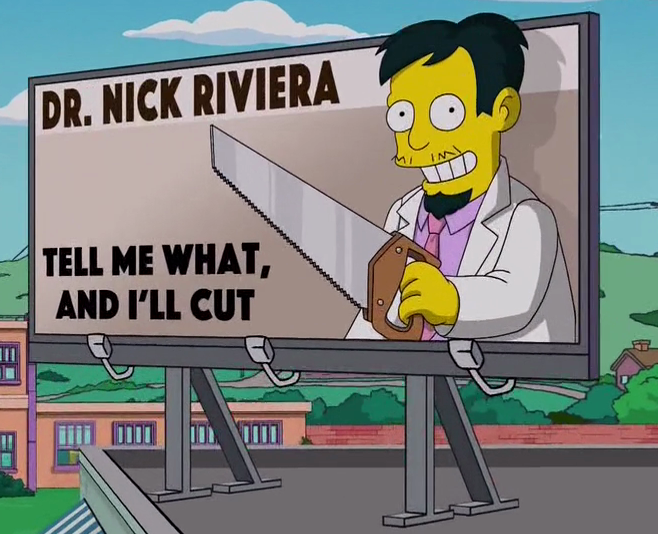

I know this is off-topic, but... Did you really not get the Simpsons reference?

Posted on: 2018/11/17 18:14

|

|||

|

||||