|

Re: JC Public Schools is short $70 million

|

||||

|---|---|---|---|---|

|

Home away from home

|

Jersey City teachers ratify contract with raiseJERSEY CITY -- Teachers with the Jersey City Public Schools have approved a contract that comes with a pay raise and stipend for those who pay into their health benefits. Members of the board of education finalized the agreement during Thursday night's meeting at Snyder High School, just under two hours after 81 percent of teachers voted in favor of the agreement, according to the teachers' union. The new contract was initially agreed upon last month following a one-day strike, with teachers demanding relief from Chapter 78 – New Jersey's 2011 law that revamped how public employees pay for their health benefits – saying they were bringing home less money despite salary increases. http://www.nj.com/hudson/index.ssf/20 ... ntract_with_6_percen.html

Posted on: 2018/4/24 3:04

|

|||

|

||||

|

Re: JC Public Schools is short $70 million

|

||||

|---|---|---|---|---|

|

Home away from home

|

Teachers to vote on contract with 6 percent raiseJersey City teachers will receive a 6 percent raise over the next two years if they ratify a contract that has already been agreed upon by the union and school district. Teachers in the 29,000-student district walked off the job last month saying they need relief from Chapter 78, New Jersey's 2011 law that revamped how public employees pay for their health benefits, has decreased their take-home pay despite salary increases. A copy of the contract obtained by The Jersey Journal indicates teachers would receive a retroactive 3.5 percent raise dated back to September, when the last contract expired. They would receive another 2.75 percent raise at the beginning of next school year. http://www.nj.com/hudson/index.ssf/20 ... with_6_percent_raise.html

Posted on: 2018/4/18 2:05

|

|||

|

||||

|

Re: JC Public Schools is short $70 million

|

||||

|---|---|---|---|---|

|

Just can't stay away

Joined:

2015/10/21 0:40 Last Login : 2019/5/15 18:48 From One of the Oranges

Group:

Registered Users

Posts:

138

|

Quote:

I agree with your assessment of the politics, especially regarding downtown, but isn't there anyone in Jersey City who understands school finance well enough to realize that the 2% tax levy increases that the JCBOE have been passing are next to nothing for a district with a budget that is 5x larger than the tax levy? For Jersey City, a 2% tax levy increase only equals 0.4% of the budget. Doesn't anyone realize that the Jersey City BOE isn't constrained by the tax cap anyway? The existing tax cap has exemptions for medical cost growth and the JCBOE already has the legal authority to raise taxes well in excess of 2.0%. Doesn't anyone realize that the Jersey City BOE needs to pass a 10% tax increase to equal 2% of the budget, or really a 15% increase to keep up with the more rapid rate of inflation in education. ---- I agree with your assessment of the politics, but that anti-tax attitude is motivated by selfishness and a desire to have the state pay for what Jersey City is capable of paying for itself. Jersey City's school tax rate is going to be 0.42. The state average is 1.3. You can find many towns where the school tax rate is >2.0. I realize that property values are increasing faster than some residents' incomes, so that there are many people in Jersey City who are living in houses that they could never afford to buy today. As sad as I would be to see someone taxed out of their property due to its appreciation, those people are asset millionaires, and I'm not going to have a lot of sympathy for them compared to people whose property taxes and underfunded school system are eroding the value of their properties and therefore is seeing their most important asset depreciate in value. As painful as it is to pay higher taxes on a house with an appreciating value, it's even worse to see someone pay higher taxes on a house that is losing value.

Posted on: 2018/4/5 14:35

|

|||

|

||||

|

Re: JC Public Schools is short $70 million

|

||||

|---|---|---|---|---|

|

Just can't stay away

Joined:

2015/10/21 0:40 Last Login : 2019/5/15 18:48 From One of the Oranges

Group:

Registered Users

Posts:

138

|

Those in Jersey City who are honestly so concerned about the JCPS being below Adequacy need to start demanding that the JCBOE use its existing banked cap and then put a referendum to the voters asking approval for a higher tax levy. Despite having an enormous gain in ratables, the JCBOE is only in 4th place among Hudson County districts in increasing its tax levy since 2010, despite the fact that its initial tax levy was so low and the JCPS was always below Adequacy. If Bayonne and East Newark can raise their tax levies by 23%, when can't the Jersey City BOE do this (except for the fact that it doesn't want to?) 2010 2017 Bayonne City 60,670,934.00 74,877,844 23% East Newark 1,178,641.00 1,447,486 23% Weehawken 16,674,798.50 20,424,896 22% North Bergen 40,489,434.00 49,217,112 22% Hoboken 36,386,944.50 43,857,211 21% Guttenberg 9,272,354.00 11,158,596 20% West New York 14,040,891.00 16,724,432 19% Kearny 45,449,873.00 52,218,164 15% Jersey City 105,961,498.00 119,464,435 13% Secaucus 31,978,788.50 35,945,958 12% Harrison 9,882,896.17 10,944,941 11% Union City 16,338,576.00 15,418,637 -6%

Posted on: 2018/4/4 19:01

|

|||

|

||||

|

Re: JC Public Schools is short $70 million

|

||||

|---|---|---|---|---|

|

Just can't stay away

Joined:

2015/10/21 0:40 Last Login : 2019/5/15 18:48 From One of the Oranges

Group:

Registered Users

Posts:

138

|

Quote:

I don't think my identity matters either on a forum like this. After all, most of the posters here are completely anonymous. But to dispel any suspicion of me because I live outside of JC, I'll tell you that I live in South Orange and was a BOE member there. Before you accuse me of having a personal, financial interest in seeing state aid reform, I would like to point out to you that the South Orange-Maplewood is only underaided by $3.6 million, or $496 per student, which isn't a large amount. If the SOMA school district got its full aid it would help the budget a little bit, but it would not be a game changer. The reason I invest so much time in state aid reform is to help districts who are much more underaided than mine, like Bloomfield, Belleville, Dover, Freehold Boro, Atlantic City etc. To me the state's distribution of state aid, where there is a range of underaiding/overaiding that ranges from a $8,999 per student deficit (Bound Brook) to a $11,827 excess (Asbury Park) it a blatant violation of the principle of equality and has to be fought on principle. But even if I were from, say, West Orange, a district that is underaided by $17.3 million and badly needs more state aid to mitigate its school tax burden, why would that call into question the sincerity and correctness of my opinions? West Orange's taxes are $36 million above Local Fair Share. Its school tax rate is 2.4477, which is 90% above the state average and almost 5x higher than Jersey City's. Although West Orange's taxes are partly its own decision to have sky-high spending, are West Orange people supposed to not be angry that the state isn't fulfilling its moral and economic obligation to them while it over-fulfills its obligations to other towns? Not everyone who is acting out of self-interest is morally in the wrong. Acting out of self-interest and acting in the common good are not mutually exclusive. Also, please remember that I am not being paid one cent for this work. There is no one paying me what to think or paying me what to write or research. Most of the Abbotts are, in fact, underaided. Newark's deficit is the largest in absolute terms in NJ. Fighting for state aid reform isn't a suburb vs Abbott issue either.

Posted on: 2018/4/4 14:16

|

|||

|

||||

|

Re: JC Public Schools is short $70 million

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

I personally have no problem with someone who's an out of town advocate for an issue as long as he's polite. SAG is extremely well-informed and has been very educational in his participation on JC List. It's not hard to think of local blowhards who are nothing but combative and disingenuous.

Posted on: 2018/4/3 23:00

|

|||

|

||||

|

Re: JC Public Schools is short $70 million

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

Stateaidguy's identity is entirely appropriate to focus on, especially when he (?) claims to be from "one of the Oranges". Why is he on this board? Who's interest is he serving with his posts? There could be very legitimate reasons for him to be here, but the conversation would be much better served by knowing the answer to those questions.

Posted on: 2018/4/3 15:53

|

|||

|

||||

|

Re: JC Public Schools is short $70 million

|

||||

|---|---|---|---|---|

|

Home away from home

Joined:

2004/2/6 23:13 Last Login : 2021/7/30 1:08 From Jersey City

Group:

Registered Users

Posts:

1225

|

I do not think anyone disagrees with your excellent analyses and assessment and yes, their first recommendation, "no further cuts to adjustment aid in districts spending below adequacy" supports the JCEA.

But the remaining 4 recommendations all ask for Jersey City to pay more ourselves; raise 2% cap (and increase levy), increase local levy, fair share of future local PILOTS and require local contribution to make up for or adjust for existing PILOTS. Personally, I am by no means happy about additional taxes after our property taxes will increase increase 50% post reval and health insurance went up 30%, but the alternative, starving our schools is worse. Quote:

Posted on: 2018/4/3 13:48

|

|||

|

||||

|

Re: JC Public Schools is short $70 million

|

||||

|---|---|---|---|---|

|

Home away from home

Joined:

2004/2/6 23:13 Last Login : 2021/7/30 1:08 From Jersey City

Group:

Registered Users

Posts:

1225

|

Jersey City is nowhere near the top of this list, last I looked about 10-15% above average. Iin Hudson County, less than Hoboken, Harrison and Union City -

The 50 school districts that spend the most per student in N.J. The most ? and least ? expensive school districts in New Jersey Quote:

Posted on: 2018/4/3 13:14

|

|||

|

||||

|

Re: JC Public Schools is short $70 million

|

||||

|---|---|---|---|---|

|

Quite a regular

|

But Data can be manipulated and he states the edlaw study is bias, where upon first reading I thought it was a good analysis. Obviously some suburban school districts are still very upset about the Abbott ruling. Also Jersey City budget ballooned under state control, which suburbs never contended with. State control is part of the reason why we needed adjustment aid to begin with. The study says we need to force pilots to contribute and increase local fair share OVER TIME. In the meantime our district still dilapidated buildings and other problems because of state control. I just want to make sure Suburban malcontents aren?t trying to hijak a nuanced debate about how to fund our schools going forward. Full disclosure my kids attend JCPS!

Posted on: 2018/4/2 23:04

|

|||

|

||||

|

Re: JC Public Schools is short $70 million

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

Stateaids identity doesn't matter; the data does. If I were stateaid I'd stay anonymous, especially in NJ. Stop focusing on the wrong thing.

Posted on: 2018/4/2 22:38

|

|||

|

||||

|

Re: JC Public Schools is short $70 million

|

||||

|---|---|---|---|---|

|

Home away from home

|

17% is the important number here, which is how much JC funds its own schools.

Posted on: 2018/4/2 22:36

|

|||

|

||||

|

Re: JC Public Schools is short $70 million

|

||||

|---|---|---|---|---|

|

Quite a regular

|

Ok so it?s clear you have some objections to the study. And I was misinformed in thinking some of edlaw researchers were related to Rutgers. Also if they are funded by JCEA I agree there is probably some bias there. But I looked on your blog and see no disclosure of your name/identity. I think that it would be powerful to disclose this information so we can see what your potential agenda/bias may be. Especially if you are accusing others...

Posted on: 2018/4/2 20:49

|

|||

|

||||

|

Re: JC Public Schools is short $70 million

|

||||

|---|---|---|---|---|

|

Just can't stay away

Joined:

2015/10/21 0:40 Last Login : 2019/5/15 18:48 From One of the Oranges

Group:

Registered Users

Posts:

138

|

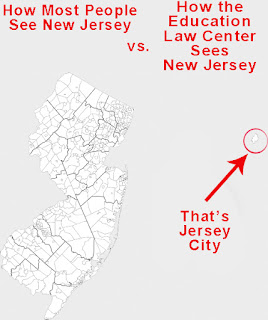

This pretty much sums up what the Education Law Center sees of needy, even desperate, districts in the rest of New Jersey.

Posted on: 2018/4/2 14:35

|

|||

|

||||

|

Re: JC Public Schools is short $70 million

|

||||

|---|---|---|---|---|

|

Just can't stay away

Joined:

2015/10/21 0:40 Last Login : 2019/5/15 18:48 From One of the Oranges

Group:

Registered Users

Posts:

138

|

Quote:

This is b******t. First of all, that's not from "Rutgers." It's from the Education Law Center, which has no formal connection to Rutgers. The Education Law Center is an entity that gets a third of its budget from the NJEA and does whatever the NJEA wants it to do. It isn't an independent group at all. Even if the ELC were an independent group and even if it were from Rutgers, so what? People from a university can be biased and/or wrong. Second, you do not understand SFRA based on your description of what that report even says. All that report points out is that Jersey City is below SFRA's (inflated) definition of Adequacy, a fact that no one disputes, but that normal people point out is due to Jersey City's refusal to raise its school taxes in any way proportional to its increase in wealth. The report blames this all on the tax cap, but the JCBOE hasn't even consistently raised taxes at 2.0%, has never used banked cap, and has never considered a referendum on a higher levy. The SFRA formula already accounts for the number of economically disadvantaged students a district has. There is no accounting for "eels," but students who are English Language Learners have an extra weight as well. Special ed classification actually doesn't have a weight in the SFRA formula (for any district.) Because the Jersey City Public Schools have a high FRL-eligible rate and a high rate of students who are ELLs, it has a much higher Adequacy Budget per student than the average budget. HOWEVER, SFRA isn't so simple as to solely give a district money based on its demographics because tax base is a factor in appropriate state aid too. NJ's aid formula, like the formulas of all states, intends to give state aid in inverse proportion to a district's wealth. Jersey City is not a "rich" district in terms of tax base, but it is an average district. Yet, despite being average in tax base, Jersey City's state aid per student is actually in the top 20 in New Jersey. Although SFRA doesn't differentiate between residential and non-residential property, Jersey City also has about double the proportion of non-residential property of the average NJ town. SFRA calculates a Local Fair Share for Jersey City (like it does all districts) of $370 million for 2017-18. SFRA calculates an Adequacy Budget for Jersey City of $630 million. The difference between that $370 million that Jersey City is economically capable of paying is Equalization Aid, Special Ed aid, and Security Aid. Jersey City, however, pays nowhere near its full Local Fair Share and it relies on Adjustment Aid to keep a low tax rate that will hit 0.42 in 2018-19, or one-third of the state average. Although Jersey City's tax base is by far the state's largest (for 2018-19 it will be $180 million larger than the next largest district's (Hoboken's) Jersey City's tax levy is only the 16th largest in NJ, and is higher than poorer and smaller towns like Newark, Cherry Hill, West Orange, and Clifton. Because of of the state's chronic budget problems, the state has nowhere near enough money to fairly or fully fund its many towns that have growing enrollments and shrinking tax bases. Some districts are underaided (by the state) by $9000 per student. Because the state cannot make the pie large enough to fully fund every district, it has to divide that pie more evenly. http://njeducationaid.blogspot.com/20 ... enter-jersey-city-is.html

Posted on: 2018/4/2 14:30

|

|||

|

||||

|

Re: JC Public Schools is short $70 million

|

||||

|---|---|---|---|---|

|

Quite a regular

|

Here?s a good overview of funding issues from Rutgers Edlaw. It?s a complex issue and will need more than just a portion of abatements to fix. But it?s good to understand that we are not overfunded based on the number of disadvantaged, eel,and special needs kids we serve. http://www.edlawcenter.org/assets/fil ... _School_Funding_Case_.pdf

Posted on: 2018/4/1 20:00

|

|||

|

||||

|

Re: JC Public Schools is short $70 million

|

||||

|---|---|---|---|---|

|

Just can't stay away

Joined:

2015/10/21 0:40 Last Login : 2019/5/15 18:48 From One of the Oranges

Group:

Registered Users

Posts:

138

|

Quote:

New Jersey has three different ways to account for per student spending. As another poster said, the Taxpayer Guide to Education Spending lists JC as spending $22,751 per student for "Total Spending Per Pupil." That amount includes pensions, construction spending, Social Security, and Post-Retirement Healthcare, plus spending from federal aid. It is the most inclusive, and most accurate, number for what any NJ school district's spending is. It is also 90% more per student than the national average. If you are doing interstate comparisons, you should use Total Spending Per Pupil. There is also "Budgetary Cost Per Pupil," which includes things that are directly under the BOE's control, essentially opex spending. A district's Budgetary Cost Per Pupil is about $4000-$4500 per student less than its "Total Spending Per Pupil." JC's Budgetary Cost Per Pupil is $18,154 per student. The state average for Budgetary Cost Per Pupil is about $15,000 per student. HOWEVER, is is a third, most exclusive, number for spending that is used in the School Funding Reform Act. It only includes Equalization Aid, Sped Aid, Security Aid, the local tax levy, and Adjustment Aid. It excludes federal aid and all of the state's numerous indirect streams of aid. This third and lowest calculation of spending is called "Spending as Defined." By this number Jersey City only spends $527,389,023 for 30,753 students, or $17,149 per student. Since "Spending as Defined" excludes so much of Jersey City's spending, and because the School Funding Reform Act has a sky-high Adequacy budget for Jersey City, Jersey City is legally about $3100 per student below Adequacy even though its spending is well above NJ's average and dramatically above the national average.

Posted on: 2018/4/1 18:51

|

|||

|

||||

|

Re: JC Public Schools is short $70 million

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

Reval,,,small potatoes.... & So Starts the REAL Fun 4 JC Taxpayers !

Posted on: 2018/3/31 19:39

|

|||

|

||||

|

Re: JC Public Schools is short $70 million

|

||||

|---|---|---|---|---|

|

Home away from home

Joined:

2015/5/28 0:34 Last Login : 2024/8/5 12:48 From Jersey City

Group:

Registered Users

Posts:

1032

|

Quote:

To be fair, It's the highest cost of living in the state so teachers should be compensated more. But I'm still trying to figure out where the other money is going. $23k a student. Ok. 40 or 50 percent of that is for teachers salaries and fringe benefits. Another percentage to operate and maintain the old schools. What about the rest? Administration seemed really high, but not the highest. Extra curricular seemed really low. Open up a voucher system and see if the private sector can do any better with 23k.

Posted on: 2018/3/31 18:37

|

|||

|

||||

|

Re: JC Public Schools is short $70 million

|

||||

|---|---|---|---|---|

|

Home away from home

|

So, a quick pass at the numbers JC school costs shows we simply pay staff more than almost anyone, #98 of 103 peer districts. One must assume from years of caving in on contract negotiations. How does a union making more than almost anyone else in the whole country keep pleading poverty?

But almost as interesting is what comes as the last priority, extracurriculars, at 8|103. Surely someone has studies connections between extracurriculars and education outcomes?? Students more engaged in participation in any school activity surely engage more in the classroom.

Posted on: 2018/3/31 17:37

|

|||

|

||||

|

Re: JC Public Schools is short $70 million

|

||||

|---|---|---|---|---|

|

Home away from home

|

www.state.nj.us/education/guide/2015/ is a great resource to show per student spending/local funding.

Posted on: 2018/3/31 15:57

|

|||

|

||||

|

Re: JC Public Schools is short $70 million

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

I want to believe you... but, as we recently saw in the immediate aftermath of the mailing of initial tax estimates, seemingly most people that publicly and loudly claim they want to pay their fair share actually don't wish to do so. The utterly predictable post reval results (substantial hikes in DTJC, with moderate to significant decreases in areas like Greenville and BeLa) yielded hysterics among many DTJC homeowners complaining about being forced to to pay for the rest of city residents. Sadly, most refuse to acknowledge the basic truth that, for years now, they have been underpaying their fair share and things are now being rectified. It is truly outstanding that some people claim (with a straight faced) that local public education is underfunded when the city per-pupil spending amounts to ~23K per year. One of the net positives to likely come out from the reval is the heightened interest by local residents in the local budgets and expenditures.

Posted on: 2018/3/31 15:35

|

|||

|

||||

|

Re: JC Public Schools is short $70 million

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

Because our fearless leader Fulop has a streak of not raising taxes he needs to keep, because, you know, elections.

Posted on: 2018/3/31 13:19

|

|||

|

||||

|

Re: JC Public Schools is short $70 million

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

29,000 students Per student spending is just shy of 23K

Posted on: 2018/3/31 12:11

|

|||

|

||||

|

Re: JC Public Schools is short $70 million

|

||||

|---|---|---|---|---|

|

Not too shy to talk

|

BTW how many students does JC have and what is our per student spending?

Posted on: 2018/3/30 21:08

|

|||

|

||||

|

Re: JC Public Schools is short $70 million

|

||||

|---|---|---|---|---|

|

Home away from home

Joined:

2015/5/28 0:34 Last Login : 2024/8/5 12:48 From Jersey City

Group:

Registered Users

Posts:

1032

|

Quote:

The blogspot site is stateaidguy's one. He is extremely knowledgeable on this complicated topic.

Posted on: 2018/3/30 16:47

|

|||

|

||||

|

Re: JC Public Schools is short $70 million

|

||||

|---|---|---|---|---|

|

Home away from home

Joined:

2004/2/6 23:13 Last Login : 2021/7/30 1:08 From Jersey City

Group:

Registered Users

Posts:

1225

|

Yes, over-aided, but under-funded. For those interested, good outside perspectives are - http://njeducationaid.blogspot.com/ and https://civicparent.org/ Quote:

Posted on: 2018/3/30 16:31

|

|||

|

||||

|

Re: JC Public Schools is short $70 million

|

||||

|---|---|---|---|---|

|

Home away from home

|

Has anyone ever run across a line item comparison of how JC spends vs other NJ districts? I have no trouble believing it's wasteful, but I have no idea in what way.

Also, Stateaidguy says we're overaided, but I don't recall hearing what our appropriate aid should be. It's surely not Zero.

Posted on: 2018/3/30 16:00

|

|||

|

||||

|

Re: JC Public Schools is short $70 million

|

||||

|---|---|---|---|---|

|

Newbie

|

Quote:

I will. I strongly believe in paying my fair share of taxes if it helps strengthen the community. But does anyone have any idea of how to voice my opinion to anyone who can make a difference? Who can I contact? I can't believe that they would be so unwilling to put it to a city vote to raise taxes by more than the 2% to make up the shortfall. Why not at least give us a chance to vote whether we'd be willing to pay for our teachers to stay employed or not?

Posted on: 2018/3/30 15:57

|

|||

|

||||