|

Re: Possible relief on the way?

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Quote:

S2 eliminated the tax cap for Abbott districts who are under Adequacy and that have taxes below Local Fair Share. "(3) In the case of an SDA district, as defined puruant to section 3 of P.L.2000, C.72 (C.18A:7G-3), in which the prebudget year adjusted tax levy is less than the school district's prebudget year local share as calculated pursuant to section 10 of P.L.2007, C.260 (C.18A:7F-52), the allowable adjustment for increases to raise a tax levy that does not exceed the school district's local share shall equal the difference between the prebudget year adjusted tax levy and the prebudget year local share." https://www.njleg.state.nj.us/2018/Bills/PL18/67_.PDF Also, the JCBOE case makes much of municipal overburden, but JC's tax rate is only 1.6%, versus a state average of 2.4%. The JCBOE will never be able to claim that a 1.6% tax rate is onerous because it isn't. The case is groundless.

Posted on: 2019/5/1 20:22

|

|||

|

||||

|

Re: Will Jersey City and Hoboken ever lose Abbott District Status?

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

JPHurst,

An "Appeal to Authority" is a fallacy when someone uses the opinion of an authority figure or institution in place of an actual argument. Since you don't talk about Jersey City's tax base and demographic needs, and you don't present a plan by which NJ could fully fund SFRA without redistributing Adjustment Aid, your argument fits the definition of "Appeal to Authority" perfectly. In JPHurst's logic, if an argument is correct if the NJ Supreme Court makes it, then, by the same token, whatever conservative holdings the US Supreme Court comes down are automatically correct too. Thus, Citizens United was correctly decided, Epic Systems was correctly decided, and if Mark Janus wins his case over mandatory agency fees, that is correctly decided as well. On the NJ level, in Hurstian logic, Berg v Christie and Burgos v New Jersey are correct as well. Yes, legally, a Supreme Court has the authority to make decisions, but its decisions are subject to the same scrutiny and criticism as anyone else's, especially when those decisions are 28 years old and the conditions they were written under have changed. A Supreme Court's decision has to be obeyed, but it is completely legitimate to challenge it and try to change it by legally-established means, of which legislation is the most valid. Indeed you are historically correct, in 1990 the NJ Supreme Court said that Jersey City and the other Abbotts had to have a certain amount of state aid, but that doesn't mean that the Supreme Court was correct even then, and it certainly doesn't mean that that "remedy" is correct now. "It is no different than State Aid Guy pulling numbers out of his tuckus from SFRA and calling them dispositive." Were you bad at math in school or something that mathematical evidence has no weight for you? I don't make up any numbers. I get the data on state aid disparities from the Department of Education, which bases its calculations on economic figures from the Department of the Treasury (Equalized Valuation & Aggregate Income) and the districts' self-reporting on their demographics. The only things I do are calculate what a district's deficit is per student and what percentage of a district's recommended state aid it gets. That's just subtraction and division, ie arithmetic. The problem with Adjustment Aid is that it overrides whatever amount of money the core formulas of SFRA say a district should get, and replaces a calculation based on current conditions with whatever arbitrary amount of state aid a district got in 2008-09. Sweeney doesn't purport to be an education expert, but he understands SFRA and he knows that Adjustment Aid contradicts the intention of SFRA. He is a duly elected official, acting without any conflict of interest, and has every right to try to change state aid. Quote:

Posted on: 2018/6/5 15:58

|

|||

|

||||

|

Re: Will Jersey City and Hoboken ever lose Abbott District Status?

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Quote:

Poor JPHurst, when all his statements turn out to be erroneous, all his has left is the Appeal to Authority. 1. Abbott II was in 1990. It has always been controversial, even among Democrats, hence, in 2008, the Democrats altered and ended the school funding regime Abbott II established in SFRA. There are ten other state constitutions that say "thorough and efficient" in reference to education. That not one of the other states that has the same constitutional language has an equivalent to Abbott should tell you that Abbott derives more from the mind of Robert Wilentz than it does from NJ's Constitution itself. 1a. The people who decided Abbott are lawyers, not education experts, anyway. 2. One basis of the Abbott decisions were that the Abbotts had "municipal overburden," ie, they did not have the capacity to raise taxes more to support their schools. The lack of municipal overburden was actually what excluded Atlantic City from the Abbott list, even though Atlantic City met the two criteria that were used for Abbottization. It turns out that the Abbotts didn't have NJ's worst municipal overburden anyway even in 1990, but that description would not remotely apply to Jersey City today, since Jersey City's school tax rate is about 0.45, which is barely a third of NJ's average, and Jersey City's all-in tax rate of 1.6 is significantly below NJ's 2.4 average. 3. Abbott was Superseded by SFRA in 2008 As mentioned above, SFRA changed the allocation of K-12 aid. SFRA creates very high Adequacy Budgets for all high-FRL districts, but it disestablished the Parity Plus doctrine. Against the demands of the Education Law Center, the Supreme Court approved SFRA unanimously in 2009 in Abbott XX. In approving SFRA, the Supreme Court only required that SFRA be fully funded for three years. (which wasn't met for non-Abbotts) Three years have now passed. SFRA is now ten years old. 4. The Exclusion of Small High-FRL districts was Central Flaw of Abbott The Abbott list was created by taking districts who were in DFG A or B AND categorized as "urban municipalities" by the Department of Community Affairs. The DOCA's definition of "urban" was imperfect because it is impossible to rigidly demarcate urban from suburban. One major flaw of the DOCA's definition of "urban" was a population minimum. Weirdly, several districts the average person would consider rural, like Pemberton, Millville, and Phillipsburg, were considered "urban" in the DOCA's eyes and were thus Abbottized. Hence, the majority of NJ's poorest districts were excluded from Abbott, including some of the densest poor districts, like the non-Abbotts of Hudson County. You could not tell the difference between Guttenberg and West New York by walking through them, but if you looked at the schools the difference would be very stark. Also, the state's listing of DFGs was out-of-date, since it was based on the 1980 Census. Had the Abbott II decision came out in 1991, North Bergen, Guttenberg, Kearny, Bayonne, Wallington, Carteret, Fairview, Dover, and Lakewood would have become Abbotts. In conclusion, the Abbott list was created by non-experts, expressing an opinion, and has been legally superseded by subsequent statute and litigation. The Abbott list was always arbitrary, hence the passage of SFRA. It's time to adjust NJ's state aid to the reality of 2018, not 1990.

Posted on: 2018/6/5 14:04

|

|||

|

||||

|

Re: Will Jersey City and Hoboken ever lose Abbott District Status?

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Quote:

Ok. You don't speak in generalities. You only speak in errors. Your quote was "The state should also phase out aid to all k-6 or k-8 districts, and impose a 10% surcharge on such districts until they merge into full k-12 districts. These micro districts create extra layers of administrative waste and are largely designed to segregate students from broader based populations which would include poorer and minority students." When some of NJ's poorest and most heavily-minority districts are K-6s/K-8s, it's hard to see how they are "designed to segregate students which would include poorer and minority students." Your statement about small districts having more administrative waste is also unfounded. Jersey City,Total Administrative Costs, $1,878 pp Let's compare to some of the non-K-12s who are the most active on state aid reform. Freehold Boro $1,619 pp Chesterfield $1,303 pp Red Bank Boro $1,586 pp Kingsway $1,283 pp Now let's see, there actually aren't that many non-K-12s who are active on state aid, so I don't need to waste more time giving examples, but your thesis about small districts > administrative waste is wrong. Your own district of Jersey City, the second largest in NJ, actually has pretty high administrative spending.

Posted on: 2018/6/4 23:19

|

|||

|

||||

|

Re: Will Jersey City and Hoboken ever lose Abbott District Status?

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Quote:

It takes a really intense kind of idiocy and selfishness to bring these insults out of me. East Newark's superintendent and principal are the same person. The person has two titles because he fulfills two roles, but his salary is roughly the same as what a principal would earn. East Newark's admin costs per pupil are $1,266. Jersey City's admin costs per pupil are $1,851. But keep on making your flat-out wrong assumptions and generalizations JPHurst. http://www.nj.gov/education/finance/f ... ts/17/2390/UFB17_2390.pdf http://www.nj.gov/education/finance/f ... ts/17/1200/UFB18_1200.pdf

Posted on: 2018/6/4 21:14

|

|||

|

||||

|

Re: Will Jersey City and Hoboken ever lose Abbott District Status?

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Quote:

This is more arrant nonsense from JPHurst. First, your generalization is unfounded. Yes, there are some K-6s and K-8s who are wealthy and who want to hoard their wealth (like at the Jersey Shore), but there are other K-6s and K-8s who are very poor, including the ones near you, such as Fairview, East Newark, and Guttenberg. You accuse K-8s of wanting to segregate their students, but who would these districts merge with to integrate? Their neighbors are also mostly low-income. In many cases if K-8s merged into their regional districts you'd just have a bigger poor, underaided district, like if Manchester Regional merged w/ Haledon, North Haledon, and Prospect Park. Second, this is a complete distraction. NJ's most underaided districts are K-12s, such as Bound Brook and Atlantic City. Third, Steve Sweeney does support the consolidation of non-K-12 districts (unlike Murphy). It isn't a front burner issue for Sweeney like state aid is, but that's because POOR K-8s THEMSELVES DON'T WANT TO MERGE WITH ANYBODY. Contrary to what some outsiders say about what they want, Freehold Boro, East Newark, Red Bank Boro are satisfied with their current configurations. Fourth, a reason the small, isolated K-8s don't want to merge with anybody is because their academics are actually a lot better than you'd expect based on their demographics and budget crises. IMO, and perhaps the opinions of the BOEs of these districts too, they are very nurturing and tend to do better by their kids than large poor districts do.

Posted on: 2018/6/4 18:38

|

|||

|

||||

|

Re: Sweeney proposes slapping payroll tax on Jersey City businesses to fund schools

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

You all have the politics of this wrong.

It isn't Sweeney who is "slapping" a payroll tax onto JC. The idea for a payroll tax has been supported by the JCBOE. The primary sponsor in the legislator is none other than Sandra Cunningham. Sweeney wants to eliminate Jersey City's Adjustment Aid, and making up for that revenue loss will require higher local taxes, but Sweeney isn't being unfair to Jersey City, since there are about 200 other districts who are going to lose Adjustment Aid with Jersey City. I'm sure that Sweeney would rather Jersey City just raise its property tax levy (like every other district). Sweeney is now supporting a payroll tax out of deference to Cunningham.

Posted on: 2018/6/3 13:25

|

|||

|

||||

|

Re: JC Public Schools is short $70 million

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Quote:

I agree that in practice larger towns don't have lower spending or lower taxes. In an in-depth study of NJ municipal spending by Raphael J. Caprio and Marc H. Pfeiffer they found that there is no correlation at all between muni spending and population. The lowest spending municipalities, in fact, have between 3600 and 5150 residents. http://blousteinlocal.rutgers.edu/wp- ... usteinlocal-sizestudy.pdf

Posted on: 2018/5/2 18:39

|

|||

|

||||

|

Re: JC Public Schools is short $70 million

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Quote:

This contract doesn't directly increase anyone's taxes. Only the JCBOE's decision to raise the tax levy can do that, and even if the JCBOE raised the tax levy it wouldn't automatically raise your own taxes because the the constant growth of the JC tax base will have a countervailing pressure. JC's school taxes per household have actually been falling relative to inflation for a few years and even in absolute terms in some years. If you expect this to lead to tax increases, then downtown's tax increase will be the same as everyone else's.

Posted on: 2018/4/24 19:21

|

|||

|

||||

|

Re: JC Public Schools is short $70 million

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Quote:

I agree with your assessment of the politics, especially regarding downtown, but isn't there anyone in Jersey City who understands school finance well enough to realize that the 2% tax levy increases that the JCBOE have been passing are next to nothing for a district with a budget that is 5x larger than the tax levy? For Jersey City, a 2% tax levy increase only equals 0.4% of the budget. Doesn't anyone realize that the Jersey City BOE isn't constrained by the tax cap anyway? The existing tax cap has exemptions for medical cost growth and the JCBOE already has the legal authority to raise taxes well in excess of 2.0%. Doesn't anyone realize that the Jersey City BOE needs to pass a 10% tax increase to equal 2% of the budget, or really a 15% increase to keep up with the more rapid rate of inflation in education. ---- I agree with your assessment of the politics, but that anti-tax attitude is motivated by selfishness and a desire to have the state pay for what Jersey City is capable of paying for itself. Jersey City's school tax rate is going to be 0.42. The state average is 1.3. You can find many towns where the school tax rate is >2.0. I realize that property values are increasing faster than some residents' incomes, so that there are many people in Jersey City who are living in houses that they could never afford to buy today. As sad as I would be to see someone taxed out of their property due to its appreciation, those people are asset millionaires, and I'm not going to have a lot of sympathy for them compared to people whose property taxes and underfunded school system are eroding the value of their properties and therefore is seeing their most important asset depreciate in value. As painful as it is to pay higher taxes on a house with an appreciating value, it's even worse to see someone pay higher taxes on a house that is losing value.

Posted on: 2018/4/5 14:35

|

|||

|

||||

|

Re: JC Public Schools is short $70 million

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Those in Jersey City who are honestly so concerned about the JCPS being below Adequacy need to start demanding that the JCBOE use its existing banked cap and then put a referendum to the voters asking approval for a higher tax levy. Despite having an enormous gain in ratables, the JCBOE is only in 4th place among Hudson County districts in increasing its tax levy since 2010, despite the fact that its initial tax levy was so low and the JCPS was always below Adequacy. If Bayonne and East Newark can raise their tax levies by 23%, when can't the Jersey City BOE do this (except for the fact that it doesn't want to?) 2010 2017 Bayonne City 60,670,934.00 74,877,844 23% East Newark 1,178,641.00 1,447,486 23% Weehawken 16,674,798.50 20,424,896 22% North Bergen 40,489,434.00 49,217,112 22% Hoboken 36,386,944.50 43,857,211 21% Guttenberg 9,272,354.00 11,158,596 20% West New York 14,040,891.00 16,724,432 19% Kearny 45,449,873.00 52,218,164 15% Jersey City 105,961,498.00 119,464,435 13% Secaucus 31,978,788.50 35,945,958 12% Harrison 9,882,896.17 10,944,941 11% Union City 16,338,576.00 15,418,637 -6%

Posted on: 2018/4/4 19:01

|

|||

|

||||

|

Re: JC Public Schools is short $70 million

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Quote:

I don't think my identity matters either on a forum like this. After all, most of the posters here are completely anonymous. But to dispel any suspicion of me because I live outside of JC, I'll tell you that I live in South Orange and was a BOE member there. Before you accuse me of having a personal, financial interest in seeing state aid reform, I would like to point out to you that the South Orange-Maplewood is only underaided by $3.6 million, or $496 per student, which isn't a large amount. If the SOMA school district got its full aid it would help the budget a little bit, but it would not be a game changer. The reason I invest so much time in state aid reform is to help districts who are much more underaided than mine, like Bloomfield, Belleville, Dover, Freehold Boro, Atlantic City etc. To me the state's distribution of state aid, where there is a range of underaiding/overaiding that ranges from a $8,999 per student deficit (Bound Brook) to a $11,827 excess (Asbury Park) it a blatant violation of the principle of equality and has to be fought on principle. But even if I were from, say, West Orange, a district that is underaided by $17.3 million and badly needs more state aid to mitigate its school tax burden, why would that call into question the sincerity and correctness of my opinions? West Orange's taxes are $36 million above Local Fair Share. Its school tax rate is 2.4477, which is 90% above the state average and almost 5x higher than Jersey City's. Although West Orange's taxes are partly its own decision to have sky-high spending, are West Orange people supposed to not be angry that the state isn't fulfilling its moral and economic obligation to them while it over-fulfills its obligations to other towns? Not everyone who is acting out of self-interest is morally in the wrong. Acting out of self-interest and acting in the common good are not mutually exclusive. Also, please remember that I am not being paid one cent for this work. There is no one paying me what to think or paying me what to write or research. Most of the Abbotts are, in fact, underaided. Newark's deficit is the largest in absolute terms in NJ. Fighting for state aid reform isn't a suburb vs Abbott issue either.

Posted on: 2018/4/4 14:16

|

|||

|

||||

|

Re: JC Public Schools is short $70 million

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

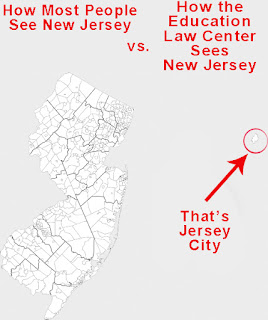

This pretty much sums up what the Education Law Center sees of needy, even desperate, districts in the rest of New Jersey.

Posted on: 2018/4/2 14:35

|

|||

|

||||

|

Re: JC Public Schools is short $70 million

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Quote:

This is b******t. First of all, that's not from "Rutgers." It's from the Education Law Center, which has no formal connection to Rutgers. The Education Law Center is an entity that gets a third of its budget from the NJEA and does whatever the NJEA wants it to do. It isn't an independent group at all. Even if the ELC were an independent group and even if it were from Rutgers, so what? People from a university can be biased and/or wrong. Second, you do not understand SFRA based on your description of what that report even says. All that report points out is that Jersey City is below SFRA's (inflated) definition of Adequacy, a fact that no one disputes, but that normal people point out is due to Jersey City's refusal to raise its school taxes in any way proportional to its increase in wealth. The report blames this all on the tax cap, but the JCBOE hasn't even consistently raised taxes at 2.0%, has never used banked cap, and has never considered a referendum on a higher levy. The SFRA formula already accounts for the number of economically disadvantaged students a district has. There is no accounting for "eels," but students who are English Language Learners have an extra weight as well. Special ed classification actually doesn't have a weight in the SFRA formula (for any district.) Because the Jersey City Public Schools have a high FRL-eligible rate and a high rate of students who are ELLs, it has a much higher Adequacy Budget per student than the average budget. HOWEVER, SFRA isn't so simple as to solely give a district money based on its demographics because tax base is a factor in appropriate state aid too. NJ's aid formula, like the formulas of all states, intends to give state aid in inverse proportion to a district's wealth. Jersey City is not a "rich" district in terms of tax base, but it is an average district. Yet, despite being average in tax base, Jersey City's state aid per student is actually in the top 20 in New Jersey. Although SFRA doesn't differentiate between residential and non-residential property, Jersey City also has about double the proportion of non-residential property of the average NJ town. SFRA calculates a Local Fair Share for Jersey City (like it does all districts) of $370 million for 2017-18. SFRA calculates an Adequacy Budget for Jersey City of $630 million. The difference between that $370 million that Jersey City is economically capable of paying is Equalization Aid, Special Ed aid, and Security Aid. Jersey City, however, pays nowhere near its full Local Fair Share and it relies on Adjustment Aid to keep a low tax rate that will hit 0.42 in 2018-19, or one-third of the state average. Although Jersey City's tax base is by far the state's largest (for 2018-19 it will be $180 million larger than the next largest district's (Hoboken's) Jersey City's tax levy is only the 16th largest in NJ, and is higher than poorer and smaller towns like Newark, Cherry Hill, West Orange, and Clifton. Because of of the state's chronic budget problems, the state has nowhere near enough money to fairly or fully fund its many towns that have growing enrollments and shrinking tax bases. Some districts are underaided (by the state) by $9000 per student. Because the state cannot make the pie large enough to fully fund every district, it has to divide that pie more evenly. http://njeducationaid.blogspot.com/20 ... enter-jersey-city-is.html

Posted on: 2018/4/2 14:30

|

|||

|

||||

|

Re: JC Public Schools is short $70 million

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Quote:

New Jersey has three different ways to account for per student spending. As another poster said, the Taxpayer Guide to Education Spending lists JC as spending $22,751 per student for "Total Spending Per Pupil." That amount includes pensions, construction spending, Social Security, and Post-Retirement Healthcare, plus spending from federal aid. It is the most inclusive, and most accurate, number for what any NJ school district's spending is. It is also 90% more per student than the national average. If you are doing interstate comparisons, you should use Total Spending Per Pupil. There is also "Budgetary Cost Per Pupil," which includes things that are directly under the BOE's control, essentially opex spending. A district's Budgetary Cost Per Pupil is about $4000-$4500 per student less than its "Total Spending Per Pupil." JC's Budgetary Cost Per Pupil is $18,154 per student. The state average for Budgetary Cost Per Pupil is about $15,000 per student. HOWEVER, is is a third, most exclusive, number for spending that is used in the School Funding Reform Act. It only includes Equalization Aid, Sped Aid, Security Aid, the local tax levy, and Adjustment Aid. It excludes federal aid and all of the state's numerous indirect streams of aid. This third and lowest calculation of spending is called "Spending as Defined." By this number Jersey City only spends $527,389,023 for 30,753 students, or $17,149 per student. Since "Spending as Defined" excludes so much of Jersey City's spending, and because the School Funding Reform Act has a sky-high Adequacy budget for Jersey City, Jersey City is legally about $3100 per student below Adequacy even though its spending is well above NJ's average and dramatically above the national average.

Posted on: 2018/4/1 18:51

|

|||

|

||||

|

Re: How much state aid will HCschool districts get in proposed budget?

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

The budget that came out last week is only the proposed budget.

The legislature has the power to amend the budget. It even has the theoretical power to write its own budget (it did this once during Florio's term). I expact the state aid distribution to undergo some changes to focus more state aid on the most severely underaided districts and to not give overaided districts any additional money.

Posted on: 2018/3/19 19:50

|

|||

|

||||

|

Re: New Equalized Valuations Out, JC at $28.4 billion

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Quote:

Since for most NJ towns a drop in property taxes is unimaginable and a 2% increase is the floor, I think -2% is a "big drop" too.

Posted on: 2017/10/6 18:19

|

|||

|

||||

|

Re: New Equalized Valuations Out, JC at $28.4 billion

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Quote:

This is correct. My statement that JC's tax rate will drop assumes that the tax levy will stay the same or increase slightly. Since JC's tax levy won't increase by the 10% growth in EV, it's a very safe assumption to make. Jersey City's official, aggregate assessed value also increased, from $6,075,860,248 to $6,214,706,588. I assume that increase is from new unPILOTed development, the expiration of old PILOTs, and some additions & improvements here and there. Knowing that the official, assessed value increased by $128 million and knowing that JC's "equalization ratio" is .2188 allows one to estimate that the new ratables increased by $634 million in Equalized Valuation and that the rest of JC's $2.7 increase in EV came from appreciation. Yes, 99 Hudson will have a big impact. All of Hudson County is going to feel that. I don't like Steve Fulop for other reasons, but he should get credit for not PILOTing 99 Hudson.

Posted on: 2017/10/6 15:23

|

|||

|

||||

|

Re: New Equalized Valuations Out, JC at $28.4 billion

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Quote:

Thank you as always, SAG. Any insight on valuation post reval? The aggregate assessed valuation and the Equalized Valuation are actually independent, but the new aggregate assessed valuation ought to be close to the Equalized Valuation since the assessed valuations are supposed to equal market values too. If the new aggregate assessed valuation isn't that close to the Equalized Valuation it doesn't really matter though, since assessed valuation is the internal apportionment of a town's tax levy whereas Equalized Valuation is for the "intertown" apportionment of county taxes (and, theoretically, state aid) . As long as the assessments are internally consistent and they align to up-to-date market values, then they are fair. Since Jersey City's real estate market is so dynamic and it might be hard for the reval firm to keep up, I wouldn't be surprised if the aggregate valuation and EV don't match as closely as they would in a less hot real estate market. What really matters for fair tax assessment is the Coefficient of Deviation, not how far the assessment is from the Equalized Valuation. Quote:

I agree that there are going to be Jersey City homeowners with extremely high tax bills post-reval, but their tax rates at ~1.9 are significantly lower than New Jersey's average of 2.4. The definitely consequence of JC's growth in EV is a slightly higher proportion of the county tax levy. For tax year 2017 Jersey City had 36% of Hudson County's total valuation. For tax year 2018 Jersey City will have 36.6%. The second consequence is harder to predict, but Jersey City ought to lose school aid given New Jersey's severe fiscal crisis and JC's ability to sustain a higher tax levy. However, we have no idea if Phil Murphy actually will cut JC's state what mechanism he would use if he decided to do so. Also, Jersey City did have ~$636 million new properties come onto the tax rolls. The average property owner's tax bill might drop because of this.

Posted on: 2017/10/6 14:01

|

|||

|

||||

|

New Equalized Valuations Out, JC at $28.4 billion

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

The Dept of Treasury just came out with new Equalized Valuations and JC grew by $2.7 billion to $28.4 billion. Of that increase, over $2 billion comes from appreciation of the existing housing stock and only $600+ million from new construction and the expiration of PILOTs.

JC's valuation is now 2.35% of the state's total. I am posting this here because I've seen so much speculation on what the new tax rate will be after the reval. (which doesn't actually change the tax rate). Anyway, JC's effective tax rate will surely decline as a result of the big increase in real estate wealth. http://njeducationaid.blogspot.com/20 ... -equalized-valuation.html

Posted on: 2017/10/6 2:31

|

|||

|

||||

|

Re: Funding reduction for JC schools.

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

I'd like to hear more in-depth news about the JCBOE's meetings on the state aid reduction. Is the BOE resigned to losing more Adjustment Aid? Is the BOE talking about the need to increase its local tax levy above 2.0% a year?

Posted on: 2017/7/28 16:31

|

|||

|

||||

|

Re: Jersey City school officials fret over plan to cut $8.5M in state aid

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

For 2016, Jersey City?s all-in (muni, county, school) tax levy

was $469,206,295. (not counting PILOT revenue). The Equalized Valuation is $25.7 billion, so you have an all-in Equalized tax rate of 1.8. If Jersey City made up for the loss of $150 million of Adjustment Aid and the Equalized Valuation didn?t increase, the all-in tax rate would still only be 2.4, which is New Jersey?s average. However, in real life the Equalized Valuation is growing and will significantly higher in five years than it is now, so Jersey City is still likely to retain taxes below the state average. Also, the Jersey City BOE does not have to make up for all the losses of state aid with local taxes anyway. If Jersey City?s state aid losses are limited to 1.5% of its budget, then it would take decades for all of Jersey City?s excess aid to be eliminated and Jersey City?s taxes will stay below the state?s average for years to come. Please remember (before you publicly worry about Jersey City) that a complete redistribution of Adjustment Aid and $500 increase in total K-12 spending is not nearly enough to bring up the underaided districts to 100% funding. I respect Steve Sweeney a lot, but he has oversold his plan. The deficit for 2015-16 is $2 billion and it grows annually, so $700 million in redistributed aid plus $500 million in new aid is not enough to bring every district to 100%.

Posted on: 2017/6/23 17:01

|

|||

|

||||

|

Re: Jersey City school officials fret over plan to cut $8.5M in state aid

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

My big observation about Jersey City and state aid is why the school administration and BOE have been so quiet about redistribution whereas Fulop and the City Council (including Michael Yun) have opposed it. If you read the article, JCBOE members do not have the fury about losing state aid that Toms River and Brick do.

It's possible that the administrators and JCBOE members actually are progressives who understand that other towns have greater needs than Jersey City. If so, I commend them. Fulop, on the other hand, is a lying _______.

Posted on: 2017/6/22 18:34

|

|||

|

||||

|

Re: Jersey City school officials fret over plan to cut $8.5M in state aid

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

The abated properties do pay school taxes on the land they own, so there is a small contribution to education.

However, the way the PILOT law is written, the total payment (land taxes + PILOT fees) is a fixed amount, so if land taxes increase, PILOT fees decrease. It wouldn't be a large loss, but higher school taxes on the land would mean lower PILOT fees to the Jersey City municipality. Quote:

Posted on: 2017/6/20 16:02

|

|||

|

||||

|

Re: Jersey City abatement vote met with mock party

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

The protesters are right, the abatements do harm other Jersey City taxpayers. Even disregarding the costs of services for new residents/workers/students, unless the PILOT fee exceeds 86% of normal taxation, Jersey City taxpayers get less of a tax offset than they would from new development brought in under normal taxation. The only time a PILOT deal would be net-positive fiscally if if the abatement truly is a but-for factor in construction. http://njeducationaid.blogspot.com/20 ... atements-hurt-jersey.html The only area I disagree with the protesters with is in who the victim is. PILOTs are tax fairness problem, not a school budget problem. If Jersey City PILOTed nothing what would happen is that other Jersey City taxpayers would pay less in taxes. Unless the BOE passed a larger tax levy, the schools wouldn't have a cent more.

Posted on: 2017/3/10 17:16

|

|||

|

||||

|

Re: Will Jersey City and Hoboken ever lose Abbott District Status?

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

What else should one call Steve Fulop's statements other than "bullshit"?

From the point of view of taxes and state aid, it is irrelevant if only one section of Jersey City is thriving because Jersey City IS A SINGLE ENTITY FROM THE POINT OF VIEW OF TAXES. Even if only 15% of Jersey City's residences are worth more than $1 million, they would comprise approximately half of the residential valuation, with other high-value properties filling in the great large majority. On top of that, Jersey City has above average amounts of commercial and industrial property. Whereas the average town in New Jersey is 84% residential in valuation, Jersey City is only 62% residential. Although officially Jersey City's property is "only" 25.3% commercial, it has billions of dollars in off-the-books PILOTed property that is disproportionally commercial. (see "Property Type Extremes") So the fact that parts of Jersey City are still poor is not relevant from the point of view of taxation and state aid. The SFRA formula takes into account a comprehensive picture of a district's tax base (except PILOTed property, which is invisible) and any heightened level of disadvantage in students.

Posted on: 2017/2/23 18:54

|

|||

|

||||

|

Re: Will Jersey City and Hoboken ever lose Abbott District Status?

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Steve Fulop is a liar, bullshit artist, and hypocrite.

http://njeducationaid.blogspot.com/20 ... hypocrisy-from-steve.html Fulop claims state aid redistribution is about helping rich suburbs, but he's wrong. The biggest beneficiaries would be towns like Clifton, Bayonne, and Bloomfield. Even when middle-class suburbs would gain aid, they desperately need it. Read about Delran whose per pupil spending is barely $12k. http://www.burlingtoncountytimes.com/ ... e6-b49d-4b0009fa55d6.html Read about Egg Harbor Township. http://www.shorenewstoday.com/egg_har ... 53-9e5e-065b6d0d43b2.html

Posted on: 2017/2/23 15:37

|

|||

|

||||

|

Re: Jersey City mayor-elect orders end to citywide reval

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Quote:

I think it's fair to say that abatements lower your municipal taxes and raise your school taxes and county taxes, although the increase in school and county taxes is a missed offset opportunity, and not a true, net increase. JC structures PILOT agreements so that the municipality gets more money than it would from regular taxation. For instance, instead of getting 50% of a $1 million all-in tax bill, it gets 95% of $750k PILOT payment. PILOTed buildings don't give the schools any money at all and pay county fees at a significantly reduced rate. If JC's PILOTed buildings paid normal taxes, they would offset the overall school levy and by a small but palpable amount for county taxes. Since a third of JC is PILOTed (by far the state's highest total), the effect on school taxes is very significant. My estimate is that JC's PILOTed buildings would have an Equalized Valuation of about $10-11 billion 2017. Hudson County's total Equalized Valuation is $71 billion. Jersey City's PILOTed buildings are thus 15% of Hudson County's total. They do pay some money to the county, but 15% is a palpable impact even on the county's tax levy for the owners of non-PILOTed buildings. It's hard to compute the net change in taxes due to PILOTing, but assuming that these buildings would be built anyway even if they had to pay normal taxes, my guess is that on the net, JC's PILOTed properties increase taxes for everyone else in Jersey City and certainly increase taxes for people living in other towns in Hudson County. Steve Sweeney is actually trying to reform the PILOT law. It's part of his state aid reform package, although he's not spoken in public (AFAIK) about what changes he wants to happen with PILOTs.

Posted on: 2017/1/14 15:24

|

|||

|

||||

|

Re: Jersey City mayor-elect orders end to citywide reval

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Quote:

I admit I misremembered JC's Equalized Valuation, but that mistake doesn't change my argument that JC's all-in tax rate will be below 2%. The FY2017 EV is $25,697,067,795. (it's a $4 billion increase from the year before, so I guess I got confused and wrote "$24 billion") The FY2016 tax levy was $448,717,388. (source is the Property Tax Tables) If you do the division, the estimated all-in tax rate 1.7%. Oops. Sorry for the distraction with the wrong EV.

Posted on: 2017/1/12 19:21

|

|||

|

||||