Browsing this Thread:

1 Anonymous Users

|

Re: So much for all of you folks who predicted a JC/NYC RE Crash

|

||||

|---|---|---|---|---|

|

Home away from home

Joined:

2007/6/12 19:00 Last Login : 2013/5/10 16:39 From Donny City

Group:

Registered Users

Posts:

224

|

Drunken Ben Bernanke Tells Everyone At Neighborhood Bar How Screwed U.S. Economy Really Is

Sometimes truth is stranger than fiction!  Hope you all are enjoying the generational looting, of course if you're not working for one of the Ivy League Tribal banksters and/or politeers, probably kind of tough... The Next Crisis is at Our Doorstep

For weeks now, I?ve been warning about a market collapse. Among the numerous items I pointed out were:

Posted on: 2011/8/3 17:21

|

|||

|

||||

|

Re: So much for all of you folks who predicted a JC/NYC RE Crash

|

||||

|---|---|---|---|---|

|

Home away from home

Joined:

2007/6/12 19:00 Last Login : 2013/5/10 16:39 From Donny City

Group:

Registered Users

Posts:

224

|

11/10/09 -- "The train has not only left the station, it has reached its next destination," Paul McCulley, portfolio manager at PIMCO, warning about maintaining long equity positions at these lofty levels

Posted on: 2009/11/11 17:41

|

|||

|

||||

|

Re: So much for all of you folks who predicted a JC/NYC RE Crash

|

||||

|---|---|---|---|---|

|

Home away from home

Joined:

2007/6/12 19:00 Last Login : 2013/5/10 16:39 From Donny City

Group:

Registered Users

Posts:

224

|

Quote:

Tea Party anyone? You have to be kidding, most of the people in JC would be on their knees in a NY second if a government official even looked their way...

Posted on: 2009/9/30 23:09

|

|||

|

||||

|

Re: So much for all of you folks who predicted a JC/NYC RE Crash

|

||||

|---|---|---|---|---|

|

Home away from home

Joined:

2007/11/29 18:19 Last Login : 2015/7/15 3:35 From Jersey City, NJ

Group:

Registered Users

Posts:

289

|

Hi. It's Friday, September 25. Just checked Chase online and 30 year fixed mortgages are now at 5.0%. Historically, that is GREAT!

It's is a fantastic rate. If you have a mortgage (and a job) above that... by at least 1 point... time to refinance. The savings will be significant. And if you are a first time buyer... hurry, you will loose that tax credit. It takes two months to close. Hopefully things are stabilizing. Also, if you bought at the peak or even up to 2 years ago, appeal your property taxes... as the value isn't the same as it was when you bought. Jersey City just raised property taxes up 11.25%. Tea Party anyone? FG

Posted on: 2009/9/26 0:53

|

|||

|

||||

|

Re: So much for all of you folks who predicted a JC/NYC RE Crash

|

||||

|---|---|---|---|---|

|

Home away from home

Joined:

2007/6/12 19:00 Last Login : 2013/5/10 16:39 From Donny City

Group:

Registered Users

Posts:

224

|

Just negotiated my lease in Newport Pavonia down 20%!

When Lefrak is dropping rents you KNOW it's a CRASH!!! P.S. This train is just pulling out of the station, buckle up

Posted on: 2009/9/26 0:44

|

|||

|

||||

|

Re: So much for all of you folks who predicted a JC/NYC RE Crash

|

||||

|---|---|---|---|---|

|

Home away from home

|

The irony is that if the current administration's policies cause higher rates then any long term fixed interest debt owed will do well. If one could get a good deal on real estate somewhere unlikely to go much further down (I suspect not JC or NYC) at 6% and rates go to 8%+ one would be sitting pretty.

Then again, it's a lot easier to buy TIPS or great companies at cheap prices without taking on any debt risk...

Posted on: 2009/6/1 0:20

|

|||

|

||||

|

Re: So much for all of you folks who predicted a JC/NYC RE Crash

|

||||

|---|---|---|---|---|

|

Home away from home

|

Real estate is currently depreciating in the area despite 6% fixed-mortgage rates.

Question: What happens if mortgage rates start creeping up? http://www.boston.com/business/market ... _interest_in_lower_rates/

Posted on: 2009/5/31 15:31

|

|||

|

||||

|

Re: So much for all of you folks who predicted a JC/NYC RE Crash

|

||||

|---|---|---|---|---|

|

Home away from home

Joined:

2007/6/12 19:00 Last Login : 2013/5/10 16:39 From Donny City

Group:

Registered Users

Posts:

224

|

Quote:

should that be 200.5k? If things aren't contained quickly in the bond market, which is starting to look unlikely, it may very well be a 100.25 by the fall... U.S. Treasury Motto for 2009: Quote: The looting will continue until moral improves!

Posted on: 2009/5/28 4:39

|

|||

|

||||

|

Re: So much for all of you folks who predicted a JC/NYC RE Crash

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

should that be 200.5k?

Posted on: 2009/5/24 11:51

|

|||

|

||||

|

Re: So much for all of you folks who predicted a JC/NYC RE Crash

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

Posted on: 2009/5/24 9:51

|

|||

|

||||

|

Re: So much for all of you folks who predicted a JC/NYC RE Crash

|

||||

|---|---|---|---|---|

|

Home away from home

Joined:

2007/6/12 19:00 Last Login : 2013/5/10 16:39 From Donny City

Group:

Registered Users

Posts:

224

|

Quote:

You might want to re-think whether gold is really a good buy... Where did I even mention gold, perhaps way back in this thread (no, I'm not gonna even bother looking). OK, well first off let me say I did buy a stash of PMs back in 2003-2004 when the writing was on the wall (for anyone with a brain) and PMs were cheap, in that I knew storing wealth would be a problem in the near future. Insurance plan #1 in place... Oh, what's that? You didn't know the function of money is that of a store of wealth, and that investment vehicles are speculative ways to perhaps increase it? Moreover, were you one of those confused sheeple that thought that RE was a safe investment? Uh no, RE is a staple that comes with liabilities, such as property taxes, upkeep, etc., but I digress... Thing is, with the markets rigged the way they are & the bankers running the show, do you believe the U$ Dollar is still a safe "Store of wealth"? You think your 201K is safe? Well do ya punk?  P.S. The paradigm has shifted, the bill for the free lunch has come due, and I have no idea what the future holds since all bets are off! But this much I am sure of, RE will continue to decline from here, so will employment, especially in this region as the complete destruction of the NYC Financial Industry rolls forward, after having been proven to be untrustworthy and fraudulent...

Posted on: 2009/5/24 2:43

|

|||

|

||||

|

Re: So much for all of you folks who predicted a JC/NYC RE Crash

|

||||

|---|---|---|---|---|

|

Home away from home

|

OK: I'll play devil's advocate...

It's all relative. If you don't think Gold is a good hedge against inflation, look at the terms that were doled out when FDR made it illegal to hold physical gold:

http://en.wikipedia.org/wiki/Executive_Order_6102

Or:

http://en.wikipedia.org/wiki/Gold_Reserve_Act

Figuring out the compound return from that point in history is relatively straightforward:

Number of years = 76

Present Value (1933): $20.67/oz

Future Value (2009): $950.00/oz

...Compound Annual Growth rate: 5.16%

To put that return in context:

Using the Dow as a benchmark if you had bought the Dow Jones Industrial Average on 5/1/1933 the value of the index was 77.79 and if you held onto that for 76yrs and sold today at 8500, that would give you a compound annual growth rate of 6.4%. (but this ignores dividends, so this return is clearly understated, call it about 9%?)

On a side note, just looking at pure inflation, $1,000 in 1933 would be worth $16,335 in today's dollars (implying about 3.74% inflation)...

Anyhow taking a step back, there is a pretty strong disagreement among economist as to whether we are entering a period of deflation or inflation. The housing bubble aftermath & destruction in household wealth (from the declining stock market) is incredibly deflationary -- i.e. people have a lot less wealth to spend on TVs, vacations, luxury condos, etc. In addition, less employment mean lower wages. (there is also less production, so falling prices are somewhat checked by that). However, layer in to that the massive amounts of household debts that need to be unwound and you can see that a lot of money will get diverted from consumption to debt reduction...

On the other hand (cue your economist jokes here), the government has been pumping money into the system via stimulus & bailouts and has dropped short term rates to (effectively) zero. They've also artificially lowered mortgage rates much lower than what a true market level would be. Uncle Sam has also been buying its own debt (just think about that one for a minute). And there are a host of other issues that I won't get into right now. All of those items argue for inflation at some point down the road.

To me, both of these arguments can coexist: We get deflation for a time during the slowdown and then inflation comes roaring back at some point in the future.

So do I think gold is good to have? Absolutely, even at these prices! But if i wanted to hedge myself in case of Armageddon, i'd rather have rice, drinking water, a shotgun, and a farm in the midwest, but that's just me!

Helpful links:

http://www.djindexes.com/DJIA110/learning-center/

http://www.wolframalpha.com <---This site is *awesome* and it only just went live 2 weeks ago...If you've never heard of it (and it's brand new, so chances are you haven't) check out this introductory video, some very cool stuff: http://www93.wolframalpha.com/screenc ... roducingwolframalpha.html

Another very

Posted on: 2009/5/24 0:39

|

|||

|

||||

|

Re: So much for all of you folks who predicted a JC/NYC RE Crash

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

I am not so sanguine. I believe that it will take a long time to unwind this real-estate bubble. Generally speaking, the prices were inflated even when the job market was strong, and now that fundamentals such as income, debt and employment are all weaker... I just don't see how real estate prices can move up at all within the next 5-7 years.... Then there's the risk of the U.S. dollar weakening significantly during the next 5-10 years. No one is a fortune teller, but we all have to consider a scenario where general inflation for goods, services and commodities occurs while (real) real estate prices decrease for 5-10 years.

Posted on: 2009/5/23 23:48

|

|||

|

||||

|

Re: So much for all of you folks who predicted a JC/NYC RE Crash

|

||||

|---|---|---|---|---|

|

Home away from home

|

yes if you want to hedge against inflation, you are better off buying real commodities such as base metal, energy or even agriculture, that way when production comes back as we come out of the recession (whenever that is), you will benefit from the increase demand and low supply as well.

For gold, although considered a commodity, it's a doomsday hedge when putting money in anything else is too risky, if you just want to hedge purely against inflation, gold is a bad choice considering the current price.

Posted on: 2009/5/23 20:59

|

|||

|

||||

|

Re: So much for all of you folks who predicted a JC/NYC RE Crash

|

||||

|---|---|---|---|---|

|

Home away from home

|

You might want to re-think whether gold is really a good buy - look over the last 20+ years - it wasn't a good hedge against inflation. I wouldn't be surprised if this proves close to gold's high water mark and over the next few years it slowly drifts back down to around $400 per ounce and then just sits there - even while everything else goes way up with inflation.... Quote:

Posted on: 2009/5/22 15:50

|

|||

|

||||

|

Re: So much for all of you folks who predicted a JC/NYC RE Crash

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Looks like Jersey City Taz just woke up, saw his shadow, and went back into his hole, predicting 6 more weeks of JC RE doom and gloom.

Nice to have you back after your winter hibernation.

Posted on: 2009/5/22 15:47

|

|||

|

Come on and rock me Amadeus

|

||||

|

||||

|

Re: So much for all of you folks who predicted a JC/NYC RE Crash

|

||||

|---|---|---|---|---|

|

Home away from home

Joined:

2007/6/12 19:00 Last Login : 2013/5/10 16:39 From Donny City

Group:

Registered Users

Posts:

224

|

Nope, in this bedtime tale the inmates are running the asylum...aren't you

Now we return you to your regularly scheduled pablum...

Posted on: 2009/5/22 15:37

|

|||

|

||||

|

Re: So much for all of you folks who predicted a JC/NYC RE Crash

|

||||

|---|---|---|---|---|

|

Home away from home

Joined:

2007/11/28 3:26 Last Login : 2014/10/27 13:13 From The fog.

Group:

Registered Users

Posts:

1013

|

Quote:

Are the walls padded? Does Nurse Ratched visit every once in a while?

Posted on: 2009/5/22 13:28

|

|||

|

||||

|

Re: So much for all of you folks who predicted a JC/NYC RE Crash

|

||||

|---|---|---|---|---|

|

Home away from home

Joined:

2007/6/12 19:00 Last Login : 2013/5/10 16:39 From Donny City

Group:

Registered Users

Posts:

224

|

So much for the optimistic spin on a generational reset...

From where I'm sitting it looks like the host is in death throws, and the parasites are celebrating. Wait until they finally figure out there will be no more blood to feast on!  P.S. The US Treasury bubble just went POP!!!

Posted on: 2009/5/22 7:50

|

|||

|

||||

|

Re: So much for all of you folks who predicted a JC/NYC RE Crash

|

||||

|---|---|---|---|---|

|

Home away from home

|

Certainly the sudden decline in high paying financial and legal jobs will hurt the real estate market, particularly sales during this summer's buying season, and a shortage of jobs will hurt entry level college graduates flocking to the city, but this is likely a short term phenomenon.

By early next year the highest paying jobs in New York will probably have stabilized and begin expanding from their payroll lows. The legal professional will probably follow 6 to 9 months later. In all likelihood the sudden cessation of construction activity will lead to a housing shortage in about 18 months. While the recent rent declines in Manhattan have allowed many borough residents to afford the island once again, their vacancies will be filled by people that had been previously forced further out. The primary factors that might further hinder real estate in the area are crime and transportation. Manhattan has seen some hot spots crop up even as the city is slashing the NYPD budget. Should these incidents prove a long term trend, the city may become a less desirable location. Additionally, if the MTA (Or Port Authority) makes serious service cuts over the next year, outer borough residences will become less desirable-- which might help Manhattan but hurt outlying areas served by subways and buses. Ultimately I think we'll be seeing a short term correction in rents and sale prices followed by a period of rapid inflation on rent and a slow increase on sale prices.

Posted on: 2009/5/22 3:55

|

|||

|

||||

|

Re: So much for all of you folks who predicted a JC/NYC RE Crash

|

||||

|---|---|---|---|---|

|

Home away from home

Joined:

2007/6/12 19:00 Last Login : 2013/5/10 16:39 From Donny City

Group:

Registered Users

Posts:

224

|

You all ready for the "JC/NYC RE Crash"?

It's almost here, we're quickly approaching the tree line & I don't think most you ideologically challenged asshats will make it out of the woods this time  Couldn't happen to a nicer bunch of morons...

Posted on: 2009/5/22 3:35

|

|||

|

||||

|

Re: So much for all of you folks who predicted a JC/NYC RE Crash

|

||||

|---|---|---|---|---|

|

Home away from home

|

Downtown JC will never become the "mecca" for yuppies that people wanted it to be thanks in part to the fine work of the people who live and work in DTJC. Good job guys!

Posted on: 2009/4/11 1:39

|

|||

|

ಠ_ಠ

|

||||

|

||||

|

Re: So much for all of you folks who predicted a JC/NYC RE Crash

|

||||

|---|---|---|---|---|

|

Home away from home

Joined:

2007/6/27 22:27 Last Login : 2012/4/20 14:33 From Hamilton Park

Group:

Registered Users

Posts:

235

|

Quote:

Are you sure? I saw what looked like people moving in a couple of weeks ago.

Posted on: 2009/4/9 13:55

|

|||

|

||||

|

Re: So much for all of you folks who predicted a JC/NYC RE Crash

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

There is no one living in the Hamilton Park condos yet. What you and your friends saw were the model units lit up to look occupied.

Posted on: 2009/4/9 2:08

|

|||

|

||||

|

Re: So much for all of you folks who predicted a JC/NYC RE Crash

|

||||

|---|---|---|---|---|

|

Home away from home

Joined:

2007/7/4 16:37 Last Login : 2021/11/4 21:55 From Hamilton Park

Group:

Registered Users

Posts:

586

|

A colleague of mine at work who purchased at Canco lofts told me that all of the 1-br units have been sold. I also observed a few lighted units at the new building on Hamilton Park last WE with some friends.

Sure the market is slow but evidence suggests funding can still be found when deals or location are there.

Posted on: 2009/4/9 1:48

|

|||

|

||||

|

Re: So much for all of you folks who predicted a JC/NYC RE Crash

|

||||

|---|---|---|---|---|

|

Home away from home

|

That'd all be great if you didn't need 40% down now to get a mortgage. Really puts a damper on the real estate investment. Plus, there's still the "everything goes to crap" contingency, which the big O is still leading us towards.

I'm with Wibbit-let's see next year.

Posted on: 2009/4/8 22:47

|

|||

|

||||

|

Re: So much for all of you folks who predicted a JC/NYC RE Crash

|

||||

|---|---|---|---|---|

|

Quite a regular

|

Quote:

that was fun. I liked the section btwn 1910 and 1920.

Posted on: 2009/4/8 21:32

|

|||

|

||||

|

Re: So much for all of you folks who predicted a JC/NYC RE Crash

|

||||

|---|---|---|---|---|

|

Home away from home

|

Not sure if this has already been posted, but here's a fun little illustration of the size of the most recent runup.

http://video.google.com/videoplay?docid=-2757699799528285056 Submitted for entertainment purposes only.

Posted on: 2009/4/8 20:14

|

|||

|

||||

|

Re: So much for all of you folks who predicted a JC/NYC RE Crash

|

||||

|---|---|---|---|---|

|

Home away from home

|

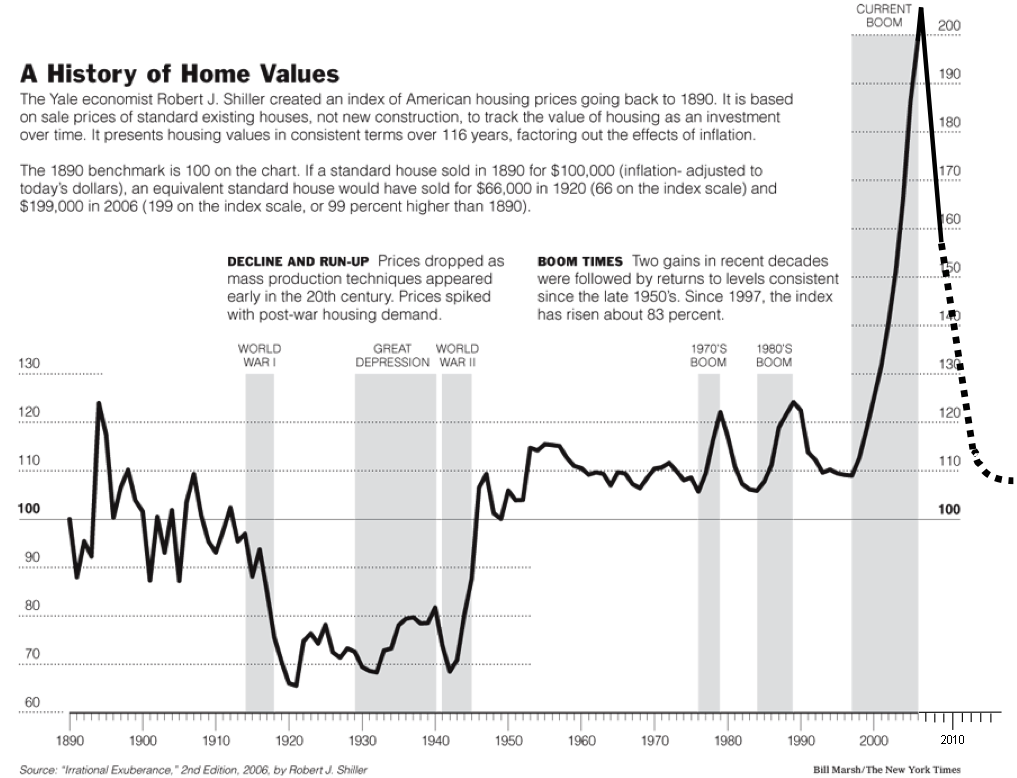

take a look at this graph, obviously it's not specific to jc but the whole country. The interesting thing to note is how small the 70s and 80s boom were compared to the last one we just experienced.

Posted on: 2009/4/8 19:30

|

|||

|

||||