|

Re: Jersey City mayor-elect orders end to citywide reval

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Quote:

You're right there will be chaos with fluctuating valuations, but when people cannot/do not pay their taxes there is no tax increase for everybody else. When someone does not pay property taxes, a lien is placed on the property. A third party buys the lien, that purchase money goes to the municipality, and then the third party has the right to collect the unpaid property taxes. The municipality, school district, and county get their money. http://www.nolo.com/legal-encyclopedi ... rty-taxes-new-jersey.html

Posted on: 2016/5/25 16:44

|

|||

|

||||

|

Re: Jersey City mayor-elect orders end to citywide reval

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Quote:

Monroe is right. It's supposed to be the county tax board that makes towns with unfair tax assessments do revals. In every county other than Hudson, Middlesex, and Union the tax board fufills its role. Until recently there were other counties where the county tax board didn't do its job, Essex for one. I believe Newark went for decades without a reval, although Newark has now done two revals this century. The NJ Constitution says that taxes have to be assessed equally (within a taxing district) and clearly gives the Dept of Treasury the authority to order a reval. Steve Fulop has said that Jersey City is being "singled out" and that the motivation for the reval is political, but the State Treasury chose the most non-compliant town in Union, Middlesex, and Hudson counties, so Elizabeth, Dunellen, and Jersey City. They could not force revals on all the non-compliant towns at once because they lacked the manpower to work with (or against) all the non-compliant towns at once. This is something I've said before, but for some of the towns who haven't done revals since the 1980s it isn't such a violation of good government, since properties have generally appreciated at uniform rates throughout the jurisdiction. So Westfield hasn't done a reval in a generation, but Westfield's Coefficient of Deviation is really low anyway and thus few people are being taxed unfairly.

Posted on: 2016/5/22 18:50

|

|||

|

||||

|

Re: Jersey City mayor-elect orders end to citywide reval

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Quote:

Your property taxes do not go to the state. The state will not gain a cent of additional taxes out of the reval.

Posted on: 2016/5/22 14:58

|

|||

|

||||

|

Re: Jersey City mayor-elect orders end to citywide reval

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Quote:

JPHurst, you made these arguments a few weeks ago and they were too ignorant for me to respond to. I thought of you again when I found this neat logical fallacy poster. After all, of all the arguments I've gotten into with people about state aid in the last couple years, you've made the worst arguments. https://yourlogicalfallacyis.com/poster Your fallacies are 1 "Special Pleading," (eg JC is different from every other town in NJ because it gets commuters) 2. "Appeal to a Higher Authority" (eg, the NJ Supreme Court said something about urban districts in 1990, therefore its opinion is infallible.) 3. "Black or White" (suggesting anyone wants to see JC's aid totally eliminated and not just reduced). 4. I wasn't sure if "Tu quoque" would apply to your argument that no district's North Bergen's or Clifton's underaiding cannot be addressed through redistribution until Millburn merges with East Orange. Tu Quoque refers to attacking the attacker with a "you too," but what Millburn does that some might object to is class segregation through zoning, not aid hoarding. However, Millburn is not a participant in any argument about state aid. So you have tried to attack Freehold Boro's case through attacking Millburn, which would be like the US attacking Switzerland after 9/11. I think there are a few fallacies rolled into one with your Millburn argument, but I can't disentangle them.

Posted on: 2016/5/21 19:20

|

|||

|

||||

|

Re: Is the $100 million proposed school aid cut designed to help Sweeney?

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

This thread has focused on Jersey City possibly losing $100 million in aid in order to allow redistribution of aid to needier districts, but it's also very possible that Jersey City can lose aid due to the state's overall f****d up fiscal situation or a loss in Berg v Christie (the NJ Supreme Court case over suspending COLA payments.)

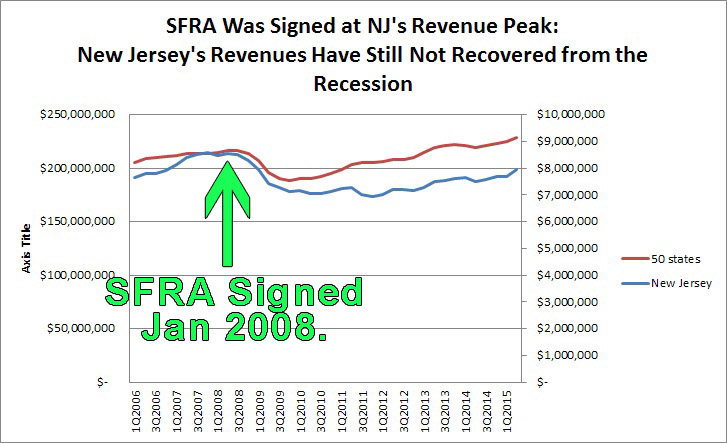

The Office of Legislative Services has just announced that NJ's revenues will run $1.1 billion below expectations for FY2016 and FY2017, mostly due to a shortfall in income taxes. http://www.dailyprogress.com/new-jers ... 10-a7e8-a17d81fc6067.html NJ can and must raise taxes, but I don't know how we deal with this without cutting services and aid too (unless we reduce pension contributions again). Since education aid is a quarter of the state budget, there's no way NJ can realistically make significant cuts without cutting education aid. And if we cut education aid, is it fair to treat districts who only get 20% of their SFRA aid the same as districts who get 150% of their SFRA aid?

Posted on: 2016/5/18 14:51

|

|||

|

||||

|

Re: Jersey City mayor-elect orders end to citywide reval

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Quote:

AGAIN. This is not a struggle over resources between suburbs and urban areas. It is not even a struggle between Abbotts and non-Abbotts. This is between districts that have gotten larger and/or poorer and districts that have gotten smaller and/or richer. The 'suburbs' are disparate, some are rich, some are average, some are poor. The connotation of suburbia as lily white and middle class is outdated. Likewise, the connotation of "urban" that people had in 1990, when the Abbott II decision came out, is outdated. We all know by now that "urban" doesn't necessarily mean poor. Hoboken is now twice as rich as Millburn in terms of tax base. You are flat out wrong to suggest that the suburbs would be the only beneficiaries of aid redistribution. You purport to put cities at the center of your moral logic, but like Atlantic City, Paterson, Newark, New Brunswick, and Plainfield are significantly underaided. You are spouting complete BS when you talk about commuters taking so much from Jersey City and that justifying aid in excess of NJ's aid formula. If someone works in JC, they work in a building and that building's owner pays property taxes (if it isn't a non-profit.) If someone goes to JC to take advantage of "urban amenities," that person spends money and probably has a pretty light impact even if they don't. By Hurstian reasoning we better start subsidizing the Jersey Shore a lot more, since New Jerseyans go to the Shore to take advantage of Shore amenities so much. We better set up a special aid stream for Parsippany, since Parsippany gets a lot of commuters too. We better set up special aid streams for Paramus, for the people who go there for shopping amenities. We better set up an aid stream for Secaucus, for all the hundreds of thousands of people who transit through Secaucus on a weekly basis. Tax base is tax base.

Posted on: 2016/5/15 0:02

|

|||

|

||||

|

Re: Is the $100 million proposed school aid cut designed to help Sweeney?

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

FYI

Sweeney was in Bayonne yesterday. When Assemblyman Nicholas Chiaravalloti asked Sweeney about helping Bayonne in its severe budget problems, Sweeney said that he wanted to and was very close to releasing his state aid reform bill. Sweeney and Beck haven't been consistent about how much Adjustment Aid they want to redistribute, but according to his comments yesterday, they want to redistribute all of it. (though gradually) I would love to Chiaravalloti's stance on this since he also represents part of Jersey City. http://www.nj.com/hudson/index.ssf/20 ... la.html#incart_river_home

Posted on: 2016/5/14 15:53

|

|||

|

||||

|

Re: Jersey City mayor-elect orders end to citywide reval

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Quote:

Could you explain what you are referring to?

Posted on: 2016/5/13 19:15

|

|||

|

||||

|

Re: Is the $100 million proposed school aid cut designed to help Sweeney?

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Quote:

Charter funding is more complex than state aid and I seldom comment on it because I don't fully understand it. I do not want to guess why the Learning Community CS is so low spending; maybe it does get some of JC's Adjustment Aid after all or maybe the mortgage payments are very large proportionally. This is the best document I've read on charter school funding. The author is staunchly anti-charter, but the document isn't polemical. (though the Red Bank CS is very unusual in having more money than its host district.) https://rucore.libraries.rutgers.edu/rutgers-lib/47968/ "Conversely, some charter schools that are not eligible for Adjustment Aid from the State because they were created after 2008, are receiving less funding than they would if the administration allocated Aid based on SFRA rather than relying so heavily on Adjustment Aid. ...." "The three [big charter] districts that would continue to receive Adjustment Aid under SFRA ?East Orange, Hoboken and Jersey City ? are not eligible for additional Equalization Aid or Categorical Aid to completely replace the Adjustment Aid that they receive. If those districts were able to increase their local school taxes, the charter schools that draw students from those districts would receive additional funding (because local school taxes are included in charter school revenue transfer calculations)." If you would like to learn more about how low spending some Hudson County charters are, check out this document. https://docs.google.com/spreadsheets/d ... mbOmUc/edit#gid=513475747

Posted on: 2016/5/13 15:28

|

|||

|

||||

|

Re: Is the $100 million proposed school aid cut designed to help Sweeney?

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Quote:

I'm glad you mentioned charters because Jersey City charters, ironically, are disadvantaged by the fact that Jersey City receives so much Adjustment Aid. Charter school funding is more complex than state aid, but charter schools founded after 2008 (when SFRA was passed), do not receive Adjustment Aid. I'm not 100% why this is. I don't know if it was legislative oversight, NJEA influence, a sincere belief that since Adjustment Aid was "hold harmless aid" that new schools didn't need to be held harmless since they had not existed pre-SFRA in the first place. Anyway, as a consequence of Jersey City's non-transference of Adjustment Aid to charter schools, some of Jersey City's charters are among the lowest funded in NJ. The following are NJ's 15 lowest spending charter schools. School Per Pupil Spending 2015-16 BRIDGETON PUBLIC CHARTER $9,276 JC GREAT FUTURES CHARTER SCH $9,197 COLLEGE ACHIEVE CENTRAL C $9,177 JC THE ETHICAL COMMUNITY CHA $8,947 JC JERSEY CITY COMMUNITY CHA $8,894 INTERNATIONAL ACADEMY OF $8,845 RIVERBANK CHARTER SCHOOL $8,682 HOBOKEN DUAL LANGUAGE CHA $8,677 THOMAS EDISON ENERGYSMART $8,395 MILLVILLE PUBLIC CHARTER $7,943 JC JERSEY CITY GLOBAL CS $7,838 JC EMPOWERMENT ACADEMY CHART $7,744 COMPASS ACADEMY CHARTER S $7,653 JC LEARNING COMMUNITY CHARTE $7,541 VINELAND PUBLIC CHARTER S $7,435 Some of the other lowest spending charters are also in big Adjustment Aid districts, like Vineland. (who gets $34 mil in Adjustment Aid), Millville (who gets $12.5 mil in Adjustment Aid), Hoboken ($5.6 mil in Adjustment Aid) Some of the other lowest spending charters are in very low spending poor non-Abbotts and thus the host districts have very little to transfer to charters in the first place. Anti-charter people always point out that charters have fewer poor kids than district schools, and that's true on average, but JC's low-spending charters can have pretty high FRL rates too. Several are above the JC district schools' average. Beloved Community is 83% FRL (for 2013-14). Ethical Community is 32%. JC Community Charter is 85% FRL. Learning Community is 35% FRL. (I couldn't find Great Futures.) If Jersey City's Adjustment Aid were gradually replaced by local taxes, JC's charter schools would come closer to matching the spending of JC's district schools. (my guess is that JC's leadership would rather change the charter funding law than the state aid distribution, which is also reasonable from their perspective.) Again, charter school funding is very complex, but since post-2008 charters don't get Adjustment Aid, JC's charters are disadvantaged by the status quo.

Posted on: 2016/5/13 14:00

|

|||

|

||||

|

Re: Is the $100 million proposed school aid cut designed to help Sweeney?

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Quote:

I think you are partly right that different districts are different apples when it comes to how they categorize spending. There are state guidelines, but I was told by an expert that when it comes to classification of spending the state is only super precise about what spending is classified as admin, but less strict with other forms of spending. BUT different districts aren't that different either. Different districts are just different cultivars of apple, not apples and oranges. If one district appears to be spending 250% as much as another on one thing, I'd be really confident that indeed, its spending on that item genuinely is higher. You asked about places outside of JC. Here are some Essex districts: Belleville, "$1,074" Bloomfield, "$1,522" Montclair, "$1,329" Orange, "$1,693" South Orange-Mpwd $1,839" Millburn $1,573 Irvington"$2,168" East Orange "$2,701" Newark, "$2,646" Here are a few more big urban districts: Paterson "$2,105" Trenton, "$2,185" Camden, "$1,409" Elizabeth "$2,201" Spending on maintenance correlates with high spending overall (though there are exceptions). Hoboken's maintenance spending is $3,153 per student. Asbury Park's is $3,615. Keansburg's is $2,351. Pemberton's $2,010. (these are all Abbotts) Atlantic City is not an Abbott, but it is also an extremely high spending district (still), and it spends $2,596 per student. Paramus has huge ratables and spends over $18k per student. It spends $2,953 on maintenance. Franklin Lakes is just plain rich and unlike, say, Millburn doesn't have a proportionally large student population. It spends $2,096 per student on maintenance. As for accountants ... every district gets an annual audit, but the audit just focuses on blatant chicanery and untidy accounts. My district's auditor always praised us for how efficient our cafeteria operations were. Our auditor never made a budget recommendation. I don't think the accountants look for bloat so much as they look for bad accounting.

Posted on: 2016/5/12 10:41

Edited by stateaidguy on 2016/5/12 11:00:39

Edited by stateaidguy on 2016/5/12 11:01:48 |

|||

|

||||

|

Re: Is the $100 million proposed school aid cut designed to help Sweeney?

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Quote:

I stand corrected on lead in some schools' water, but I don't think this is germane to my overall point about the aid distribution being unfair. I don't know enough about the lead issue, so I'll leave that aside for the moment, but in terms of overall facilities, JC should be doing relatively well. You can't judge facilities purely by spending, but Jersey City's "Total Operations and Maintenance of Plant" spending is extremely high: $2,573 per student according to the User Friendly Budgets. Bayonne's is only $1,522. Kearny's is only $1,420. West New York's is only $1,377 North Bergen's is $1,543 Guttenberg's is $1,045 "Operations and Maintenance-Salaries and Benefits" is much higher for JC too. So I believe you when you say that Jersey City has some bad facilities, but there are so many other districts whose situations are far worse and most of those districts lack the capacity to increase local taxes very much. I'm not going to speculate who or what might be at fault for not addressing the lead because I don't know enough about the issue, but the problem may be how money is allocated, not the raw amount going into the system.

Posted on: 2016/5/12 1:34

|

|||

|

||||

|

Re: Is the $100 million proposed school aid cut designed to help Sweeney?

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Quote:

Aggregate income is half of the calculation of LFS. The other half is Equalized Valuation. You are right that (residential) PILOTed buildings skew the calculation. PILOTed buildings are only "half invisible" to the formula for LFS. The value of the "improvement" is not part of Equalized Valuation, but the income of the residents is part of Aggregate Income. Yes, this is messed up. Jersey Cityans should point out how PILOTing distorts state aid when the JC City Council tries to give out another PILOT to residential building in a hot location. Jersey City is overaided based on its non-PILOTed property. JC's Equalized Valuation has risen from barely 1% of the state's total EV in 1998 to nearly 2% now ($21 billion) Even if the formula for LFS were purely based on EV Jersey City would be overaided. http://njeducationaid.blogspot.com/20 ... s-of-new-jerseys-big.html Quote:

Commercial property is assessed differently from other kinds of property, but the tax rates are the same per dollar of value. The formula for LFS treats all property types the same. I think this is actually ok since a town with a lot of non-residential property will end up having a big LFS relative to its Adequacy Budget and not get very much state aid. What you heard about Secaucus is right. Only 34.50% of Secaucus' property wealth is residential, compared to an 84% state median. 30% of Secaucus is commercial, compared to a 10% state median. I've been working on a post for my blog about towns with the highest and lowest proportions of non-residential property and Secaucus is at the top of non-residential property. JC needs a reval, but based on the existing assessment, JC is 61% residential, 25% commercial, 7% industrial, etc so as you can see, Jersey City also has a high proportion of non-residential property compared to the median NJ town.

Posted on: 2016/5/11 18:11

|

|||

|

||||

|

Re: Is the $100 million proposed school aid cut designed to help Sweeney?

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Quote:

I try to always say that Jersey City is "overaided," not "overfunded." I don't think anyone else observes this distinction, but since we call the money that the state gives schools "state aid," I think that if a district gets more than it's supposed to or less than it's supposed to, we should say "overaided" or "underaided." Every district budget is made up of local, state, and a little bit of federal funds. It's possible for a district to be underaided but have an excellent budget if its taxes are high enough; likewise it's possible for a district to be overaided and have really bad budget if it keeps its taxes low. Jersey City, along with Brick and Toms River, is a district that is overaided but underfunded due to its taxes being lower than SFRA says they should be. Unfortunately many people, including David Hespe, say "overfunded" and "underfunded" when they talk about state aid and this imprecision creates confusion. Jersey City is spending $17,500 per pupil for 2015-16, but that's technically below Adequacy based on SFRA because with Jersey City's student demographics it should be spending closer to ~$19,000 per student. So, a person could honestly say that Jersey City's schools are "underfunded," but the person would be wrong to imply that the reason is a lack of state money. The reason JC's schools are underfunded is a lack of local tax dollars. I'm sure that Jersey City's schools could use more money. I bet even if they got their $19,000 per student they could still do more with more money. Since SFRA's Adequacy targets are (inevitably) arbitrary and SFRA is woefully underfunded, overfunding and underfunding has to be seen in relative terms. So yeah, technically Jersey City should be spending at least $1000 more per student, but compared to Bayonne, Kearny, North Arlington, East Newark, Lodi, Guttenberg, North Bergen? Compared to those districts, Jersey City is quite well funded. Quote:

Yes, you can use the User Friendly Budgets for a single district's spending. To make comparisons between districts there is no tidy source, but I can tell you where to get the data if you want to dig deeper. http://www.state.nj.us/education/finance/fp/ufb/2015/17.html

Posted on: 2016/5/11 16:59

|

|||

|

||||

|

Re: Is the $100 million proposed school aid cut designed to help Sweeney?

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Quote:

I've seen this argument about municipal and school district consolidation before. It's theoretically compelling, but when researchers study tax rates and the cost of government per person on the municipal level, the cost per government are effectively the same for the smallest towns and the largest towns, with the lowest costs per person being in municipalities that have populations between 3,601 and 5,150. It's not even true that NJ has home rule gone wild. We have more units of government per land area than other states, but when it comes to units of government per person we are average. When it comes to taxes, not costs per government, the highest taxed ARE IN OLDER SUBURBS, the school districts that tend to be the state's most underaided and whose plights I am constantly trying to make people more aware of. "The heaviest property tax burdens are found in small, older suburbs that have low property tax bases and limited personal incomes among their residents; excessive spending is rarely found in such places, and the only feasible assistance must come from outside the community. State school aid is of considerable help in many places, especially in urban communities [because of Abbott; non-Abbotts get screwed], but State municipal aid is insufficient and poorly distributed." http://blousteinlocal.rutgers.edu/wp- ... usteinlocal-sizestudy.pdf

Posted on: 2016/5/11 15:58

|

|||

|

||||

|

Re: Is the $100 million proposed school aid cut designed to help Sweeney?

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Quote:

There's too much here to respond to, but this isn't "Jersey City vs the suburbs," it's "towns that have gotten wealthier and/or lost student population versus towns that have gotten poorer and/or gained population." The districts that are the worst off are towns that you might have once considered "working class," but have had large increases in population, often from Latino immigration. Geographically these towns may be "suburban," but they don't fit your idea of a suburb demographically or in tax base. It's awful if there is lead in JC schools, but JC isn't alone in having this problem and if it exists, it's not an issue of costs, since JC is one of NJ's higher spending districts. I read about JC kids having elevated lead levels, but NJSpotlight doesn't list a single JC school as having lead in its drinking water. http://www.njspotlight.com/stories/16 ... -jersey-s-drinking-water/ If JC kids don't have greenspace... umm, maybe that's because JC is a densely populated city? Finally, how often do you really read articles about school budget problems outside of Jersey City? What news sites do you follow? Did you know that Clifton just laid off 49 classroom staff members despite a growing population? Did you know that Dover can't even afford to offer calculus even though its students are very high performing and the school has 800+ kids? Did you know that Freehold Boro has converted its library and auditorium into classrooms because of space constraints? Did you know that someone with a $200,000 house in Prospect Park would pay $5,000 a year in school taxes alone? Did you know that Red Bank Boro hasn't skipped any tax increases, but one recent year it had to increase the tax levy by 10% because its student population was growing so rapidly? Did you know that Belleville has had to borrow over $7 million in the last year?

Posted on: 2016/5/11 14:55

|

|||

|

||||

|

Re: Is the $100 million proposed school aid cut designed to help Sweeney?

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Quote:

The districts that are in the vanguard of the fight for fair aid are Red Bank Boro, Swedesboro, Freehold Boro, Chesterfield, Newton, Bound Brook, and Delran. Clifton (who just eliminated 49 staff positions) is starting to get pissed off too, which would be a very big deal since Clifton is the largest of severely underaided districts. Paterson and Newark aren't that underaided, but they think they are and they are demanding more money. They aren't talking redistribution yet, but maybe somebody there will get wise too. Most underaided districts are very passive about it. Others are angry, but think that the solution is putting more money into education aid overall and not redistribution. However, the calls for redistribution weren't there last year from anyone. Things are changing.

Posted on: 2016/5/10 22:48

|

|||

|

||||

|

Re: Is the $100 million proposed school aid cut designed to help Sweeney?

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Quote:

No other newspaper I know of other than the Hudson Reporter has reported Christie saying anything about Jersey City losing $100 million. The Hudson Reporter doesn't even have a direct quote. The author of that article doesn't even understand what the rationale for Jersey City's "extra aid" even is. The author doesn't know that the aid is called "Adjustment Aid" and that it has nothing to do with tax abatements. Until you read something in a higher quality journal that has a real quote, don't rush to conclusions. I don't know what Sweeney says in private, but in public when he has talked state aid he has never singled Jersey City out as a district that should lose aid (or any district). Unlike Jack Ciattarelli and Mike Doherty, Sweeney has never sought to remind the public that Jersey City receives massive subsidies from the rest of the state. Maybe Sweeney will come out with these attacks once the campaign heats up, but he hasn't used them so far.

Posted on: 2016/5/10 22:31

|

|||

|

||||

|

Re: Is the $100 million proposed school aid cut designed to help Sweeney?

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Quote:

Yvonne, I was thinking about this and the test to see if a reduction of Jersey City's school aid is motivated by wanting to hurt Steve Fulop or motivated by fairness is how other districts are affected. Jersey City is one of about 200 districts that are overaided (of whom 150 officially get Adjustment Aid.) If a politician proposes redistribution and somehow only Jersey City is losing money, then I think the purpose is to embarrass Steve Fulop. But if Jersey City loses state aid alongside with scores of other districts, then I think the motivation is fairness for other districts. If someone proposes PILOT reform and it looks like Jersey City is being hurt more than other municipalities & school districts, well, that's just because Jersey City PILOTs way more construction than anybody else. Even if you think that Jersey City is losing aid disproportionately to other overaided districts it isn't necessarily unfair since Jersey City is among NJ's most overaided districts by multiple standards. The best measure of overaiding/underaiding is aid surplus or deficit per student, and here Jersey City gets $4300 more per student than it is supposed to. This is the 18th highest in NJ. If the Jersey City BOE protests about devastating cuts, it is because Jersey City is more dependent on Adjustment Aid than all but a handful of districts. Jersey City's Adjustment Aid (which should be $130 million, not $114 million) is a quarter of its budget. For most other districts getting Adjustment Aid, the Adjustment Aid is 1-5% of the budget. But anyway, we haven't heard anything from Christie about JC losing aid. The original Hudson Reporter article doesn't give its source for Christie's comment or use a direct quote and therefore I don't consider it authoritative.

Posted on: 2016/5/10 17:36

|

|||

|

||||

|

Re: Jersey City mayor-elect orders end to citywide reval

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Quote:

For Jersey City and ~150 other districts, state aid is determined by what Jersey City got in 2007-2008. There is no rational calculation based on Jersey City's contemporary tax base or student enrollment. I know that this does not make sense, but this is how NJ's school funding law, SFRA, works. SFRA has a provision for something called "Adjustment Aid" (aka "Hold Harmless Aid") that disallows any district from getting less than 102% of what it got when SFRA became law in January 2008. Even if state aid were determined by current tax base, a reval would still have no effect on Jersey City's state aid since state aid is calculated based on Equalized Valuation, not official assessment. Equalized Valuation is already recalculated every year by the county tax assessor. http://njeducationaid.blogspot.com/20 ... ty-reassessment-wont.html

Posted on: 2016/5/10 10:38

|

|||

|

||||

|

Re: Is the $100 million proposed school aid cut designed to help Sweeney?

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Quote:

What the heck are you talking about?

Posted on: 2016/5/10 2:37

|

|||

|

||||

|

Re: Is the $100 million proposed school aid cut designed to help Sweeney?

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Quote:

We shall see. As of yet, I haven't seen a bona fide quote from Christie on Jersey City's state aid. Christie doesn't like Fulop, but he's buddies with Brian Stack and hurting Fulop on state aid would require hurting Brian Stack. What's extraordinary about Hudson County aid dynamics is how passive Vincent Prieto is. Prieto's district, District 32, is the most or second most underaided in NJ. Prieto's district includes East Newark, Fairview, and Guttenberg, three of the ten most underaided school districts in NJ. Kearny, North Bergen, and NOrth Arlington do really badly too. If legislators actually worked 1) for their constituents 2) for justice, Prieto would be all over state aid (Nick Sacco has been involved), but Prieto does absolutely nothing. http://njeducationaid.blogspot.com/20 ... to-put-hudson-county.html I don't believe that Prieto is just an agent for Steve Fulop, but I don't think Steve Fulop is exaggerating when he says "I have significant clout with Speaker Prieto."

Posted on: 2016/5/10 2:28

|

|||

|

||||

|

Re: Is the $100 million proposed school aid cut designed to help Sweeney?

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Quote:

We don't know yet if the redistribution will affect Jersey City or how much it would lose, but JC's school tax levy was $112 million for 2015-16, so $100 million would be nearly a doubling of that. We also don't know how many years this would take place over. Jersey City's tax base is growing so rapidly that even if it raised taxes by $10 million a year the tax rate would still be falling. In Steve Fulop's press release about JC's S&P upgrade he talked about how JC's Equalized Valuation increased by 10% in the last year. Mind you, if Jersey City lost all its Adjustment Aid and were funded at 100% of its uncapped aid, it would still be better funded than most NJ districts. Right now the median district only gets 80% of its uncapped aid.

Posted on: 2016/5/10 2:20

|

|||

|

||||

|

Re: Mayor Fulop Email: The Truth about Atlantic City, NJ & Casinos in JC

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Posted on: 2016/5/3 20:36

|

|||

|

||||

|

Re: Mayor Fulop Email: The Truth about Atlantic City, NJ & Casinos in JC

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Worth reading from Sweeney:

--- According to Sweeney, one of the main areas of concern with Prieto?s bill is an issue of fairness. Sweeney said that if Atlantic City fails to meet the first of the Prieto bill?s outlined benchmarks, the state will need to give the city a large sum of money regardless of the needs of other New Jersey municipalities. ?If Atlantic City doesn?t hit any of the benchmarks, the state will have to write a check for $96 million. How does [Budget Chair] Senator [Paul] Sarlo or myself explain that to the mayor of Paterson, the Mayor of Newark?? Sweeney also said that Prieto?s bill will just lead to a repetition of history if it passes in the assembly. ?The governor vetoed a bill that would have given Atlantic City two years. He already did that. I saw that movie,? Sweeney said. ?Realize I sponsored the PILOT bill in November of 2014.? According to Sweeney, a state takeover is important because the AC municipal government has yet to make progress on the financial issues there. ?They have done nothing or very little to deal with their problem up to this point,? Sweeney said. ?Atlantic City has had plenty of time to deal with this problem but every time you turn around they are giving misstatements and flat out lying. Atlantic City?s failure, which is coming, will have an impact on ten innocent communities that aren?t in this battle so, unfortunately, we aren?t in a good place.? If Atlantic City defaults on debts, Moody?s said that 10 municipalities with poorer credit ratings, including Newark, Paterson, Trenton, and Union City, will also face credit downgrades. ?The point is I need a solution to a serious problem,? Sweeney said. http://politickernj.com/2016/05/sween ... -about-jersey-city/Quote:

Posted on: 2016/5/3 20:35

|

|||

|

||||

|

Re: Is the $100 million proposed school aid cut designed to help Sweeney?

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Quote:

Just to be accurate, Jersey City is overaided by over $100 million based on its non-PILOTed property. If the PILOTed property were included (using a $9 bil figure for its Equalized Valuation), Jersey City would be overaided by an additional $59 million. Also, we don't know if redistribution will effect JC. Sweeney and Beck haven't released their bill yet, but they've talked about only taking Adjustment Aid from districts that are over Adequacy and JC (due to undertaxing) is slightly below Adequacy. Even if this did effect JC it wouldn't lose all of its aid. It would still have about $300 million. Finally, I think the HR article is awful because it doesn't identify the the real (or to a cynic, purported) reason for redistribution: to help the poorest districts. FYI: (The formula for Local Fair Share for 16-17 is (Equalized Valuation x 0.013156218 + Aggregate Income x 0.046185507)/2=LFS )

Posted on: 2016/5/1 20:35

|

|||

|

||||

|

Re: Is the $100 million proposed school aid cut designed to help Sweeney?

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

I don't think the HR story is accurate and it definitely isn't complete. The article doesn't even have a direct quote from Christie and there's no state aid stream that has anything to do with tax abatements, although Jersey City's promiscuous PILOTing makes Jersey City's overaiding even more glaring.

I assume there is a kernel of truth to this story though about Jersey City losing state aid, but it's completely insensitive to say that this is "designed to help Sweeney."

If it's right that NJ's leaders want to take away some of JC's state aid it's because they want to do the right thing and help desperately underaided and underfunded districts who are fiscally f*&#ed by the status quo. It's designed to help the numerous districts in NJ who are facing both declining tax bases AND growing student populations. It's designed to help the few dozen districts in NJ who have seen massive Latino immigration and yet not gotten any new state aid (or proportional state aid) to help educate those children.

It's designed to help districts whose taxes exceed Local Fair Share and who are being wrecked by their taxes.

Quote:

Stringer wrote:

Posted on: 2016/5/1 19:00

|

|||

|

||||

|

Re: Will Jersey City and Hoboken ever lose Abbott District Status?

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Quote:

I don't see the plethora of school districts as NJ's #1 (or even top 5) school budget/tax problem, but I agree. It wouldn't be easy, but I think it's at least possible to merge K-8 (sometimes K-6) districts with the other K-8 (or K6) districts that they share a regional high school with. Steve Sweeney is for this, so it's not impossible. The legislature passed weak legislation to this effect sometime in the Corzine admin IIRC. However, mergers like this wouldn't resolve all the state aid equities you have. Say that North Haledon, Prospect Park, and Haledon merge (the districts that share Manchester Regional)... Ummm...the combined district would still be underaided by $19 million. You wouldn't eliminate that many admins either. SOmetimes these tiny districts share admins. Manchester Regional's supt is also Haledon's supt. (his name is Miguel Hernandez) And sometimes when you eliminate top admins you just have to add more middle management. District consolidation is good, but it's a red herring. I think you miss an important nuance about suburban hysteria if NJ had full state funding. Not all suburbs are affluent. Many are poor. There are plenty of suburbs who are among NJ's higher taxed towns. Your image of a suburb is out of date. If NJ had a hypothetical equal tax rate, 100% state funding system there are plenty of suburbs whose taxes would be lower.

Posted on: 2016/4/22 14:24

|

|||

|

||||

|

Re: Will Jersey City and Hoboken ever lose Abbott District Status?

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Quote:

Abbott precedes SFRA by quite a lot. The Abbott II decision was in 1990. Abbott II was the decision that created the "Parity Plus" doctrine that required the state to fund the Abbott districts above the average level of the DFG I and J districts. In 1990 there was state aid, but it was a very even distribution on a per student basis. Poor districts got more than rich districts, but not by a lot. Millburn then, for instance, spent about $6000 per student, whereas Irvington only spent about $4500, and Millburn and Irvington were not even the greatest extremes of spending. So many people felt that poor, urban districts didn't get enough money back in 1990. Differences in local tax capacity overwhelmed the equalizing effects of state aid and resulted in gross inequity. I have two big probs with Abbott. 1. It applied only to the Abbott plaintiffs. Poor districts that weren't part of the Abbott lawsuit were left behind. The Abbott list has always been disparate. Neptune and Pemberton, for instance, were in DFG CD in 1990 and yet they became Abbotts while about 20-30 DFG A districts didn't. I doubt that Hoboken ever had one of NJ's lowest tax bases. 2. The "Parity Plus Doctrine" went too far (and has no constitutional basis anyway). It's one thing to give greater resources to poor districts so they spend an above average amount (this is what Florio originally wanted to do), but to have them spend above the richest districts is unaffordable, takes from other poor districts, and enters into the territory of diminishing returns.

Posted on: 2016/4/21 19:56

|

|||

|

||||