Browsing this Thread:

1 Anonymous Users

|

Re: my tax abatement went up 30%, confused about assessed value

|

||||

|---|---|---|---|---|

|

Home away from home

Joined:

2006/11/13 18:42 Last Login : 2022/2/28 7:31 From 280 Grove Street

Group:

Registered Users

Posts:

4192

|

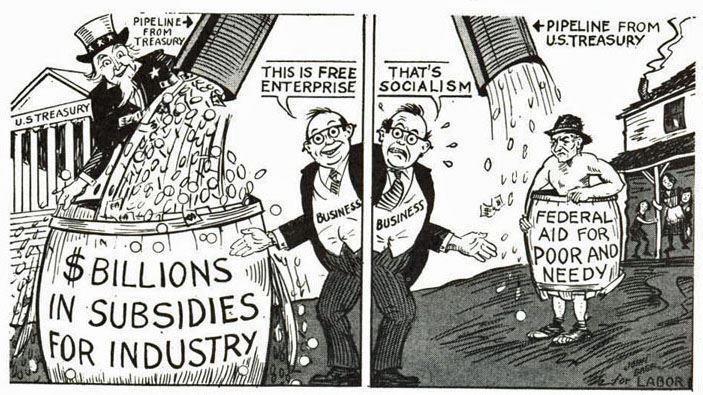

Someone has to pay to run the city, especially when we have abatements offered to corporations / hotels that run for 30 years!

Posted on: 2014/10/8 21:49

|

|||

|

My humor is for the silent blue collar majority - If my posts offend, slander or you deem inappropriate and seek deletion, contact the webmaster for jurisdiction.

|

||||

|

||||

|

Re: my tax abatement went up 30%, confused about assessed value

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

Simplest explanation is probably the correct one - a standard 5-year abatement from a new condo/condo conversion is ending.

Posted on: 2014/10/8 20:52

|

|||

|

||||

|

Re: my tax abatement went up 30%, confused about assessed value

|

||||

|---|---|---|---|---|

|

Home away from home

|

Is it also possible that they are phasing you up toward your future tax state (if, as someone mentions, your abatement is ending soon)? I understand from older threads that they do that so it's felt gradually instead of the taxes suddenly skyrocketing. They 'forgot' to do that for Port Liberte and there was a lot of churn around that a year or so ago.

Posted on: 2014/10/8 19:57

|

|||

|

||||

|

Re: my tax abatement went up 30%, confused about assessed value

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

Correct. Quote:

It's a little more complex than that. You have to find at least 3 qualifying sales that list price/sq ft - then use the average price of those sales to calculate the implied market value of your property. So lets say the av price works at $400/sqft and if your condo is 1000 sqft - then you'd get to a $400k valuation. The sales need to be in a pretty tight date range - like Oct 2013 thru Sep 2014, and exclude special sales like foreclosures. Sites like easytaxfix.com and lowermyassessment.com might help you out with comparables - but they are probably inactive this time of year - try Dec-Jan. Personally I'd avoid the attorneys that send mail offers - they'll take a 1/3 or so of your saving - whereas you can diy for $100 or so - I used easytaxfix a few years ago. See also: http://www.hudsoncountynj.org/tax-appeal-faqs/ Quote:

I think so. Sounds like you have or had a 40% exemption/abatement in 2014. Like: Tot=180000 Exemption=72000 Assessed=108000 Note you can't appeal until that abatement expires - but it sounds like it will expire in 2015- so you can appeal April 2015. (Also note the City did some weird math around some rental conversions to condos. I think they converted pilots to a long-term abatement on the condos - which pretty much locked in property taxes for those condos with no chance of appeal. But I don't think you're in that boat - given your taxes are increasing. Given you bought in 2009 - looks like you had a standard 5-year abatement given to pretty much every new property)

Posted on: 2014/10/8 18:57

Edited by dtjcview on 2014/10/8 19:14:30

Edited by dtjcview on 2014/10/8 19:15:16 |

|||

|

||||

|

Re: my tax abatement went up 30%, confused about assessed value

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

thanks that was very helpful. So to get the actual property value it will be: assessed/0.3124, in my case 180000/0.3124 = 576k? If i can find comparables in my area that sold for 400k, i should get my tax abatement reduced? She mentioned the tax abatement is 60% of the assessed value right now. So 180000 * 0.6 * 0.074 = 7992 which is about what i am buying. Is this correct? thanks

Posted on: 2014/10/8 17:36

|

|||

|

||||

|

Re: my tax abatement went up 30%, confused about assessed value

|

||||

|---|---|---|---|---|

|

Home away from home

|

Ah, another JC property tax f*ck up. The madness has got to stop. This is crazy stuff. All the voodoo about equalization rates, assessed values, real values, etc is creating unnecessary complexities to what should be a very basic system: property worth x amount, tax rate is y amount, multiply the two and done.

Posted on: 2014/10/8 17:32

|

|||

|

||||

|

Re: my tax abatement went up 30%, confused about assessed value

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

For assessed value of 180k in JC you should be paying $13,438.8/year for 2014 ($7466/$100k assessed value). http://tax1.co.monmouth.nj.us/cgi-bin ... istrict=0906&ms_user=monm Are you sure you are reading the site correctly? There should be a table giving the following Land/Imp/Tot = Assessment before exemptions Exemption = any abatement Assessed = Tot - Exemptions - what your tax bill is based on You can also check you billing under: http://taxes.cityofjerseycity.com/ The JC equalization rate for 2014 was 31.24%. If your property is valued at $400k - that implies an assessed value of $124960 ($400k*0.3124) - grounds for an appeal since there's a difference of over 15%. It does however mean you have to prove the $400k value or so based on sqft cost of recent comparable sales. But that $124960 assessment means you should be paying around $9.3k - a lot more that the $6k or so you have been paying.

Posted on: 2014/10/8 17:03

|

|||

|

||||

|

my tax abatement went up 30%, confused about assessed value

|

||||

|---|---|---|---|---|

|

Home away from home

|

Hi i just got hit with a 30% increase in my tax abatement payment and plan to appeal.

From talking to the tax assessor office (surprisingly helpful), the nice lady said the reason is because of the increased assessment on my condo. However i am very confused about the assessed value in the http://tax1.co.monmouth.nj.us/ website, can someone please tell me how to actually read it. I purchased the property in 09 for 380k, it is now worth around 400k. But the monmouth website is showing "Assessed" as 180k and also it doesnt show any increase in the assessed value, it is 180k for the last 5 years with no change. I guess my question is where can i find the actual assessed value of my property that jersey city used to increase my tax abatement 30%? I am paying more than 6k a year in taxes i know for a fact they are not based on the 180k assessment, or it would be much lower. Once i know the actual assessed value then i can find comparables to do the appeal. Thank you

Posted on: 2014/10/8 16:31

|

|||

|

||||