|

Re: A Case Study in What's wrong with JC Real Estate:

|

||||

|---|---|---|---|---|

|

Home away from home

|

A few things Chief:

a) I started the thread, therefore I'm interested in the topic and would be likely to post on the thread... b) Rates are at 30+year lows (might be more like 60yr lows), if you're not getting alot of refi business you're doing something wrong. The fact that you're posting useless 2 sentence posts on this thread and then following them up with defensive tirades makes me wonder exactly how much business you actually are getting, but that's neither here nor there... c) There may be a lot of money on the sidelines but the people with that money are scared of losing their jobs and don't want to buy inflated real estate d) Whether a person is a renter or owner does not invalidate their opinion on the topic e) I don't know about your claim that your property would "cashflow" but I assume by that you mean it will cover all the costs of owning that property. That claim, I highly doubt. Good Luck with your townhouse - I wish you nothing but the best!

Posted on: 2009/1/29 22:15

|

|||

|

||||

|

Re: A Case Study in What's wrong with JC Real Estate:

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

Awesome contribution to the thread! No offense chief, but you're hardly a disinterested observer given that you have an advertisement for your mortgage banking services right there in your signature. But whatever - no one here claims to be an expert we're just having a civil conversation about JC real estate. I'm not sure that qualifies us as "obsessed"... Anyway, Back to the thread: Add Zephr lofts to the "lots of units in the building on the market" category. However I am not sure that I'd really call that a Jersey City building... to me, that's Hoboken. But I saw one on the market --> 1437 sq ft 2br/2ba for $469k - that works out to about $325sq ft - and this particular unit has a caveat saying they seller will pay 2 full years of maintenance on the unit...I gotta believe the taxes & maint on that building are pretty high given the low price/sqft - anyone know? Edit: After doing a little digging i found a 1,050 sq ft unit with maintenance fees of $660 and since generally Maint is allocated based on sq footage, this particular unit would be around $900/mo, so getting 2 free yrs of maintenance would be worth about $22,000 -- Yikes! Once again, I just think these so-called "luxury" buildings will be the hardest hit in the coming downturn...People are looking to save money where ever they can and the true cost of living in one of these places is a *lot* higher than the mortgage payment. But this was the first time i'd seen someone go so far as to give 2yrs of free maintenance to a buyer -- imagine *that* cost of living increase at the end of 2yrs!!

Posted on: 2009/1/29 20:53

|

|||

|

||||

|

Re: Steve Lipski not seeking re-election to his Journal Square council seat

|

||||

|---|---|---|---|---|

|

Home away from home

|

This is truly a stunning development... (Just kidding)

Posted on: 2009/1/29 16:08

|

|||

|

||||

|

Re: A Case Study in What's wrong with JC Real Estate:

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

For many people a sizable portion of their net worth is tied up in their home, so for them the market value of their real estate is relevant. Furthermore, if what you say were actually true, why are people (who are upside-down on their mortgages) defaulting in record numbers. The reason is that they no longer wish to pay for something that they have no equity in that is declining in value. Quote:

I'm pretty sure he *gets* it...

Posted on: 2009/1/29 3:03

|

|||

|

||||

|

Re: A Case Study in What's wrong with JC Real Estate:

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

Just for clarity sake -- There is nothing wrong with a "Jumbo" mortgage. All that means is a loan amount greater than can be insured by Fannie Mae or Freddie Mac (this limit used to $417,000 but has increased for certain "high cost" areas). Just because someone takes on a large mortgage doesn't mean they can't afford it. In any case, JC & NYC are not detroit, but there are certainly similarities...Prior to this downturn most housing market declines were related to shocks to the job market in geographical areas (Oil Bust in Texas, Base closings, Factory Closings, etc). The Wall Street mess is exactly the same, however layered on top of that, you have a massive housing bubble that preceded it. So, I tend to think the ripple affects from the wall street crisis are still in their infancy. In past history you merely had job losses, but now you have job losses and a massive contraction in available credit. Anyway, just my 2c.

Posted on: 2009/1/29 2:50

|

|||

|

||||

|

Re: Change We Can See, Healy's Re-election Slogan, Yeah More Crime, Higher Taxes, No Accountability

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

I haven't seen the 2008 numbers, but i'll take your word for it that the ones you posted above are correct. It might be useful to look at those numbers with some perspective rather than just looking at 2years in a vacuum: The number of murders between 2000 and 2007 respectively were: 17, 25, 21, 24, 23, 38, 22, and 20. So the 27 that you claim was this year's number doesn't seem too far off from what we've experienced the last 8 years. [On a side-note, I'm not sure how you can blame the mayor for people getting murdered. If someone wants to murder someone they are going to do it.] Also, what is the population of Jersey city, was it larger or smaller than 2007 - i.e. if there are more people, (all else being equal) you would expect more murders. (i'm not trying to be morbid here, just stating a fact, a town of 100 people should have less murders than a town of 250,000 all else being equal). Lets look at the Rape #s. Again from 2000-2007: 74, 89, 86, 98, 71, 43, 60, and 47 (for 2008). Healy took over after the 98 statistic. As for Robbery, those numbers are 1237, 1301, 1381, 1416, 1418, 1642, 1553, and 1248. So this stat of 1256 for 2008 is basically exactly the same as the prior year. Assaults were 1,438 - 1,419 - 1,389 - 1,382 - 1,413 - 1,255 - 1,106 - 954. So after peaking in 2005, Assault has gone down every year Healy has been in office. Burglary: 2350, 2285, 2191, 2044, 2216, 1670, 1504, 1868. Tough Economy causing more break-ins? I won't sugarcoat this one, looks like an ugly jump there. Theft was up vs. 2007 but lower versus 2006, 2005, etc Auto Theft, With the exception of 2005 has gone down every single year since the year 2000. I'm sick of typing out all these numbers, so look them up yourself... But again what does the mayor have to do with my ability or desire to commit a crime? If I want to burn down a house or kill someone, I would probably do it whether or not Lou Manzo, Jeremiah Healy, or Fat-Ass-Bike were the mayor... Also, if your cure for the uptick in crime is more police officers - how do you plan on paying for them given that tax receipts most likely will be down versus last year? I'm just curious.

Posted on: 2009/1/28 21:39

|

|||

|

||||

|

Re: A Case Study in What's wrong with JC Real Estate:

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

Proximity to city is the reason, but the reason people flock to manhattan is because of all the high paying jobs there. If that reason goes away (and i'm not saying it necessarily will) there goes a main selling point for Jersey City. The high paying jobs were skewed by the financial sector. Real estate is heavily dependant on job creation. Why do you think you can buy a $15,000 *house* in Detroit or Buffalo, NY? Because there aren't very many quality, high paying jobs there. Low rates will certainly help, but at the end of the day, who in their right mind would take on a mountain of debt if they are worried about losing their job?

Posted on: 2009/1/28 20:12

|

|||

|

||||

|

Re: Next Meeting with Captain McDonough

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

I'm no expert on what is required from JCPD when they take these moonlighting gigs, but if you're wearing the uniform, my opinion is that you have a duty to enforce the law, should you see it broken. I walk home from work everyday by 77 Hudson and they sometimes have a cop stationed there directing traffic or overseeing god knows what. I've almost been run over crossing the street by people running red lights there or speeding, or whatever else... On occasion, I'll give the cop a look saying "what the f*ck" and he won't do a damn thing. So i can understand the frustration if there were cops nearby doing far less pressing things rather than responding to criminal activity. (although it doesn't sound like the cop was that close...) Sad thing is, with this economy the way it is and tax receipts going down, I wouldn't expect much of an expansion in city services. More likely they'll have to make budget cuts due to dwindling tax money...

Posted on: 2009/1/27 21:54

|

|||

|

||||

|

Re: NY Times best-selling author James Arthur Ray is coming to town

|

||||

|---|---|---|---|---|

|

Home away from home

|

Although it has since been taken down from Amazon.com - this spam reminds me of a great review I read on Amazon.com of "The Secret". You can find a cached version of it here.

Believe me, you will not be disappointed.

Posted on: 2009/1/27 20:49

|

|||

|

||||

|

Re: A Case Study in What's wrong with JC Real Estate:

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

Here's the part from that Goldman report that you'd be interested in, if you think we're heading back to the income relationships that existed pre-wall street years: "In fact, it is instructive to consider the potential implications of a return of relative Manhattan incomes toward the national norm prevailing before the Wall Street boom of the past two decades, either because of pay cuts in the financial industry or because of a possible out-migration of affluent individuals. From 1969 to 1986, Manhattan per-capita income averaged 2 times the national average, with no clear trend. Over the next two decades, however, it grew to 3 times the national average. If incomes fell back to the pre-1986 level of 2 times the national average?and if national per capita income remained unchanged?prices would need to fall as much as 58% to return to the 1995-1999 price/income ratio." Here's a graphic representation of the home price appreciation that the NYC Area has experienced over the last 20 years... (This is the Case-Shiller NYC index from 1988-2008) Note how it goes practically parabolic from 1999 - mid 2006:  Click on this to make the chart bigger - i can't remember how to make the image bigger in the message itself...

Posted on: 2009/1/27 17:47

|

|||

|

||||

|

Re: A Case Study in What's wrong with JC Real Estate:

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

There are 4 or 5 units at 1 greene st on Trulia - check again (1 3br/2ba, 2 2br/2ba units, and a 1br, i think). There are also multiple listings in 149 Essex -- Not all are on Trulia, but I think most of them are... The best way to find them is to do your search for JC and the use the map to zoom in on the area you want and it'll update your list for only places that fall into the particular area of the map you're looking at...Also Trulia's numbers may not be as up-to-date as what you'd find if you dropped by the open house or whatever. Trulia has added some pretty cool features like previous sales date & prices, taxes, etc to their site. It's good to see they are constantly improving. Other interesting ones i've seen lately (not in Paulus Hook, but other luxury places with high taxes & maintenance): -1175 sq feet in portofino for $530k (2br/2ba with a deck) - didn't that place used to go for over $600sqft? -1175 at Grove Point for $530k (2br/2ba) Taxes & maint on these two are about $10k/yr & $700/mo respectively.

Posted on: 2009/1/27 17:15

|

|||

|

||||

|

Re: A Case Study in What's wrong with JC Real Estate:

|

||||

|---|---|---|---|---|

|

Home away from home

|

From the Jan 22nd Business Week:

Rents Drop Nationwide as Vacancies Spike

Posted on: 2009/1/26 20:57

|

|||

|

||||

|

N.J. Transit May Cut Projects, Raise Fares Due to Lease Deals

|

||||

|---|---|---|---|---|

|

Home away from home

|

From Bloomberg News:

N.J. Transit May Cut Projects, Raise Fares Due to Lease Deals By Terrence Dopp Jan. 26 (Bloomberg) -- New Jersey Transit may have to raise fares more than 10 percent or defer maintenance to cover costs related to $150 million in equipment lease deals at risk of default following the ratings reduction of insurer American International Group Inc., the agency?s executive director said. The agency entered into 16 such transactions between 1994 and 2003 to pay for purchases such as new cars, Richard Sarles told a state legislative panel today. New Jersey Transit will ask the federal government to guarantee the deals or defer projects for one or two years before turning to fare increases, he said. ?I hope we would not have to make it up at the fare box; that?s the last place we?d want to go,? Sarles told the Assembly Transportation Committee. ?I?m hopeful and optimistic something will come? from the federal government. Sarles said 31 transit systems nationwide are at risk of defaulting on $1.5 billion in so-called lease-in-lease-out deals. He said either the U.S. Treasury Department would need to approve the funding on its own or it would need to be included in the second round of the Troubled Asset Relief Program. The deals allowed public transit systems to pay for rail and bus purchases by selling equipment and depreciation credits to banks in exchange for upfront payments. The banks then leased the assets back to the agencies, using the depreciation to lower their taxes. Deals Unraveled The transactions fell apart when insurers such as AIG and Ambac Financial Group Inc. lost their top credit ratings. Sarles said his agency has received letters from its banks notifying them the contracts are in technical default, though no payments have been missed. Default may force the agency to have to pay the balance of the leases, Sarles said. U.S. transit systems, already suffering from declining ridership, rising labor costs and less state aid, may pay more than $2 billion to banks after the downgrades triggered early termination of the deals, Fitch Ratings said last month. The payments may force increased borrowing, service cuts or deferred maintenance, Fitch said. ?These sums, which are unbudgeted and could be sizable, if required to be paid, will compound the existing and emerging problems of lower sales tax revenue to support operations, reduced fare box revenue as ridership declines with employment losses, and the outlook for reduced state and federal funds for capital needs,? Fitch said in a news release. Hudson Tunnel Sarles was invited by the transportation committee to provide testimony on transit issues including the planned second Hudson River commuter-rail tunnel. He said the state hopes to receive a commitment from the federal government in March or April on its request for $3 billion in funding for the project. Construction on the new tunnel will begin this summer, Sarles said. The state is looking for the money to be included in an $825 billion economic stimulus package being worked on by President Barack Obama and congressional Democrats. ?Actual construction will start, not just design work,? Sarles said. ?We?re on track to begin construction this year.? A group of congressional representatives from New Jersey and New York earlier this month urged the project be included in Obama?s stimulus package. Governor Jon Corzine said it would double rail capacity into New York City and create or protect 44,000 jobs amid the U.S. economic slowdown. New Jersey has asked the federal government for more than $3 billion for the $8.7 billion project and the Port Authority of New York and New Jersey has committed $3 billion. The state set aside $1.5 billion and will get another $1.25 billion from an October toll increase on the New Jersey Turnpike and Garden State Parkway, according to transit officials.

Posted on: 2009/1/26 19:14

|

|||

|

||||

|

Re: A Case Study in What's wrong with JC Real Estate:

|

||||

|---|---|---|---|---|

|

Home away from home

|

Well said Ianmac... Not rocket science, just supply & demand. Goldman Sachs just did a study of condo prices in Manhattan and found that they would need to drop 25-35% to return to historical relationships between rent/owning, price vs. income, and standard metrics of affordability (i.e. can the median income earner afford the median house in a given area). Those are pretty staggering numbers, especially when a standard mortgage requires a 20% down payment. If anyone wants to read that, I can send it your way.

As for what you can invest in other than real estate, there's a ton of stuff out there, here's a sampling: -Gold, Silver, other Metals -Grains/Livestock/Pork Bellies (remember the movie Trading Places with Eddie Murphy?) -Oil & Energy related Commodities -Foreign Currencies -Foreign Stocks & Bonds -US Treasury Bonds, Municipal Bonds, Corp Bonds...hell, you could even buy Mortgage bonds -And of course, if you think Stocks are bad, you can always short them...(or short any of the things I listed above). Last year while the stock market was disintegrating long treasury bonds (30yr bonds issued by the US government) gained over 25%... But I digress...

Posted on: 2009/1/26 18:51

|

|||

|

||||

|

Re: A Case Study in What's wrong with JC Real Estate:

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

There is a whole world of things you can invest in other than Real Estate and the stock market. Not sure what's funny about that...

Posted on: 2009/1/26 17:10

|

|||

|

||||

|

Re: A Case Study in What's wrong with JC Real Estate:

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

My rent hasn't changed significantly in 3yrs and it won't change this year either. I think many landlords would rather get the same rate from a good tenant versus gamble on trying to fill an apartment for a month... Demand for housing is stagnant & supply of available housing is large & rising. Supply & demand tells you rents & property values aren't rising... Ianmac hit the nail on the head - there is a lag between when people roll of their leases vs. when they've lost their jobs. Here's the conversation I'm imagining: Landlord: You need to pay more rent, the city just hiked my taxes Tenant: I just lost my job, so I can't afford to live here anyway Landlord: Ok, well how about I keep you on the same lease for another year? Tenant: Well, i was going to move back in with my mother, but If you want to knock $50 bucks off, maybe we can talk and i'll dip into my savings Landlord: Done As for the smug comment about renters renting and buyers buying, there are alot of things you can buy on margin (borrowed money) that have a better chance of going up than real estate...

Posted on: 2009/1/26 16:58

|

|||

|

||||

|

Re: A Case Study in What's wrong with JC Real Estate:

|

||||

|---|---|---|---|---|

|

Home away from home

|

JCShep, I'm not bitter, just making observations about the economics of what's going on in my neighborhood...

Punchy - Point well taken. Certainly a 3br/2ba place doesn't qualify for most "first time home buyers" however I think a 2br/2ba place does, so you compare that to a rental place with similar features. My example for $2100 was 25% smaller than the 2br place and only had 1 1/2 baths, so that wasn't a great comparison. More comparable would be Windsor at Liberty House which rents 2br/2ba places for $2600-2800/mo (which includes parking as far as i know). So maybe with the discount you get for mortgage interest on your taxes, it's not that bad compared to what you can get in the neighborhood... But to me, I'd rather have the piece of mind to know that a) my money is in a bank rather than a real estate investment, b) my monthly payment is fixed and not at the whim of the City (taxes) or a Condo Board (maintenance). That's got to be worth something, right? But, what do I know, I'm just a dumb renter -- Right JCSHEP?

Posted on: 2009/1/26 15:32

|

|||

|

||||

|

Re: A Case Study in What's wrong with JC Real Estate:

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

I think that is the old way of thinking. Back in the day, i think you paid a big premium over renting because you had (for lack of a better term) a call option on the home price appreciation. I.e. if the house went up in value, you could pocket the money by selling/build up equity/etc. If it didn't go up, it was not much different than renting. No one ever contemplated prices going down... If you take away that home price appreciate you're left with paying down a massive debt-load that has huge transaction costs should you decide to move. What are real estate commissions -- like 5%? Not only that, it's a big leveraged investment - you're taking out $4 in debt for every $1 you put in, or in some cases like people only putting 5% down... they're taking on $19 in debt for every $1 in equity. It doesn't take much of a decline in prices to wipe out your entire investment... But your point is well taken - owning will always cost a bit more because our tax code gives massive incentives via writing-off mortgage interest at tax-time (i mentioned that in my OP). Quote:

The prices are right and my guess is that the people selling would sell for even less. Like I said the places need some work (non-renovated kitchens, old tiling, etc). I can PM you the place if you really care, but I'm not going to call them out in a public forum. It's one thing to joke about the $4mm place on newark - but these places in the $4-500k range are right in the wheelhouse of first time home buyers and my only point was - they are still not affordable. The larger point though is that there are plenty of places out there with low taxes & maintenance that can command a much higher price/sqft because the total cost of ownership is much less. Would you rather pay $200/mo to a small condo association with no amenities or $600-900/mo to a big condo association and get a pool & health club? In this economy, I think more people will choose the former...

Posted on: 2009/1/26 13:54

|

|||

|

||||

|

Re: “It’s not a copout; it’s a blackout.” – Steve Lipski (about urinating on Grateful Dead fans)

|

||||

|---|---|---|---|---|

|

Home away from home

|

On a side note, the 9:30 club is still a good place to see a show. Shame it got caught up in this thing - one of the best places in DC to see a show/concert.

Posted on: 2009/1/25 21:43

|

|||

|

||||

|

A Case Study in What's wrong with JC Real Estate:

|

||||

|---|---|---|---|---|

|

Home away from home

|

So I just went to an open house and to me, it represented exactly why some places in the Jersey City real estate market (NOT ALL places!) will have a very hard landing.

Our first Now, for Paulus Hook, you think to yourself, "$450k, that's not so bad, I could put $90k down (20%) take out a mortgage for $360k at 5% and my payments would only be $1932/mo!" Wow, housing really *is* becoming affordable... Not so fast! Taxes a little under $9k/yr so add on another $750/mo and monthly maintenance is another $650/mo. The good news is that for all that you do get a parking space (Awesome!), bad news is, you have to pay maintenance for the parking space (not so awesome). I didn't get a number on this last bit, but it's safe to assume that's at least another $100 bucks a month. Apparently you can get valet parking $275/mo -- In this economy? So add it all up and your monthly cost to own this place is around $3,400+/mo. And now for the really bad news, another 2br place about a block away which admittedly is about 300sq feet smaller with a direct view of the statue of liberty just rented for $2150/mo. OK, yes, I'm leaving out the part where you get back some of your living expenses come tax season, but even still, would you rather rent, or buy? An even more egregious example was the 3br/2ba unit nearby... 1700sq ft place (that needed a fair amount of work) offered at $499k...that works out to $293/ft! Remember when $500/ft was considered reasonable for jersey city? What's even more jaw dropping though is the taxes are $14,300/yr and the maintenance is $1,000/mo! So without even getting a mortgage, you're paying out $2200/mo. ($4350 with a mortgage). I doubt you could rent it out for over $4k/mo... Maybe if the taxes got reassessed you could make it work, but otherwise, I just don't see it working... Am i crazy or are things still not very cheap? Maybe on a relative basis (relative to 2yrs ago) they are cheap, but are they cheap on a stand-alone basis? Maybe my problem is with the taxes & maintenance on these things and not the value of the real-estate itself... Any thoughts?

Posted on: 2009/1/25 21:36

|

|||

|

||||

|

Re: 1 family, 4.6 million

|

||||

|---|---|---|---|---|

|

Home away from home

|

The pics they have posted are terrible. For people in that segment of the market , my guess is they'd want to see the massive bedroom & bathroom, the kitchen, the pool, the view. Instead they put up a picture of 1) a bed, 2) the front door 3) a staircase and 4) a dining room table and 5) and a view.

But there is a virtual tour available with much better pics and a better perspective on the space... Check it out here: http://rtvpix.com/RE-8594-61ZPKI-01

Posted on: 2009/1/10 17:13

|

|||

|

||||

|

Re: Lipski responds regarding controversial coach hiring for CREATE Charter Schoo

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

Is it just me, or can you not take anything this guy says/does seriously any more? I can't wait for the campaign ads (er...maybe not...)

Posted on: 2009/1/9 22:18

|

|||

|

||||

|

Re: 1 family, 4.6 million

|

||||

|---|---|---|---|---|

|

Home away from home

|

This is great... Read the description:

Quote: Description: Dude, does this guy realize that his home is in Jersey City! a 300sq ft bathroom? a pool? Not one, but two waterfalls? I'm sorry, come again... a waterfall? Just for comparison, an entire brownstone on essex st. (in Paulus Hook) just went for exactly $2mm, so why would a place that's 2 blocks from that cemetery (not to mention the highway) go for over double that? (that extra $2.6mm is for the pool & waterfalls i guess...). Don't get me wrong, the place is beautiful, but $4.5mm in this economy is a total joke... I'm no real estate expert, but given the location, maybe you pay $300sq ft (7,000x300=$2.1mm +100k for the parking+100k?? for the pool) so maybe $2.3mm? Plus, have fun getting a jumbo loan for that place...

Posted on: 2009/1/9 21:43

|

|||

|

||||

|

Re: Great Depression II

|

||||

|---|---|---|---|---|

|

Home away from home

|

For those quibbling with the use of the term "Great Depression II" - read Paul Krugman's piece from a few days ago: http://www.nytimes.com/2009/01/05/opinion/05krugman.html?_r=1&em

Here are the salient points from the article: "The fact is that recent economic numbers have been terrifying, not just in the United States but around the world. Manufacturing, in particular, is plunging everywhere. Banks aren?t lending; businesses and consumers aren?t spending. Let?s not mince words: This looks an awful lot like the beginning of a second Great Depression ? It turns out, however, that preventing depressions isn?t that easy after all." "Under Mr. Bernanke?s leadership, the Fed has been supplying liquidity like an engine crew trying to put out a five alarm fire, and the money supply has been rising rapidly. Yet credit remains scarce, and the economy is still in free fall ... Here?s my nightmare scenario: It takes Congress months to pass a stimulus plan, and the legislation that actually emerges is too cautious. As a result, the economy plunges for most of 2009, and when the plan finally starts to kick in, it?s only enough to slow the descent, not stop it." "Meanwhile, deflation is setting in, while businesses and consumers start to base their spending plans on the expectation of a permanently depressed economy ? well, you can see where this is going. So this is our moment of truth. Will we in fact do what?s necessary to prevent Great Depression II?"

Posted on: 2009/1/7 13:55

|

|||

|

||||

|

Re: Property taxes/maintenance fees for condos/townhouses in JC?

|

||||

|---|---|---|---|---|

|

Home away from home

|

For taxes, go HERE:

Obviously change the county to "Hudson", the City to "Jersey City" and then in the search criteria, specify which street you're looking for. It's all a matter of public record, it'll even show you what price people paid for their place on what date. I'm pretty sure this is one of the components that feeds sites like zillow, et al. And of course you can find out some pretty interesting stuff about the street you live on (or are interested in living on)...

Posted on: 2009/1/5 21:56

|

|||

|

||||

|

Re: Great Depression II

|

||||

|---|---|---|---|---|

|

Home away from home

|

Posted on: 2008/12/29 17:11

|

|||

|

||||

|

Re: Great Depression II

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

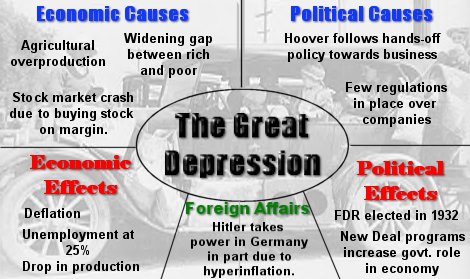

Me and colleague argue about this topic all the time. The picture above claims that one of the causes of the great depression was "overproduction of agriculture" but the truth of the matter is that one of the reasons many historians argue that the GD lasted as long as it did, and people couldn't afford food, waited in soup/food lines, etc was precisely because under the new deal, many farmers were paid *not* to farm, thus increasing the cost of food. You can read more about that, HERE. In deflationary environments such as the Great Depression, the last thing you want to do is increase the cost of something that everyone consumes. Incidentally, the recent fall in Crude Oil/Gasoline/Heating Oil is a welcome change as that money goes directly into consumers pockets (or more to the point, goes directly to pay off consumers credit cards & home loans).

Posted on: 2008/12/22 6:05

|

|||

|

||||

|

Re: Great Depression II

|

||||

|---|---|---|---|---|

|

Home away from home

|

Quote:

The most Amazing thing about this Madoff Scandal is that it was reported to the SEC over 3yrs ago, and they did nothing to investigate it. Barron's also wrote a negative story about Madoff in 2001. The complaint from 3yrs ago detailed about 27 red flags that explained why the fund was either a) illegal insider trading or b) outright fraud (the world's largest Ponzi scheme). If you're so inclined, you can read the documents sent to the SEC here: http://www.ritholtz.com/blog/2008/12/ ... red-sec-madoff-complaint/ Thanks for the memories Chris Cox...

Posted on: 2008/12/20 23:21

|

|||

|

||||

|

Re: Great Depression II

|

||||

|---|---|---|---|---|

|

Home away from home

|

If anyone wants to be truly informed about the crisis and where it is (most likely) heading, read David Rosenberg's latest commentary on the subject. I uploaded a copy HERE:

Some of the key takeaways: -The Debt to Income ratio of US households rose as much in the last 7yrs as it did in the previous 39 years -GDP will fall by 3% next year which would be the worst performance since 1946 -Consumer balance sheets (Total Household Assets minus Debts) are shrinking at an alarming rate, which is highly deflationary. -Because of this (as others mention earlier in the thread) consumer spending gets ugly and the savings rate goes way up. -The housing supply hangover continues and there really is no pent up demand for housing (there is a 68% homeownership rate right now versus around a 64% rate before the mania began) One other interesting point from his article was about household consumption of durable goods. Here's the quote: "The average household owns near $40,000 of non-housing durable assets (i.e. the art, the third SUV, the 4th television set, etc.) a number that has tripled since the debt super cycle began...in the mid 80s. The boomers are not just satiated, but over-saturated, and since of the few booming segments of the economy are consignment stores, it goes without saying that these assets are being liquidated so the marginal household can trim its record debt and interest burden. Again, this is a very deflationary experience, especially for retailers." "We reached a point at the apex of the credit bubble where the average household owned 2.2 motor vehicles (Fido, the dog, owns a fifth of a car). No other country [in the world] has this dynamic, but it is now in the process of mean-reverting and for the first time on record, auto sales have fallen below replacement demand. In other words, we are in the early stages of removing the number of cars and trucks from the roads, interstates and driveways." That last point really makes you wonder about the auto bailout. Overall though, aside from a few dry parts of economist-speak the article paints a pretty interesting picture about the economy. The Appendix of the article includes some interest anecdotes about people's new saving habits.

Posted on: 2008/12/19 15:30

|

|||

|

||||