|

Re: Carpet Cleaners

|

||||

|---|---|---|---|---|

|

Newbie

|

Posted on: 2/3 14:27

|

|||

|

||||

|

Re: Need to reupholster Dining chairs

|

||||

|---|---|---|---|---|

|

Newbie

|

Hi! If you're in the Jersey City area, you might want to check out UCM Carpet Cleaning. They offer upholstery cleaning services and could help refresh your chair cushions before deciding to reupholster. If you still need reupholstery afterward, local upholstery shops or recommendations from community groups could be your next step. Good luck!

Posted on: 2/2 13:55

|

|||

|

||||

|

Re: Oriental Rug Repair?

|

||||

|---|---|---|---|---|

|

Newbie

|

Posted on: 2/2 13:51

|

|||

|

||||

|

Re: Oriental Rug Repair?

|

||||

|---|---|---|---|---|

|

Newbie

|

Posted on: 1/29 15:49

|

|||

|

||||

|

Re: Liberty Humane Closing Dec 31?!?

|

||||

|---|---|---|---|---|

|

Newbie

|

Listen, I totally agree with you.This organization was not fulfilling their duties at all.I know of cases where people tried to surrender their animals, and nothing came of it.They reported the issue, but no one ever showed up.The fact they did adoptions via Zoom is just ridiculous.What kind of practice is that anyway?

Posted on: 2024/9/27 12:04

|

|||

|

||||

|

Re: wtf is happening to my property tax

|

||||

|---|---|---|---|---|

|

Newbie

|

Yeah, that’s exactly what’s happening. New property assessments just came out and many people are seeing increases. It’s mostly due to rising values but also local regulations are shifting. Check it out, there are some tax relief programs. Talking to neighbors could help too.

PS. Local tax office might have useful info as well. It’s better to stay on top of things, 'cause sometimes you miss something and then it’s a problem.

Posted on: 2024/9/25 8:17

|

|||

|

||||

|

Re: wtf is happening to my property tax

|

||||

|---|---|---|---|---|

|

Newbie

|

I'm not sure what's happening with the property tax, but it seems like it might be related to new assessments. Many people are noticing increases, which could be due to changes in local regulations or rising property values. Check if there are any new updates on this.

Additionally, it's a good idea to talk to neighbors or reach out to the local tax office. Sometimes there might be relief programs or support options that not everyone knows about. Staying informed is key! :)

Posted on: 2024/9/20 13:04

|

|||

|

||||

|

Re: McLaughlin Funeral Home sold their parking lot.

|

||||

|---|---|---|---|---|

|

Newbie

|

McLaughlin selling their parking lot could definitely impact their business. These days, convenient parking is a huge asset, especially in busy downtown areas. If people start looking for more convenient locations, it could be hard for them to compete with other funeral homes that still offer adequate parking.

It’s always sad to see a long-standing business facing challenges. We’ll see how it plays out, but I think the lack of parking could be a significant issue in such a competitive environment. Greetings, Andrew

Posted on: 2024/8/12 15:14

|

|||

|

||||

|

Re: McLaughlin Funeral Home sold their parking lot.

|

||||

|---|---|---|---|---|

|

Home away from home

|

LOL - ChatGPT bot. Didn't even have enough sense to create a new account before it replied to itself. Or realize that No one in JC is gonna give a crap about a funeral service in the UK.

Quote:

Posted on: 2024/8/5 12:49

|

|||

|

||||

|

Re: McLaughlin Funeral Home sold their parking lot.

|

||||

|---|---|---|---|---|

|

Newbie

|

That’s really unfortunate about McLaughlin Funeral Home. Parking is such a crucial part of making things easier for everyone during a tough time. When my family needed to find a place for my grandmother’s service, we had a similar worry about parking and overall service quality.

Posted on: 2024/7/26 8:15

|

|||

|

||||

|

Re: New Housing

|

||||

|---|---|---|---|---|

|

Newbie

|

Hopefully this means more housing for people of color and black people. Happy Juneteenth.

Posted on: 2024/6/18 23:08

|

|||

|

||||

|

Re: JC Burlesque is back! 3/28 at Art House Productions

|

||||

|---|---|---|---|---|

|

Newbie

|

Love this kind of stuff!

Posted on: 2024/6/18 23:07

|

|||

|

||||

|

Re: wtf is happening to my property tax

|

||||

|---|---|---|---|---|

|

Newbie

|

My tax bill has gone up a lot too and I just moved here!

Posted on: 2024/6/14 1:25

|

|||

|

||||

|

Re: Jersey City Government Corruption Scandal - 16 arrested

|

||||

|---|---|---|---|---|

|

Home away from home

|

Sorry for necroing.

I'm not really shocked about these scandals. Just look at senator Bob Menendez. Honestly, it seems like a case of "when," not "if." Anyone who dips their toes into illegal activities is caught sooner or later. But they still can get out by appealing the verdict. According to Oberheiden P.C., they can appeal on various grounds, like if evidence was unlawfully obtained or wrongfully presented or if there was a legal error during the trial. So, if they have the resources, they could do this and stay out of jail.

Posted on: 2024/5/7 14:28

|

|||

|

||||

|

Journal Square’s Pompidou Art Museum is a disaster! I told you all years ago this “museum” sucked

|

||||

|---|---|---|---|---|

|

Home away from home

|

Read this: https://hudsoncountyview.com/njeda-tel ... st-address-19m-shortfall/

I was ridiculed and laughed at when I said this thing was a waste of money that never should have happened. It’s really just a veiled attempt to increase rents in the new Journal Squared towers. Now years later the truth is out. So much money would have been saved, and gained, if that shithole building was just demolished and a non-tax abated 95 storey condo tower was put in its place like 99 Hudson. Fulop has a mess on his hands and Jersey City’s taxes are going to go up as the State retaliates and cuts funding.

Posted on: 2024/4/27 17:55

|

|||

|

||||

|

Re: Earthquake?

|

||||

|---|---|---|---|---|

|

Home away from home

|

According to my firsthand reports, it was felt from Philadelphia to Boston. Wow-

Posted on: 2024/4/5 15:14

|

|||

|

||||

|

Re: Earthquake?

|

||||

|---|---|---|---|---|

|

Home away from home

|

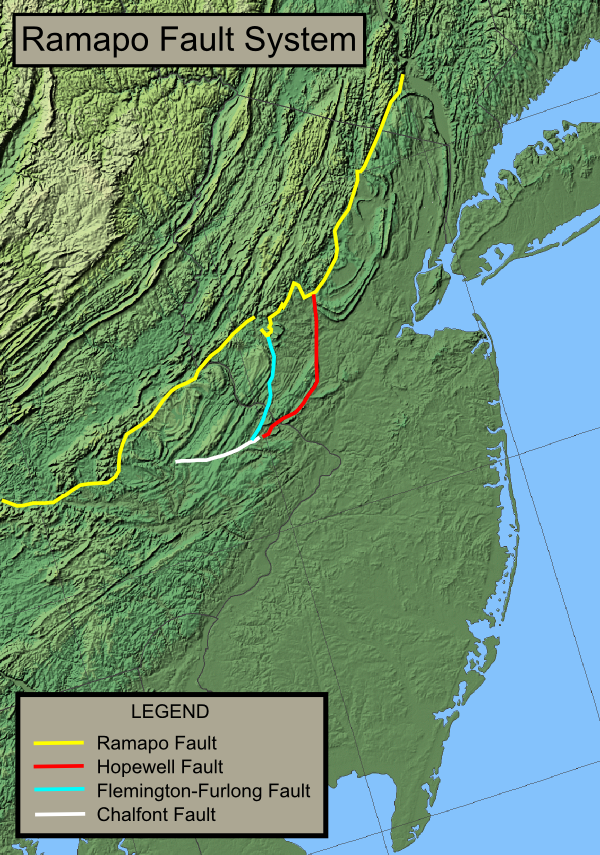

Looks like it is from the Ramapo fault

Posted on: 2024/4/5 14:44

|

|||

|

||||

|

Re: Earthquake?

|

||||

|---|---|---|---|---|

|

Home away from home

|

Now listed at USGS as a 4.7

https://earthquake.usgs.gov/earthquakes/map/?extent=39.63954,-76.79169&extent=41.39535,-72.39716

Posted on: 2024/4/5 14:40

|

|||

|

||||

|

Re: Earthquake?

|

||||

|---|---|---|---|---|

|

Home away from home

|

4.8 quake 5 km deep (very shallow) centered near Lebanon, NJ.

Ramapo fault line?

Posted on: 2024/4/5 14:38

|

|||

|

||||

|

Re: Earthquake?

|

||||

|---|---|---|---|---|

|

Home away from home

|

We had a good shake downtown a minute ago and I'd also guessed it was an earthquake. Downtown I'd say it lasted only about 5-10 seconds -- my computer monitor was shaking and I could hear a big rumble outside-

Posted on: 2024/4/5 14:30

|

|||

|

||||

|

Earthquake?

|

||||

|---|---|---|---|---|

|

Home away from home

|

A few moments ago there was shaking.. Lasted about 30 seconds....

Posted on: 2024/4/5 14:26

|

|||

|

||||

|

Blood Donation

|

||||

|---|---|---|---|---|

|

Just can't stay away

|

Hi all.

Does anyone know where to donate blood in JC where it is just a walk in, easy peasy thing? Any help would be appreciated. Thanks!

Posted on: 2024/3/30 2:24

|

|||

|

||||

|

JC Burlesque is back! 3/28 at Art House Productions

|

||||

|---|---|---|---|---|

|

Newbie

|

Hudson Hurly Burly | March 28, 2024

www.arthouseproductions.org/co ... hurly-burly-march-28-2024 Award-winning international Burlesque impresario Lillian Bustle is at it again, bringing a breathtaking array of nightlife stars to the stage for HUDSON HURLY-BURLY! Join us for a dazzling, irreverent evening featuring a stunning and diverse lineup of acclaimed artists, live singing, incredible prizes from local sponsors, and thrills galore. Feeling feisty? Our front row VIP seats include a special gift from Lillian and a feathery photo opportunity! Featuring the tantalizing talents of: MiscAllaneous DomTop Mo Honey Anna Archaic Magnifique Maria Milagros Tiffani Monroe HOST: Lillian Bustle Sponsored by Spectrum Boutique Extravagant dress is welcome! but whether you’re in sequins or jeans, we’ll always take good care of you. Lillian is committed to showcasing a wide array of eclectic entertainers from NYC, NJ, and beyond. She also strives to cultivate community and a safer space for her audiences, and as such all shows have a zero-tolerance policy towards hate speech, harassment, and unwanted touch. Doors 7:30 Show 8PM THIS EVENT IS 18+ Art House Productions 345 Marin Boulevard in Jersey City, NJ This venue is accessible and ADA compliant

Posted on: 2024/3/19 5:07

|

|||

|

||||

|

Re: What’s going there? (Journal Square edition)

|

||||

|---|---|---|---|---|

|

Home away from home

|

For sale, 42-story high-rise development project in Journal Square, almost shovel ready

Updated: Mar. 14, 2024, 6:59 p.m.|Published: Mar. 14, 2024, 5:20 p.m. By Mark Koosau | The Jersey Journal Want the chance to own the site of a proposed 42-story high rise in Jersey City with sweeping views of the Manhattan skyline? It could all be yours in a bidding contest after its previous owner filed for bankruptcy on the project. It’s the latest twist in the saga of the proposed project at 500 Summit Ave. in the Journal Square neighborhood, where after 14 years and two settlements later, a shovel has yet to be put on the ground. More.. https://www.nj.com/hudson/2024/03/for- ... -almost-shovel-ready.html (subscribe to the JJ/nj.com it is around 100 dollars a year and it helps the newspapers)

Posted on: 2024/3/15 0:22

|

|||

|

||||

|

Re: Al's Diner site

|

||||

|---|---|---|---|---|

|

Home away from home

|

Laborers union, community hold vigil for worker who died in Jersey City construction site fall

Updated: Feb. 09, 2024, 3:56 p.m.|Published: Feb. 09, 2024, 3:35 p.m. https://www.nj.com/hudson/2024/02/labo ... nstruction-site-fall.html

Posted on: 2024/2/9 21:53

|

|||

|

||||

|

Re: What’s going there? (Journal Square edition)

|

||||

|---|---|---|---|---|

|

Home away from home

|

Have not kept up a current list on this thread.

Funny there is so much new construction from small projects to massive ones it is hard to keep track. Amazing.

Posted on: 2024/2/7 23:56

|

|||

|

||||

|

Re: Al's Diner site

|

||||

|---|---|---|---|---|

|

Home away from home

|

Yeah and an odd place for apartments on busy Communipaw.

This is from Jersey Digs: https://jerseydigs.com/851-859-869-877 ... ave-jersey-city-approved/ Also a worker died there on Feb 2 he fell 4 stories: https://www.nj.com/hudson/2024/02/work ... -site-in-jersey-city.html

Posted on: 2024/2/7 23:51

|

|||

|

||||

|

Re: Liberty Humane Closing Dec 31?!?

|

||||

|---|---|---|---|---|

|

Home away from home

|

I am sorry you have been fooled into believing this organization was doing the right things.

They were not. They were not picking up any animals they were contracted to, not accepting owner surrenders, and violating animal control laws and best practices, services they were being paid to perform in Hoboken & Jersey City while masquerading as a no kill shelter. They had no public hours, were performing adoptions on Zoom, and it's questionable as to whether there were even any animals in the facility. Many residents were put on surrender wait lists during evictions and who knows what happened to those pets. I know personally of cases where animal cruelty, bite incidents, and other animal attacks were under-reported. The list goes on. Don't believe these people were doing the right things. The city should have never given them animal control and I am glad they are losing the property and the facility. GOOD RIDDANCE!

Posted on: 2023/11/13 18:14

|

|||

|

||||

|

Liberty Humane Closing Dec 31?!?

|

||||

|---|---|---|---|---|

|

Home away from home

|

I was so saddened to hear this! We adopted our two beautiful cats from them. They are so wonderful. So very sad!!

Posted on: 2023/10/22 16:14

|

|||

|

||||